Overview of India’s Labor Code

Foreign companies looking to establish in India should understand the country’s multiple federal labor laws as well as locally enacted laws that are specific to the state, industry, and the size of the firm. Since labor is a concurrent subject in India, both the Centre as well as the states can make laws regulating labor.

|

Existing Labor Laws in India |

||

|

Enacted and enforced by the federal government |

Enacted by the federal government, enforced by federal and state governments |

Enacted by the federal government, enforced by the state government |

|

|

|

|

Note: The list is not an exhaustive account of India’s labor laws; it excludes worker and sector-specific regulations. |

||

While the federal government has spearheaded major reforms to consolidate the numerous existing laws into four major labor codes, these Codes are yet to be implemented. They are:

- The Code on Wages;

- The Code on Social Security;

- The Industrial Relations Code; and

- The Occupational, Safety, Health, and Working Condition Code.

|

New Labor Codes and Corresponding Laws it Will Subsume |

|

|

New labor code |

Subsumed laws |

|

Code on Wages, 2019 |

|

|

Code on Social Security, 2020 |

|

|

Occupational Safety, Health, and Working Conditions Code Bill, 2020 |

|

|

Industrial Relations Code Bill, 2020 |

|

Employment Contracts

There is no provision in existing labor laws that requires an employer to provide a written statement of particulars to a newly hired employee. However, as a matter of best practice, written employment contracts are executed between the employer and the employee, or a detailed written appointment letter is issued to the employee, the terms of which are required to be duly accepted and acknowledged by the employee.

There are three types of employment contracts in India:

- Permanent (direct) contract;

- Fixed contract; and

- Temporary contract.

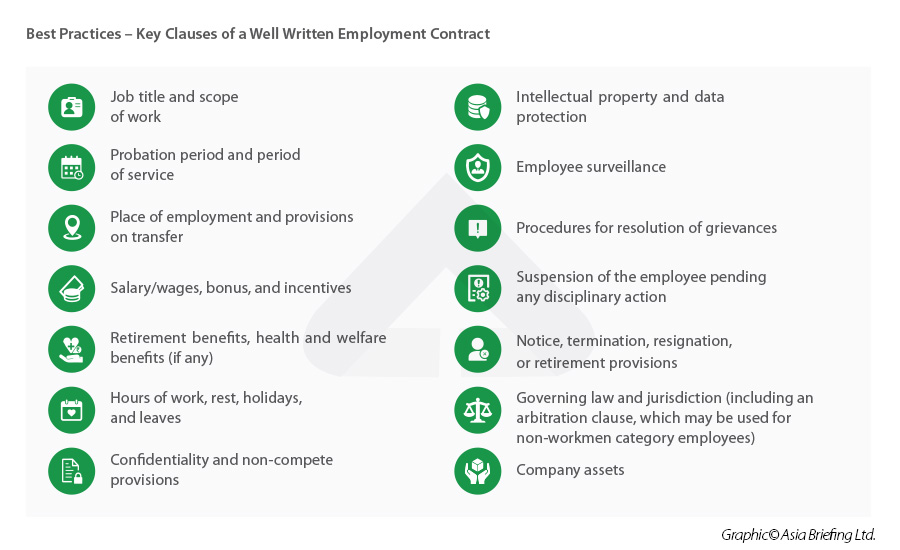

The employment contracts used in India contain the following information:

Working hours, overtime payments & leave policy

Working hours

The working day of an adult (unskilled/semi-skilled/skilled) worker should be inclusive of the interval of rest – it shall not exceed 12 hours on any day.

The below table summarizes the hours worked in a day and week with rest intervals, including meals for four metropolitan cities of India, according to the respective state-specific S&E Acts.

|

Working hours |

New Delhi |

Mumbai |

Chennai |

Kolkata |

|

Maximum hours in a day |

9 |

9 |

8 |

81/2 |

|

Maximum hours in a week |

48 (normal circumstances) 54 (special circumstances) |

48 (normal circumstances) 54 (special circumstances) |

48 (normal circumstances) 54 (special circumstances) |

48 (normal circumstances) 54 (special circumstances) |

|

Rest interval |

1/2 hour (rest and meal interval) for every 5 hours of continuous work |

At least one hour (rest and meal interval) for every 5 hours of continuous work |

At least 1/2 hour (rest and meal interval) for every 4 hours of continuous work |

1 hour (rest and meal interval) for every 51/2 hours of continuous work |

An adult (over 18 years of age) cannot work for more than 48 hours in a week and not more than 9 hours in a day. Further, the spreadover should not exceed 10½ hours. Otherwise, the overtime rules are applicable.

