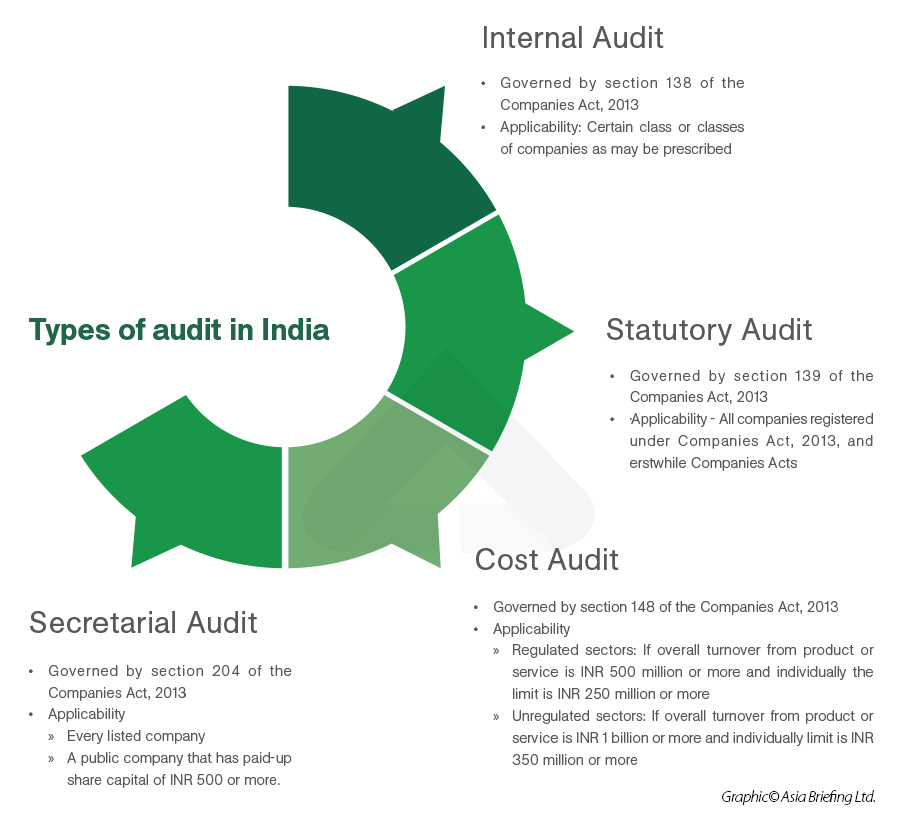

India’s audit regulations require businesses to comply with various types of audits, governed under different laws. The most common audits are statutory audits, internal audits, secretarial and cost audits under the Companies Act, 2013, and tax audits under Section 44AB of the Income-Tax Act, 1961. Since the commencement of the Goods and Services Tax (GST) law in 2017, businesses and entrepreneurs in India are also required to conduct GST audit each year.

Here we examine each type of audit, what classes of companies are required to conduct it, and penalty for non-compliance.

|

An Overview of Types of Audits under the Companies Act, 2013 |

||||

|

Type of audit |

Scope of audit |

Standards to comply |

Who conducts the audit? |

Who is the report submitted to? |

|

Statutory audit |

Audit of the financial records and statements of the company |

Auditing standards recommended by Institute of Chartered Accountants of India (ICAI) |

A chartered accountant (CA) (excluding the statutory auditor of the company); or A cost accountant; or A professional decided by the Board. |

Members |

|

Internal audit |

Audit of the functions and activities of the company |

NA |

A CA (excluding the statutory auditor of the company); or A cost accountant; or A professional decided by the Board |

Board of Directors |

|

Secretarial audit |

|

Auditing Standards recommended by the Institute of Company Secretaries of India (ICSI) |

A practicing company secretary (CS |

Members |

|

Cost audit |

Audit of the cost records of the company |

Cost auditing standards issued by the Institute of Cost and Works Accountants of India |

A practicing cost accountant |

Board of Directors |

Tax audit

The major objective of tax audit are outlined below:

- Ensure proper maintenance and correctness of books of accounts and certifications of the same by a tax auditor;

- To report prescribed information, compliance of various provisions of income tax act;

- Proper books maintenance, calculation, and verification of total income, claim for deductions; and

- Reporting observations/discrepancies noted by tax auditor after methodical examinations of the books of account.

