What is a financial audit?

A financial audit is an objective examination and evaluation of the financial system and statements of an organization to make sure that the financial records give a true and fair view of the financial position of the company.

According to the Company Law of the People’s Republic of China, “Companies shall prepare financial accounting reports at the end of each accounting year, and such financial accounting reports shall be audited by an accounting firm in accordance with the provisions of the law.” This applies to all FIEs, irrespective of their corporate structure. Almost all companies receive a yearly audit of their financial statements – which includes an examination of the income statement, balance sheet, cash flow statement, and statement of changes in equity, among others – as the first step of annual compliance.

Annual compliance procedures for FIE

In advance of being able to distribute and repatriate profits, FIEs must complete annual compliance procedures involving the following steps:

- Conducting audit preplanning (preliminary audit);

- Producing a statutory annual audit report;

- Making a CIT reconciliation report; and

- Reporting to relevant government bureaus.

For FIEs, regardless of wholly foreign-owned enterprises (WFOE) or joint ventures (JV), the annual compliance requirements start after the end of the fiscal year (December 31 as China follows the calendar year) and usually take place until the end of June.

These procedures are not only required by law but are also a good opportunity to conduct an internal financial health check. The relevant procedures and key considerations vary slightly by region and entity type. Companies should either contact a service provider or the local government to achieve full compliance.

Step 1: Conduct audit preplanning (preliminary audit)

The preliminary audit is designed to plan the audit, spot the potential issues, and leave enough time for companies to make self-corrections.

Companies generally start the preliminary audit in November or December, during which auditors will do a risk assessment and internal control review by understanding the internal and external environment of the company and making inquiries to relevant personnel, both financial staff and the operational team.

A company that has completed a preliminary audit of its finances for the first nine or 10 months can significantly reduce the amount of substantive audit work to be conducted in the annual audit. They can therefore avoid the ‘rush period’ in late January and February, when businesses are scrambling to get their audit reports finished, and will therefore have ample time to conduct a more comprehensive audit and to implement changes in terms of how finances are run, or internal control is managed, as needed.

Auditors will also make audit plans and communicate the significant audit matters with the company in advance, which will help companies prepare and improve audit efficiency.

Step 2: Prepare an annual audit report

The annual compliance procedures start with the annual audit of the business. Although the audit report is generally not required to be submitted in the compliance process for FIEs nowadays – companies only need to disclose whether they have done an annual audit during annual reporting – most companies still conduct their audit on a yearly basis out of various considerations, and get the audit report ready before the end of April to meet the May 31 tax reconciliation deadline.

The annual audit report for FIEs generally consists of:

- Audit report (opinion page);

- Financial statements (including balance sheet, income statements, cash flow statement, and change in equity statement); and

- The notes.

To ensure that FIEs meet Chinese financial and accounting standards, the annual audit report should be conducted by qualified accounting firms and signed by two Certified Public Accountants (CPAs) registered in China.

Despite a requirement by the Company Law, in some cities, companies may not be required to submit the annual audit report to the local tax bureau. Rather, they may only need to disclose whether they have done annual audit during annual reporting. Companies are advised not to take the chance andconduct their audit on a yearly basis regardless.

In the case where an annual report is required, the requirements for the report may vary by region. For instance, in Shanghai, companies must include a taxable income adjustment sheet in the audit report, which is not a necessary supplement in Hangzhou, Beijing, or Shenzhen.

Step 3: Conduct CIT reconciliation

The next step following the audit report is to conduct an annual CIT reconciliation, which is also called annual CIT filing, before May 31 every year.

Although the State Taxation Administration (STA) oversees all kinds of tax, only corporate income tax requires annual reconciliation to the tax bureau at the company level.

CIT is paid on a monthly or quarterly basis in accordance with the figures shown in the accounting books of the company. Companies are required to file CIT returns within 15 days from the end of the month or quarter. However, due to discrepancies between China’s accounting standards and tax laws, the actual annual CIT taxable income is usually different from the total profits shown in the accounting books.

The STA requires companies to conduct annual CIT reconciliation within five months from the previous year’s year-end to determine if all tax liabilities have been met and whether the company needs to pay supplementary tax or apply for tax reimbursement.

Generally, the Annual CIT Reconciliation Report must include adjustment sheets to bridge the discrepancies between tax laws and accounting standards among other documents. FIEs that conduct transactions with related parties should prepare an Annual Affiliated Transaction Report on transfer pricing issues as a supplementary document to the Annual CIT Reconciliation Report.