Overtime

Overtime payments are given to employees in the category of workmen in factories and commercial establishments prescribed by the concerned state authorities.

Overtime wages are calculated at a rate of up to twice the normal wage under various acts, including the S & E Act for various states.

Several statutes regulate overtime and overtime payment, and different legal acts provide for different periods of working hours.

Leave policy management

Formally employed workers are entitled to privileged leave, sick and casual leaves and other types of leaves as established by the company, such as marriage leave, private affairs leave, paternity leave, bereavement leave, exam leave, etc.

The number of leave days and holidays given by the organization to its employees working in its offices in different states should follow the prescribed numbers under all applicable state laws pertaining to the same.

Minimum wages

Both the central and state governments have control over fixing the minimum wages of employment. Wage rates of employment differ across occupations, skills, sectors, and regions. Given the extent of difference between various kinds of employable work, there is no set wage rate that can be set for each specific work across the country. Businesses are advised to track the periodically updated minimum wage amount across various categories of employment in their respective state/city/zone of operation, such as:

- Unskilled;

- Semi-skilled;

- Skilled; and

- Highly skilled workers.

Each state government has the power to fix the minimum wage rates for the following:

- Time work;

- Piecework; and

- Overtime work.

Minimum wages for an employee are based on the following parameters:

- Nature of employment;

- Industry;

- Geographic location; and

- Employee’s age.

Salary

India’s salary structure consists of basic salary, allowances, social security contributions, and reimbursements, which cumulatively is considered as the cost to the company (CTC). Employers have to deduct tax at source (TDS) from the employees’ salary income and deposit the same with the government treasury on a month-to-month basis.

Allowances and benefits

Allowance can be partially or fully taxable, depending upon the type of allowance. The allowances provided and their respective limits will differ from one company to another, as per their respective policies.

- Dearness allowance (DA);

- House rent allowance (HRA);

- Conveyance allowance;

- Leave travel allowance (LTA);

- Medical allowance; and

- Books and periodicals allowance.

Termination, severance, and payment

The different classifications of termination of employment as recognized under Indian labor law are:

- Voluntary Termination;

- Involuntary Termination;

- Layoffs and Downsizing

- Getting fired

- Illegal dismissal

- Termination under contract; and

- Termination by law.

Severance pay is offered to employees who retire, are laid off, or reach the end of the contractual agreements. Employers are advised to consult relevant legal provisions applicable to their industry, location, and type of establishment. Employees are entitled to gratuity payments after five years of continuous service.

Social security

India’s social security system is composed of a number of schemes and programs spread throughout a variety of laws and regulations. India’s social security schemes cover the following types of social insurance:

- Employee provident fund,

- Health insurance and medical benefits under respective schemes;

- Disability benefit;

- Maternity benefit; and

- Gratuity.

Hiring foreign employees

Labor laws in India are applicable to all establishments incorporated or doing business in the country, irrespective of the nationality of staff employed. However, the framework of labor legislation is only applicable to establishments, employers, and employees within India.

Prevention of sexual harassment of women in the workplace

The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 (the Act) prescribes a system for investigating and redressing complaints against sexual harassment of women in the workplace. It also provides safeguards against false or malicious charges. The major provisions of the Act lay down the following responsibilities for employers to ensure a safe working environment for women:

- Display penal consequences of sexual harassment;

- Organize workshops and sensitization programs;

- Formulate an internal policy, charter, resolution, declaration;

- Form an ‘Internal Complaints Committee’ (ICC) where the number of employees is more than 10;

- Provide necessary facilities to the committees;

- Secure attendance of witnesses/respondent;

- Monitor timely submission of committee reports;

- Assist the woman in pursuing a criminal case if she so chooses;

- Maintain confidentiality of the inquiry process. The Act lays down a penalty of INR 5,000 on the person who has breached confidentiality; and,

- With sexual harassment being a crime, employers are obligated to report offenses.