It also verifies if the individual has complied with various requirements of income tax law, such as filing income tax returns, and income tax deductions among others. The tax audit report is submitted along with the income tax return.

Who needs a tax audit?

A tax audit is applicable to all companies, LLPs, as well as professionals whose turnover crosses a particular threshold limit. Mandatory tax audit limit for different categories of taxpayers:

- Any individual carrying on a business whose sales, turnover, or gross receipts of the business exceeds INR 100 million; or

- Any individual carrying on a professional whose gross receipts exceeds INR 5 million; or

- Any person carrying on a business where the profits and gains from business are determined on a presumptive basis under section 44AE or 44BB of the Income Tax Act; or

- Any person carrying on a business, whose income is determined on a presumptive basis under section 44AD of the Income Tax Act. If the cash transactions are up to 5 percent of total gross payments, the threshold limit of turnover for an audit is increased to INR 100 million.

Businesses registered as MSME (medium, small, and micro enterprises whose turnover is less than INR 50 million (US$611,000) will not be required to undergo a tax audit and carry out less than five percent of their business transactions in cash.

Tax audit report

The audit must be conducted by a practicing licensed chartered accountant (CA). The auditor must submit the tax audit report in the following format:

- Form 3CA: When a company is already mandated to get their accounts audited under any law. This is applicable to companies that get their accounts compulsorily audited under the Companies Act, 2013; or

- Form 3CB: When a company or individual gets their accounts audited under the section 44AB of the Income Tax Act.

Further, the tax auditor must submit Form 3CD along with either of the above-mentioned forms, as it is a part of the audit report.

Penalty for non-compliance

If a company or an individual is not in compliance with the tax audit provisions, or fails to conduct a tax audit, then a penalty of 0.5 % of total sales not exceeding INR 1,50,000 is imposed.

Managing a GST audit

The GST system requires taxpayers to self-assess their tax liability and pay their tax without any intervention by the tax authorities. The law provides for a robust audit mechanism to measure and ensure compliance by the taxable person.

The GST audit checks the accuracy of information furnished, taxes discharged, refund claimed, and input tax credit availed by the individual taxpayer.

As per changes introduced to the GST audit norms by the Finance Act, 2021, any registered taxable person whose annual aggregate turnover exceeds INR 50 million during a financial year needs to get their accounts audited.

Furthermore, the compulsory GST audit requirement by a Chartered Accountant or a Cost and Management Accountant for taxpayers with a turnover exceeding INR 20 million stands removed. The Form GSTR-9C is to now be self-certified and submitted by taxpayers with a turnover of more than INR 50 million from FY 2020-21 onwards.

|

Turnover |

GSTR 9: Annual return to be filed yearly by taxpayers registered under GST |

GSTR 9C: Certified copy of the audited annual accounts and a reconciliation statement |

|

Up to INR 20 million |

Optional |

Not Applicable |

|

INR 20 million - INR 50 million |

Mandatory |

Optional |

|

Above INR 50 million |

Mandatory |

Mandatory (can bbbe filed through self-certification, no professional required |

Items included to calculate turnover:

- All taxable (inter-state and intra-state) supplies other than supplies on which reverse charge is applicable;

- Supplies between separate business verticals;

- Goods supplied to/received from job worker on principal basis;

- Value of all export/zero-rated supplies;

- Supplies of agents/ job worker on behalf of the principal;

- All exempt supplies. For example, agricultural inputs, such as produce, that is supplied along with branded ready-to-consume food; and

- All taxes other than those covered under GST, such as entertainment tax paid on the sale of movie tickets.

Items excluded when calculating the turnover

- Inward supplies on which tax is paid under reverse charge;

- All taxes and cess charged under the GST, that is, the CGST and SGST or IGST, Compensation Cess;

- Goods supplied to or received back from a job worker; and

- Activities that cannot be categorized as supply of goods or service under schedule III of the CGST Act.