Moreover, FIEs in certain regions might be required to prepare another separate CIT audit report by meeting certain conditions, which also vary from city to city.

The CPA firm that prepares the financial audit report usually also has Certified Tax Agents (CTAs) to prepare audit reports for CIT. In the case that the CPA firm does not have CTA qualification, companies must hire another CTA firm to do the report. The CTA firm usually requests an annual (financial) audit report as a reference for CIT reconciliation.

In the current trend of digitalization and business reform, annual CIT reconciliation can be conducted through online channels, under which companies can conveniently submit relevant information in the appointed system. However, if companies cannot make online CIT reconciliation due to certain circumstances, they can still go to the tax bureau in person to submit relevant materials as required.

The deadline for conducting annual CIT reconciliation is May 31 every year, but the investigation of the tax compliance could last until the end of the year, and companies should be prepared to provide supporting documents upon demand from the tax bureau. Besides, where companies are unable to conduct CIT reconciliation within the stipulated deadline due to a force majeure event, they may apply for an extension. But they must submit a report to the tax bureau immediately upon cessation of the force majeure event. The tax bureaus shall investigate the facts and approve accordingly.

Every year around March, depending on the location, the local tax bureau will issue annual guidance on CIT reconciliation. FIEs are suggested to keep an eye on the guidance for any potential changes regarding the requirements and procedures.

All companies engaging in production and operation, including pilot production and operation, are required to go through this procedure, regardless of whether or not the company is under a tax deduction period and whether or not the company makes a profit. For companies maintaining branch offices in multiple locations and required to pay tax on a consolidated basis, there are special rules and requirements regarding CIT reconciliation procedures.

The Annual CIT Reconciliation Report must include adjustment sheets to bridge the discrepancies between tax laws and accounting standards, among other documents. FIEs that conduct transactions with related parties should prepare an Annual Affiliated Transaction Report on transfer pricing issues as a supplementary document to the Annual CIT Reconciliation Report.

Deadline

The deadline for conducting annual CIT reconciliation is May 31 every year, but the investigation of the tax compliance could last until the end of the year, and companies should be prepared to provide supporting documents upon demand from the tax bureau. Besides, where companies are unable to conduct CIT reconciliation within the stipulated deadline due to a force majeure event, such as when the company was quarantined due to COVID-19 control measures, they may apply for an extension. But they must submit a report to the tax bureau immediately upon cessation of the force majeure event. The tax bureaus shall investigate the facts and approve accordingly.

Every year around March, depending on the location, the local tax bureau will issue annual guidance on CIT reconciliation. FIEs are suggested to keep an eye on the guidance for any potential changes regarding the requirements and procedures.

Step 4: “Many-in-one” annual reporting

The fourth step of annual compliance is to conduct annual reporting to multiple government bureaus before June 30 every year to ensure that companies are compliant and that the information related to each department is updated.

The annual reporting to the local Administration of Market Regulation and the annual combinative reporting are merged into one “many-in-one” annual reporting, under which the FIEs can submit all relevant information at once through the National Credit Information Publicity system.

Companies are no longer required to separately report to the local State Administration of Market Regulation (SAMR, which previously was called the Administration of Industry and Commerce or AIC), the Commerce Bureau, the Finance Bureau, the Tax Bureau, the Statistical Bureau, and the foreign exchange bureau. The annual report submitted should cover at least the following information:

- Basic information about the enterprise, including the contact information, the existence status of the enterprise, the business scope, the licensing situation, the staffing and salary information, the social insurance contributions, the IP situation, etc.;

- Investor profile, including information regarding the subscribed and paid in amount, time, ways of contribution, the actual controller of the investor, etc.;

- The name and URL of the website of the enterprise and of its online shops;

- Equity change information of the equity transfer by the shareholders of a limited liability company;

- Information relating to any investment by the enterprise to establish companies or purchase equity rights;

- The balance sheet information of the enterprises, including total assets, total liabilities, total owner’s equity, etc;

- Warranties and guarantees provided for other entities;

- Information regarding the operation of the enterprise, including total revenue, taxable income, and net profit;

- Number of employees; and

- Information regarding employee social insurance.

Part of the information will be synced automatically from the statistics maintained by other government bureaus, such as the Social Security Bureau and Tax Bureau. Enterprises are required to prepare and submit other information online during the period between January 1 and June 30.

