Op-Ed Commentary: Chris Devonshire-Ellis

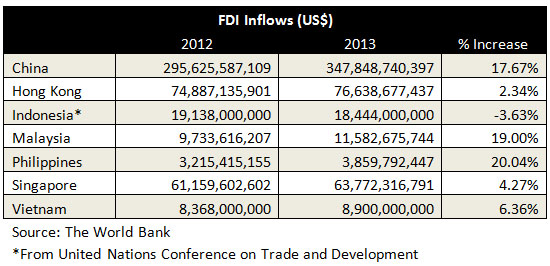

The most recent FDI data from the World Bank shows that China and the larger ASEAN nations have performed well the past 18 months in terms of generating increased foreign direct investment. The data, which covers 2013 figures in total, show a 17.7 percent overall increase in FDI for China, yet an even more impressive 20.4 percent for the Philippines and 19 percent for Malaysia. The Philippines data may seem overly strong given the much publicized spat with China over disputed islands, yet this has clearly, as was stressed at the time, not manifested in a slowdown of investment. Both the Philippines and Malaysia remain strong destinations for Chinese as well as other foreign investment.

Vietnam showed an increase of some 6.36 percent year on year, a lower figure than maybe some analysts would have expected given its cheaper labor costs and proximity to China, often marking it out in the media as a competitor to the Chinese for lower cost manufacturing. Yet, as we have repeatedly stated, Vietnam is not yet in full ASEAN Economic Community compliance, meaning that applicable Free Trade benefits than ASEAN members, such as the Philippines and Malaysia, have signed as part of the ASEAN bloc have not yet fully filtered down in Vietnam. That is expected to be rectified at the end of 2015, meaning that a surge in Vietnamese FDI can be expected next year rather than in these figures.

Meanwhile, Hong Kong FDI remained relatively stable at a 2.34 percent increase, yet performed poorly when compared to its main Asian rival Singapore, with a near two percentage points advantage over Hong Kong in terms of attracting more FDI. That may well be indicative of Hong Kong’s lack of any Free Trade Agreement with ASEAN – the agreement China has with the bloc excludes Hong Kong. It remains to be seen whether what is ultimately Beijing’s decision to delay an ASEAN-Hong Kong FTA may be a reflection on how Beijing regards the population of the territory. With recent protests concerning democracy, it is possible the Central Government may feel less obliged to provide Hong Kong with important treaty status if the population is considered unworthy of support. Either way, the lack of an ASEAN FTA with Hong Kong is to Singapore’s advantage, and the resulting FDI figures would appear to suggest Singapore is taking over as a the more desirable business hub when considering pan Asian investments.

Of the other major tigers, data for Indonesia was disappointing, with the country actually reporting a drop of FDI over the twelve month period indicated. That says a lot about tax reform, political change and poor infrastructure – Jakarta is one of the very few remaining Asian capital cities not to have a metro system in place, and frequent flooding of the capital – including investment zones – is driving investment elsewhere.

The trends therefore seem to be plain – Singapore is increasingly the place to be as an investment base from which to structure a China and ASEAN investment strategy, and is gaining ground over Hong Kong in this regard, with the latter increasingly being relegated to being purely a China play. Vietnam’s time as an Asian investment darling is still 12 months away and is linked to their AEC issues, while Malaysia and the Philippines are stealing a march on the rest of ASEAN. One can expect Indonesia and a more politically settled Thailand to show improvement over the coming months, but for the ASEAN minnows of Cambodia, Laos and Myanmar, it is still very early days to obtain both manufacturing quality and production sustainability as well as those ASEAN free trade breaks.

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates – a specialist foreign direct investment practice providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam, in addition to alliances in Indonesia, Malaysia, Philippines and Thailand, as well as liaison offices in Italy, Germany and the United States. For further information, please email asia@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Manufacturing Hubs Across Emerging Asia

Manufacturing Hubs Across Emerging Asia

In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

The Gateway to ASEAN: Singapore Holding Companies

The Gateway to ASEAN: Singapore Holding Companies

In this issue of Asia Briefing Magazine, we highlight and explore Singapore’s position as a holding company location for outbound investment, most notably for companies seeking to enter ASEAN and other emerging markets in Asia. We explore the numerous FTAs, DTAs and tax incentive programs that make Singapore the preeminent destination for holding companies in Southeast Asia, in addition to the requirements and procedures foreign investors must follow to establish and incorporate a holding company.

Are You Ready for ASEAN 2015?

Are You Ready for ASEAN 2015?

ASEAN integration in 2015, and the Free Trade Agreements China has signed with ASEAN and its members states, will change the nature of China and Asia focused manufacturing and exports. In this important issue of Asia Briefing we discuss these developments and how they will impact upon China and the Global Supply Chain.