Filing GST audit

To file the audit, the taxpayer must submit the following documents electronically:

- An annual return using the form GSTR-9 by December 31 of the next financial year;

- A copy of audited annual accounts;

- A certified reconciliation statement in the form GSTR-9C, reconciling the value of supplies declared in the return with the audited annual financial statement; and

- Any other particulars as prescribed under the law.

In this category of audit, the government prescribes different types of annual return: GSTR-9 is for regular taxpayers and GSTR-9A is for composition scheme.

Taxpayers must note that the annual return is applicable to all registered persons in GST except input service distributors, casual taxable persons, non-resident taxable persons, and persons liable to deduct tax at source.

For the reconciliation statement, it is advisable for GST registered entities to have a copy and maintain their accounts as a proof to show correctness with regard to the following:

- Production of the goods (taxable inward supply of goods and/or service or both taxable outward supply of goods and/or services or both);

- Stock of goods;

- Input tax credit availed; and

- Output tax payable and paid.

General GST audit

In general GST audit the commissioner or any other officer authorized by the commission may undertake the audit of any registered individual for such period, at such frequency, and in such manner as prescribed under the GST law.

The audit may be conducted at the place of business of the registered person or in the office of the commissioner or officer authorized by the commissioner.

The time-frame for carrying out the audit is three months. The officials serve registered taxpayers an advance notice at least 15 days prior to the audit commencement. Starting from this day, the audit must be completed within three months. In special cases, the authorized officer can extend the time-period for audit completion by not more than six months.

During the course of GST audit, the authorized officer may require the registered person to:

- Provide the necessary facility to verify the books of account or other documents as required; and

- Furnish such information as required and render assistance for timely completion of the audit.

Special GST audit

Special audits are audits ordered by a GST Officer and conducted by a Chartered Accountant or CMA. An assistant commissioner of the GST can order a GST special audit when he/she suspects that the assessee declared taxable values incorrectly or provided the utilized input tax credit inappropriately. These disparities may include:

- Incomplete audit;

- Discrepancies observed in the liability with the intention to evade tax; and

- Incorrect revenue declaration.

The officer orders a special audit through Form GST ADT-03 and the taxpayer should audit the accounts after or before the commencement of any scrutiny, enquiry or investigation. The GST Officer shall select the CA or CMA to perform the audit and the taxpayer should cooperate with the Auditor for completion of the audit.

Once the audit is complete, the CA or CMA would submit the findings of the audit in Form ADT- 04. A special audit must conclude by an auditor within 90 days. In rare cases, the due date may extend to another 90 days by the Commissioner, based on an application made by the CA or CMA.

On conclusion of a special audit under GST, the taxpayer is provided with an opportunity to be heard in respect of any material gathered in the special audit which is proposed to be used in any proceedings against the taxpayer.

How to prepare for the GST audit and annual return filing

Companies that have a presence in multiple locations, in the form of a subsidiary or branches across the country, must compute annual turnover on an all India PAN basis. The GST Law treats every entity of a company located in more than one state or union territory as distinct.

If the entity is registered in more than one state or union territory, and the aggregate turnover from all such states exceeds INR 50 million, then the entity must get state-wise accounts audited under the GST law.

Aggregate turnover includes the value of all exempt supplies and exports under the same PAN, on an all-India basis. In cases, where companies have multiple GSTIN state-wise registrations on the same PAN, traders and dealers must internally derive their turnover GSTIN-wise and declare the amount in Form GSTR-9C.

Companies that have multiple registrations within the state must maintain separate accounts as the law requires companies to file a reconciliation statement separately for each (GSTIN) registration within the state.

FAQ:Common Compliances for Companies in the Indian Regulatory Landscape

What are the challenges companies face while ensuring that necessary regulatory compliances are completed?

Managing compliances in today’s highly complex economic and regulatory environment is no easy task. Companies face many challenges, including:

- Rapid globalization;

- Ongoing developments in tax and other allied laws;

- Changes in accounting standards;

- Increased demand from regulatory authorities for greater transparency and cooperation;

- Acute shortage of qualified professionals;

- Obtaining accurate data in an efficient manner;

- Global trends towards centralization of compliances; and

- An ever-evolving technology ecosystem.

Can you list a few common laws and legislations that are applicable to companies in India?