Step 5: Prepare and submit transfer pricing documentation

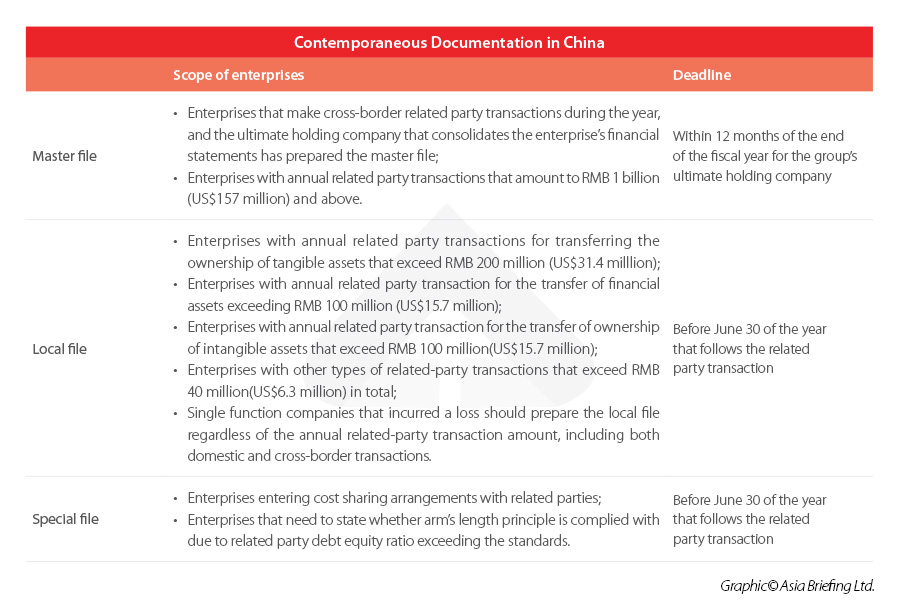

In addition to filing the related party transaction forms during the annual CIT reconciliation, enterprises exceeding the relevant transaction threshold (except those that are covered by an advance pricing agreement or that only transact with domestic related parties) should prepare and maintain contemporaneous transfer pricing documentation before the stipulated deadlines.

Under the current transfer pricing regulation, a three-tiered contemporaneous documentation framework – master file, local file, and special file – is implemented in China. For easier understanding, we summarize the three-tiered framework of contemporaneous documentation as below.

Consequences of failing to follow annual compliance requirements for FIEs

If the enterprise fails to submit the annual reporting information on time, it will be put into the Catalogue of Enterprises with Irregular Operations (Irregular Operations Catalogue), which is open to the public.

Besides, the enterprise will also be put into the Irregular Operations Catalogue if fraudulent information or serious concealment is discovered by authorities in the random check following the annual reporting.

If the enterprise is listed in this catalogue for three years in a row, there will be more serious consequences – the enterprise will be put into the Catalogue of Enterprises with Illegal and Dishonest Behaviors, which serves as a blacklist for future operations and investments.

The legal representative and the general manager of the blacklisted enterprise will be banned from taking the legal representative or general manager role in other enterprises for three years, and the blacklisted enterprise will be in a disadvantageous position in bidding, government procurement, licensing application, obtaining land, as well as making new investment in the future.

FIEs are suggested to pay attention to the deadlines and requirements, or make timely correction where incompliance happen, to avoid serious consequences.

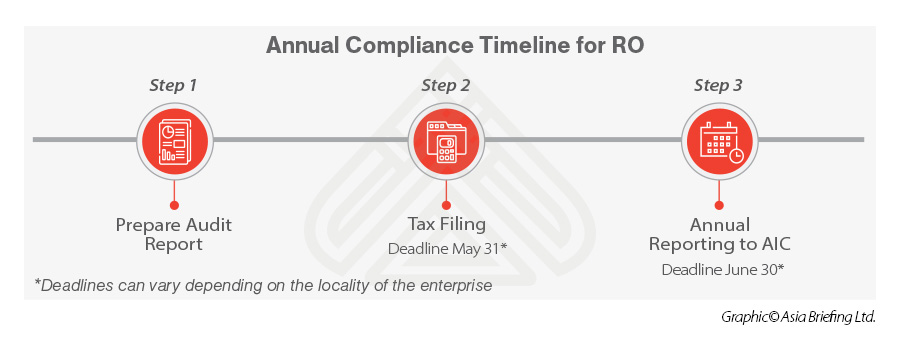

Annual compliance requirements for ROs

RO’s annual compliance includes preparing an annual audit report and a tax reconciliation report and then reporting to the local SAMR in charge. While the procedure looks like that applicable for FIEs, each step has different requirements and focus.

