Corporate tax is levied on the income earned by companies at a rate varying between 20-40%, depending on the companies’ particulars.

A company, whether Indian or foreign, is liable to pay CIT under the country’s Income Tax Act, 1961.

Domestic corporations are registered under the Indian Companies Act and have their business and management entirely based in India. On the other hand, foreign corporations are companies that are not registered under the Indian Companies Act and have their base and management outside India.

Foreign corporations are liable for corporate taxes in India only on the income earned within the country. However, domestic corporations are taxed on their overall income.

CIT rate

Resident companies are generally taxed at approximately 34 percent including surcharge and cess (if net income is above INR 4 billion).

However, in case of domestic companies having total turnover not exceeding INR 4 billion, the applicable tax rate has been reduced to 25 percent (effective maximum rate being 29.12 percent).

Domestic companies have the option to be taxed at an effective rate of 25.17 percent (including surcharge and cess) as per the Income-tax Act. To avail of this option, companies must meet certain conditions such as not claiming certain deductions and exemptions under the Act and not being allowed to set off current or carried forward losses or depreciation attributable to these deductions.

Companies can claim depreciation as prescribed under the Act but cannot claim additional depreciation under section 32(1)(iia).

Tax rate for domestic companies

|

Tax Rates for Domestic Companies for FY 2023-24 |

||

|

Section |

Conditions |

Tax rates (%) |

|

Section 115BA |

|

25% |

|

Section 115BAA |

|

22% |

|

115BAB |

|

|

|

First Schedule to Finance Act 2010 |

Turnover or gross receipt of the company is less than INR 4 billion in the previous year |

25% |

|

First Schedule to Finance Act 2010 |

Other domestic company |

30% |

|

Surcharge Applicable to Companies for FY 2023-24 |

|

|

Total income |

Surcharge rate (%) |

|

If total income is more than INR 10 million |

7% |

|

If total income is more than INR 100 million |

12% |

|

If domestic company opted section 115BAA and 115BAB |

10% |

|

Note: The amount of income-tax and the applicable surcharge, shall be further increased by health and education cess calculated at the rate of 4% of such income-tax and surcharge. |

|

Corporate residence

A company is treated as a resident of India in any previous year if:

- It is an Indian company, or

- Its place of effective management in that year is in India.

Tax rates for foreign companies

A foreign company is liable to pay income tax at 40 percent of the average taxable Income.

Tax rate for partnership firms, including LLP or local authorities

A partnership firm, LLP, or a local authority must pay income tax at 30 percent of average taxable Income.

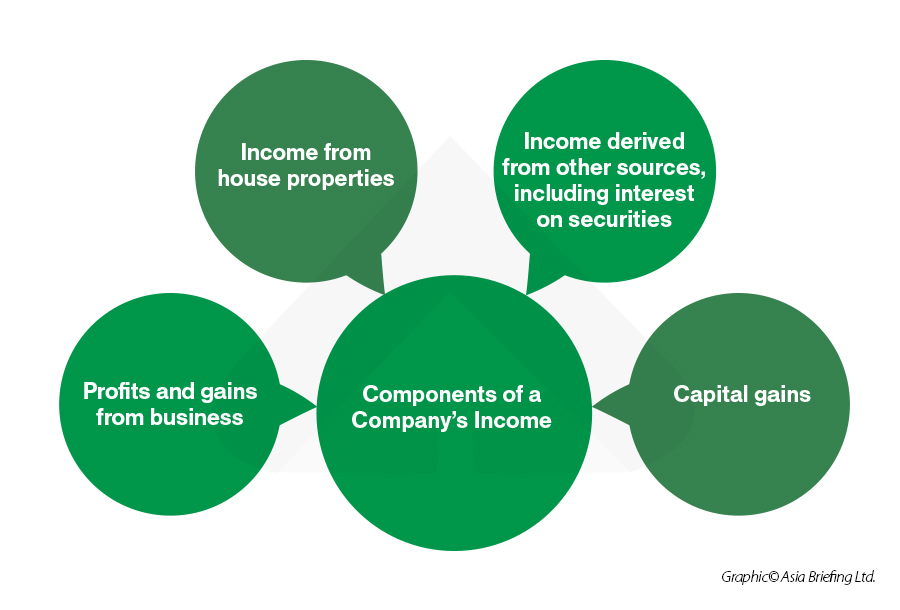

Components of taxable corporate income in India

Corporate tax in India is calculated after taking into account deductions such as depreciation, administrative expenses, cost of goods sold, and salary expenses. Both domestic and foreign corporations in India must pay corporate tax, which is based on the corporate income tax rate and their annual turnover.

Lowered corporate tax rate for eligible companies

The corporate tax rate for domestic (locally incorporated) companies is 22 percent and new domestic manufacturing companies, 15 percent. Choosing the concessional regime would require meeting certain specified conditions.

Increase in threshold limits of presumptive taxation scheme for professionals/ businesses

Starting from the assessment year (AY) 2024-25, subject to certain conditions, the threshold limit for Section 44AD has increased to INR 3,00,00,000, while the limit for Section 44ADA has increased to INR 75,00,000.

If a non-resident chooses to be taxed in a particular year, they will not be permitted to offset any unabsorbed depreciation or carry forward losses in subsequent years. These changes will be effective from the assessment year (AY) 2024-25 and onward.