The following laws are applicable to companies in India:

- The Companies Act 2013 and Rules thereof;

- Labor and Employment Laws;

- Environmental Laws; and

- Tax and Stamp Duty.

Can you explain the scope of compliances under Companies Act, 2013?

The scope of compliances under the Companies Act covers but is not limited to the following:

The Companies Act, amongst other provisions, lays down detailed guidelines regarding qualification and appointment/ removal of directors, retirement of directors, their remuneration, passing board resolutions, arranging board and shareholders meetings, oversight on related party transactions, timely maintenance of books of accounts and the preparation and presentation of annual accounts (matters that must be included in the annual reports of the companies), filing of forms with the Registrar of Companies periodically, etc.

Subsequent to the completion of all legal formalities required for incorporation, and the issuance of the certificate of incorporation, the company is recognized as a separate legal entity in the eyes of the law, distinct from its members who have incorporated the entity.

Whether it is a private or a public company, various things are supposed to be dealt with post incorporation. There are matters that must be undertaken in the first board meeting immediately post incorporation, and then there are tasks that are required to be carried out on a periodical basis.

A company conducts its business through its Directors who are accountable in the event of failure to comply with the above compliances.

Soon after a company is incorporated, but no later than 30 days, an appointed director is under obligation to call the First Board Meeting by issue of notice (together with the agenda) of the meeting at least seven days prior to the meeting. Several important matters need to be resolved in this first board meeting.

A company must also place its sign board outside the registered office address, with its name, registered office address, company identification number, e-mail ID, and phone number (mandatory fields as per the current mandate), Website address and fax number, if any, stated on it. These details must also be printed on all business letters, billheads, and all other official publications.

As mentioned under section 173(1) of the companies act of 2013, a company must convene at least four board meetings, in addition to the first board meeting, with a gap of no more than 120 days between two consecutive board meetings in a calendar year. Detailed minutes of the meetings should be prepared, recording the important actions taken by the Board of Directors and the same must be maintained as a permanent document by the company. Within 30 days from the meeting, the minutes must be prepared, duly signed, and maintained in a minute’s binder.

Similarly, on allotment of shares, the company must issue share certificates to those who have been allotted the shares and must maintain both a members register and a shares allotment register. A company is also required to file various financial statements along with the auditor’s report and annual return before the due date every financial year with the Registrar of Companies.

Additionally, there are several instances wherein a company has to intimate the concerned Registrar of Companies, on a timely basis, about the appointments/ removal of directors and certain other changes in a prescribed manner.

The above-mentioned compliance requirements under the Companies Act is not an exhaustive list. Some companies may also be required to ensure several other additional compliances such as registration under the GST, Professional Tax, and Shops and Establishment Act. It is important to understand that the responsibility of complying with the central and state by-laws is indeed, a continuous process.

What is the scope of compliances under Labor and Employment Legislation?

The scope of compliances under Labor and Employment Legislation covers, but is not limited to, the following:

Businesses with production lines, factories, must consider and comply with a host of statutes such as:

- The Employees' State Insurance Act, 1948;

- The Maternity Benefits Act, 1961;

- The Industrial Disputes Act, 1948;

- The Contract Labor (Regulation and Abolition) Act, 1970;

- The Trade Union Act, 1926;

- The Equal Remuneration Act, 1976;

- The Payment of Gratuity Act, 1972;

- The Workmen’s Compensation Act, 1923; and

- The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, etc.

The above statutes govern pressing issues such as duration of work, conditions of employed workers, minimum wages and remuneration, rights and obligations of the trade unions, insurance cover for employees, maternity benefits, employment retrenchment, payment of gratuity/provident fund, payment of bonus, and regulations of the contract labor, amongst other issues concerning employees.

However, many provisions of the existing labor laws trace their origins to the time of the British Colonial era, and with changing times, many of them have either became ineffective or do not have any contemporary relevance. Rather than protecting the interests of workers, these provisions ensured unwarranted difficulties for them.

The web of legislations back in the British colonial era were such that workers had to fill four different forms to claim a single benefit. Therefore, the present Government has repealed the outdated Labor Laws and has codified 29 of such labor Laws into four new Labor Codes.