Step 1: Prepare the annual audit report

While FIEs are only required to submit the audit report in limited scenarios, it is a mandatory requirement for an RO to do so. The annual audit report for ROs should be prepared by external licensed accounting firms and signed by two CPAs registered in China.

When doing the annual audit for ROs, auditors should pay special attention to the following factors:

- Bank statements, cash, staff, and IIT: The balance on the bank book should be the same as that stated in the bank statement. If not, a bank reconciliation should be prepared to verify the differences. The balance on the account should be the same as the cash contained in the cash box. The auditors will perform a cash count during their fieldwork. Employment of staff must be registered in accordance with the relevant regulations (local employees registered with qualified dispatch agencies and valid work permits for expatriate staff ), and IIT correctly assessed and filed.

- Expenses report: Expenses include rent, transportation, telephone, salary, office purchases, entertainment, audit fees, utilities, and dispatching service fees, regardless of whether these are paid from the RO or directly from its head office. Any expenses belonging to the fiscal year should be properly accrued with contracts or agreements as support. The total salary of the chief representative, whether paid offshore or locally, must be included in the expenses. If employees are involved in overseas social security plans, these payments must be included in the expense report.

- Taxable income: According to relevant laws and regulations, ROs of foreign enterprises in mainland China must pay CIT on their deemed taxable income, as well as VAT and CT when it is applicable. The CIT liability will be assessed by the deemed profit method, cost-plus method, or actual revenue method. Among these three methods, the cost-plus method is the most used since the other two methods require ROs to submit numerous supporting documents. Under the cost-plus method, the taxable income, that is, the deemed revenue, is calculated on the basis of the expenses:

DEEMED REVENUE = RO EXPENSES / (1 - DEEMED PROFIT RATE*)

*The deemed profit rate is decided by the tax bureau.

Step 2: Annual tax reconciliation

Like FIEs, ROs also need to submit the Annual Taxation Consolidation Report to the tax bureau by the end of May each year, though regional variations may exist. If the audited taxes due are found to be different from the taxes paid by the RO, the RO shall discuss the variation with the tax bureau.

For foreign companies that suspect this might occur, it is wise to hold preemptive discussions with tax advisors prior to audit submission. The annual tax reconciliation could be conducted through online filing. Offline channels are also available if online filing is unsuccessful.

Step 3: Annual reporting to local branches of SAMR

ROs are required to submit an annual report between March 1 and June 30 every year providing information on the legal status and standing information of the foreign enterprise, ongoing business activities of the RO, and an audit report. As compared to FIEs, the reporting period starts later, and the audit report is mandatory in all circumstances.

During the annual reporting process, the following documents should be provided in paper or online:

- Annual report (the template will be distributed by local authorities around March);

- Business registration certificate;

- Audit report; and

- Proof of information on the legal status and standing of the headquarters overseas.

Penalty for non-compliance

Failing to submit the annual report on time may lead to additional penalties, ranging from RMB 10,000 to RMB 30,000. An RMB 20,000 to RMB 200,000 penalty might be given if the report includes fraudulent information. Failing to make corrections as required or fraud could lead to license revocation.

Internal control and audit

Strong internal control systems and periodic audits are essential to preventing fraud when running a company. The following is a list of common types of fraud in China-based enterprises (including FIEs with less than adequate internal control systems), separated by department:

- Payroll

- Discrepancy between contract salary and payroll payments;

- Deliberate over-accrual/unauthorized use of welfare benefits; and

- Ghost employees (non-existent employees).

- Supply Chain

- Purchasing of overpriced raw materials due to relationship/inappropriate agreement between staff and supplier;

- Improper disposal of scrap;

- Fake invoices; and

- Poor inventory control.

- Sales

- Sale of goods at/below cost due to relationship/inappropriate agreement between sales staff and purchaser;

- Payment of unauthorized sales commissions to employees or friends; and

- Lack of competitive bidding process.

A key aspect of the Chinese legal environment is the use of official company seals, or “chops”, to legally authorize documentation (often in place of a signature). To safeguard against fraud, chops should not all be held by one person, and steps should be taken to ensure that chops are not misused.

Depending on its business scope, a company may hold any number of chops, all for different purposes and used on different types of official documentation, including a company chop, financial chop, contract chop, customs chop, invoice chop, etc.

An internal audit ordered directly by company headquarters is the best way to evaluate the effectiveness of internal control systems and prevent fraud in a China-based entity. An internal audit engaged by the China-based entity and reporting only to that entity runs the risk that fraud discovered at the local level may not be reported to the overseas headquarters.

FAQ: Annual accounting and audits in China

How to prepare for an effective annual audit in China?

Whether an audit is effective or not makes a big difference in a company’s governance and development in the long run, though it is not easy to identify the audit effectiveness right after the process.

From the company’s perspective, an effective audit can help maintain its financial health and offer advice on how certain processes may be improved. To be more specific, an effective audit can:

- Ensure that the financial statements of the company present a true and fair view of its financial situation;

- Reveal irregularities and suboptimal business practices;

- Identify risks in different functional areas; and

- Offer advice on improving internally.

An effective audit should also be completed on schedule and with minimal disruption to the company.

To achieve audit effectiveness, besides choosing a qualified audit firm, it is vital for companies to make preparations in advance, among others. An audit will be more meaningful for companies if auditors have adequate time to analyze accounts and evaluate control procedures instead of being occupied with simple checks. This article is designed to provide some practical guidance based on our professional on-the-ground experiences.

What do companies need to prepare in general?

For companies, preparing for the annual audit goes beyond simply providing the accounts and ledgers. In general, companies can help to improve the audit effectiveness by taking the below measures:

Make a thorough inventory of the assets

Before the auditor conducts a spot check of the company’s assets in the substantive audit, companies are suggested to make a full-scale stock take of the assets by themselves to verify the existence and completeness of their assets. This is especially recommended if companies rarely check their assets on a regular basis.

Companies should arrange cash count, inventory count, and fixed assets inspection, among others. If obsolete inventory items, idling assets, and defective products are found during the check, they should let the auditors know and start to think about making impairment assessments.

The thorough stock take is suggested to be arranged as close to year-end as possible. Otherwise, companies may need to provide stock-in and stock-out information to roll back or roll forward to reconcile the actual stock-take results and year-end accounting books.

Arrange confirmations

Bank confirmation is a primary focus in verifying the bank balance of the financial audit. Before the auditor’s investigation, companies are suggested to get relevant information ready in advance, including bank statements, bank reconciliations, bank balance, borrowings, guarantees, time deposits, bank mailing address, contact number, etc. This will shorten the time spent at this stage and provide the auditor with a good impression.

Besides bank confirmations, auditors may arrange confirmations for the current accounts to verify the existence and accuracy of the selected amounts, such as the related-party balances and transactions, trade receivables and payables, inventory on consignment, advancements to employees, etc. From the companies’ perspective, they are suggested to check accounts with current customers before the annual audit if they don’t do this regularly. This will save much time for their auditors.

Analyze recoverability of receivables (credit risks)

Credit risk analysis on financial assets often involves management’s judgment. While many companies find it difficult to conduct such an analysis, it is nevertheless essential to assess the recoverability of financial assets such as trade debtors.

Under the newly effective accounting standard on financial instruments, the expected credit loss model should be adopted when making the analysis. The accounts receivable ageing analysis alone is no longer sufficient for the impairment assessment of financial assets.

Companies should make clear accounting policies on what factors are to be taken into consideration when assessing credit risks, look for reasonable and supportable forward-looking information that is available to the management, and determine the risk of default.

If there are indeed such default risks based on companies’ self-evaluation, it will very likely be noticed and inquired by the auditor during the audit. Companies are suggested to think about how to justify the risks when being asked.

Prepare for expense checking

It’s important for companies to obtain and maintain tax-deductible expense vouchers, which, in China, mainly refer to VAT invoices. Companies are suggested to check and prepare relevant invoices and other documentation in advance. When the year-end approaches, for invoices that should have been but are not yet obtained, companies should try to see if there is any chance to get them ready before the financial audit. Should companies fail to obtain legitimate expense vouchers before filing the annual CIT returns, relevant expenses will become non-deductible for CIT purposes in the current year.