For ensuring workers’ right to minimum wages, the Central Government has amalgamated 4 laws in the Wage Code, 9 laws in the Social Security Code, 13 laws in the Occupational Safety, Health and Working Conditions Code, 2020 and 3 laws in the Industrial Relations Code. By getting these Bills passed in the parliament, the Central Government has made significant headway in changing the standard of living of workers.

These labor reforms will enhance ease of doing business in the country. Employment creation and output of workers will also improve. The benefits of these four Labor Codes will be available to workers in both the organized and unorganized sector. Now, the Employees’ Provident Fund (EPF), Employees’ Pension Scheme (EPS) and coverage of all types of medical benefits under Employees’ Insurance will be available to all workers.

Companies must put consistent effort to ensure that proper compliance of these various statutes vis-à-vis the working condition for its employees are in order, and that the HR policies are formulated in accordance with the guidelines mentioned in the central and state by laws.

What is the scope of compliances under Environmental Laws?

The scope of compliances under Environmental Laws covers, but isn’t limited, to the following:

Environmental and pollution control matters fall under the ambit of various statutes such as:

- The Environment (Protection) Act, 1986;

- The Water (Prevention and Control of Pollution) Act, 1974;

- The Air (Prevention and Control of Pollution) Act, 1981;

- Hazardous Wastes (Management, Handling and Trans boundary Movement) Rules, 2008;

- The Manufacture, Storage, and Import of Hazardous Chemicals Rules, 1989;

- The Indian Forest Act, 1927;

- The Forest (Conservation) Act, 1980;

- The National Environment Tribunal Act, 1995; and

- The Public Liability Insurance Act, 1991, etc.

Companies are required to comply with the provisions of these environmental laws to the extent specifically applicable to their business operations. The consequences of non-compliance with the provisions of any such statutes and rules are provided in the respective statutes.

What is the scope of compliances under Tax and Stamp Duty related laws?

The scope of compliances under the Tax and Stamp Duty related laws covers, but is not limited, to the following:

There is a federal tax structure in India and taxes are levied by both the Central and State Governments, along with other local regulatory authorities. These taxes are broadly classified as:

- Direct Tax (which includes income tax, dividend distribution tax, minimum alternate tax (MAT), share buy-back tax),

- Indirect Tax (which includes GST, Excise Duty, Customs Duty, Entry Tax, R&D Cess), and

- Charges on transactions (including stamp duty, securities transaction tax, and commodity transaction tax).

All Indian companies are subjected to payment of tax and stamp duty for their business transactions undertaken during any financial year and on the income generated from such operations. Delayed/ non-payment and inadequate payment of tax and stamp duty may attract moderate to heavy penalties, cause enforceability issue of the documents and, in some cases, impounding of the documents by the authority.

Apart from the ones mentioned above, are there any other enactments that are applicable for companies in India?

Whilst the above explained laws and enactments lays down the general laws governing a company in India, local state laws also play a very important role. Therefore, the need for companies to be mindful of adhering to local state laws in which they are registered and conducting their business must not be overlooked.

What are the consequences of non-compliance of the provisions of Acts and Enactments as mentioned above?

The policy and procedures regulating, and governing Indian corporations have been progressively liberalized and simplified over the last few years. However, there are several compliance mandates that must be adhered to, failure to do so could trigger various compliance risks such as disqualification of directors, attracting of penal provisions and in some cases even imprisonment of the directors and key management personnel.

What is compliance risk and how can companies manage it?

Compliance risk refers to an exposure to legal penalties, financial forfeiture, and the material loss an organization faces when it fails to act in accordance with industry laws and regulations, internal policies, or prescribed best practices. Compliance risk can also be referred to as integrity risk. Several compliance regulations are enacted to ensure that companies operate ethically and in a fair manner.

Compliance risk management constitutes the widely known collective governance, risk management, and compliance (GRC) discipline. The three fields have been known to overlap frequently in the areas of internal auditing, incident management, operational risk assessment, and compliance with regulations such as the Sarbanes-Oxley Act of United States. Penalties for compliance violations include payments for damages, fines, and voided contracts, which can lead to a loss of reputation and business opportunities for organisations, as well as devaluation of its franchises.