For outbound expenses paid to overseas vendors, relevant taxes must be withheld, or else such expenses will not be pre-tax deductible.

Besides obtaining VAT invoices and other legitimate tax-deductible vouchers, companies should also make full provision of the expenses in their accounting books, regardless of whether they have received the VAT invoice or not. All expenses should be properly recorded before the end of December.

Remember to bind your accounting vouchers and keep them tidy and organized. By making a good impression on the auditors, companies may expect fewer questions from the auditors.

Analyze profits and justify fluctuations

Companies should analyze their profit ratio in advance. In case significant changes are found for essential indicators, such as gross margin fluctuations or increasing selling expenses, companies should have valid explanations to justify the fluctuations. As such, irregulates will definitely be noticed by their auditors and lead to queries during the audit.

Make sure relevant staff are on duty

As introduced above, beyond providing documentation prior to the actual audit, companies should prepare to offer additional information and details behind the figures, which requires close support from all key staff during the audit.

Thus, companies should plan around the audit to ensure that all key finance and accounting staff and other key staff of the operational teams haven’t booked time off and have a general free schedule during the audit. Ideally, these staff should be available at any time when required.

What are the corporate income tax (CIT) preparations?

Under the current policy, companies decide whether they are qualified for certain CIT incentives based on their self-assessments. This simplifies the process of enjoying tax incentives but increases potential tax risks where there have been misjudgments. So, auditors generally will help to make CIT-relevant evaluations in the annual audit, although they do not express an opinion in this regard.

From the companies’ perspective, they are suggested to prepare relevant sub-ledgers and gather and retain supporting documents for such items in advance. On the other hand, they are suggested to carefully examine if they have exhausted all possible tax reductions.

What is accounting digitalization?

Accounting digitalization, or tech-powered accounting solutions, means the use of information technology to optimize the finance and accounting processes. “Shift to digital” has been an emerging trend, especially since the outbreak of COVID-19.

Different from other preparations directly related to the annual audit and can be made right before the process, accounting digitalization is more like a long-term investment with multiple benefits, including making the financial audit easier and more effective.

To be more specific, compared to traditional methods, finance, and accounting technology has advantages in efficient allocation of work hours, accurate accounting through real-time capture of information and computerized calculation, system integration with compliance/reporting mechanisms, and more optimal (rather than one-time) use of company data.

For example, a lot of information that needs to be prepared for the audit, such as how much money is owed to each vendor and what the ageing schedule/accounts receivable ageing for each outstanding transaction, can be displayed on a searchable accounts payable list. This information itself is delivered from a specific module of the tech-powered accounting software, which in turn gets populated automatically from the digitalized expense management app.

Another example relates to fixed assets management. Important questions during audits include: What information does the company have about its fixed assets? How far have they depreciated? What is the nature of these assets? All this information will be pulled directly from the fixed assets module of the tech-powered accounting software and displayed on a fixed assets list. At the very least, going digital results in most documentation being accessible online, saving auditors and executives from rifling through filing cabinets at the financial year-end. Companies that haven’t adopted finance and accounting technology are well advised to think about it for the next year or plan for it in the near future. Newer tech-enabled accounting solutions are no longer prohibitively expensive or difficult to use. For companies that use an accounting service provider and don’t have highly complex requirements in terms of processing or reporting, flexible platforms now exist whose access is part of the services provided by accounting providers to smaller firms, sometimes with only minimal upfront setup fees.

How to get the most out of the annual audit?

An effective audit is beneficial to a company’s management and development in the long run. To pursue audit effectiveness, close collaboration between the auditor and the auditee is needed.

From the companies’ perspective, by conducting necessary self-checking, preparing needed accounting and tax documentation, analyzing core finance issues, and preparing for auditors’ inquiries in various aspects, they can not only help to minimize the disruption of the annual audit on their business operations but also enable a more comprehensive audit that can help senior management gauge the efficiency of the financial workings of their company. In addition, to get the most out of the annual audit, companies are suggested to take the chance to improve their internal control and review related-party transactions. Especially for smaller companies that don’t have a designated team to handle the matters and don’t have separate internal control reviews and transfer pricing assessments, it is well advised to integrate these value-added reviews into the annual audit process. Given this, auditors will likely increase the risk assessment level and come up with more inquiries, more tests of controls, and more substantive tests.

Companies should be mentally prepared and get ready to collaborate with the auditors more closely for additional inquiries and tests.