Human Resources in Singapore

Human resource management in Singapore has evolved in tandem with the dynamic and competitive market environment. Human resource management policies and strategies at the national level were developed with the goal of maximizing human capital to support significant transformation. The Singaporean government has long supported a centralized system for managing its human resources, and foreign investment continues to have an impact.

Singapore still depends largely on a foreign workforce. From this perspective, it is prudent to be aware of the following human resource policies:

Labor laws

The labor laws, in Singapore are derived from the Employment Act (EA). It establishes a minimal set of terms and circumstances that employers must follow when recruiting workers who are subject to the legislation.

The Act regulates employment terms and conditions for all employees under a work contract with an employer. The EA covers the following:

- Minimum days for giving notice of termination of contract;

- Actions employers are entitled to upon misconduct of employees;

- Salary periods, time of payment;

- Maternity protection and benefits, and childcare leave for parents and

- Public holiday, leave and sick leave entitlements.

The Employment (Part-Time Employees) Regulations provide protection to part-time employees who are covered by the EA.

If this legislation relates to an employee's employment, the corporation must follow the applicable employer requirements and offer the employee terms that are no less favorable than those in the EA.

Employers in Singapore must also adhere to the Fair Consideration Framework (FCF) and the Tripartite Guidelines on Fair Employment Practices, which outline requirements for employers to ensure fair hiring and employment practices.

The tripartite partners oversee employment laws i.e., the Ministry of Manpower (MoM), the National Trades Union Congress (NTUC), and Singapore National Employers Federation (SNEF).

Hiring employees

Singapore, known for its strong economy, vibrant business environment, and multicultural workforce, has become a global hub for companies seeking expansion opportunities.

As businesses thrive and grow, hiring the right employees becomes a critical aspect of their success.

Singapore has a very strong legal infrastructure for protecting the rights of workers, and as such, employers are subject to a number of labor and fair employment laws and regulations.

Employers are obligated to:

- Formalize an employment contract in adherence to all applicable labor laws;

- Submitting employment income information to relevant authorities;

- Making social insurance contributions; and,

- Ensure all labor laws and HR management compliances are adhered to.

Hiring employees in Singapore requires a deep understanding of the local labor market, compliance with employment laws, and effective recruitment strategies. By aligning recruitment efforts with the specific needs of the business and fostering a diverse and inclusive work environment, companies can attract and retain top talent in this thriving global business hub. With the right approach, hiring the right employees becomes a catalyst for business growth and success in Singapore.

Visa and employment permits

The Employment of Foreign Manpower Act lays down strict guidelines for the recruitment of foreign workers in Singapore. A foreign worker must have a valid work permit, applied for by the employer, in order to work in the city-state.

The Ministry of Manpower (MoM) issues a wide range of employment permits to expatriates. Each employment permit differs across various categories of employees and is based on their professional skills and monthly salaries.

There are several options for foreign workers that meet specific criteria for business visas and work permits:

- Employment pass

- Personalized employment pass

- Entrepreneur pass

- S pass

- Pass

- Overseas networks and expertise pass

- Manpower for Strategic Economic Priorities scheme

- Global investor program

One of the most commonly used permits for foreign businesses in Singapore is the Employment Pass issued to expatriates employed as foreign managers, executives, and skilled professionals. First-time candidates can obtain an EP for an initial two years which can then be renewed for up to three years at a time.

Singapore will introduce a new points system for EP applicants from September 1, 2023, called the Complementarity Assessment Framework (COMPASS), in addition to higher qualifying salary thresholds. Future EP applicants must score at least 40 points under the COMPASS system, awarded based on four attributes and two bonus criteria.

Annual leaves and public holidays

Given Singapore's multiculturalism, official holidays are designed to appeal to a diverse collection of people. Every major race and religion usually receives two public holidays each; New Year's Day, Chinese New Year, Good Friday, Labor Day, National Day, Deepavali, Hari Raya, and Christmas Day are just a few examples.

Terminating employees

The termination of employment in Singapore can be implemented by either the employee or the employer and both parties must follow the terms and conditions for termination stated in the contract of service.

Employees are generally hired with a probation of three to six months and will be hired as permanent employees after the probation period ends. The employment contract will usually set out the terms of termination and what notice is required if any. It is vital for all employees to be sure exactly what their employment contract says so that they can proceed accordingly.

The termination of the contract of service can occur in the case of:

- Employee resignation;

- Employer dismissal; or

- Expiration of the contract terms.

Payroll in Singapore

Salary and wages

It is important for companies operating and hiring employees in Singapore to understand the key elements of the country’s payroll process and stay updated on the latest regulatory changes when computing salary.

Singapore does not have a minimum wage for most sectors. Wages are determined by market demand and the supply of labor. Employers are expected to pay employees based on their competencies, skills, and experience. Further, while hiring foreign employees, the employer must consider the minimum salary requirements relevant to obtain various employment passes.

The Employment Act of Singapore defines ‘salary’ as all remuneration including allowances, base salary, bonuses, commissions, and incentives, payable to an employee for work done under the contract of service which is calculated and must be paid on the basis of a complete calendar month, irrespective of the total number of days in a month.

Social insurance

The Central Provident Fund (CPF) is a social security savings scheme funded by contributions from employers and employees. This program is mandatory for Singaporeans as well as Singapore permanent residents and an important pillar of Singapore’s social security system and aims to meet the retirement, housing, and healthcare needs of its people.

Foreigners cannot pay into Singapore’s CPF scheme.

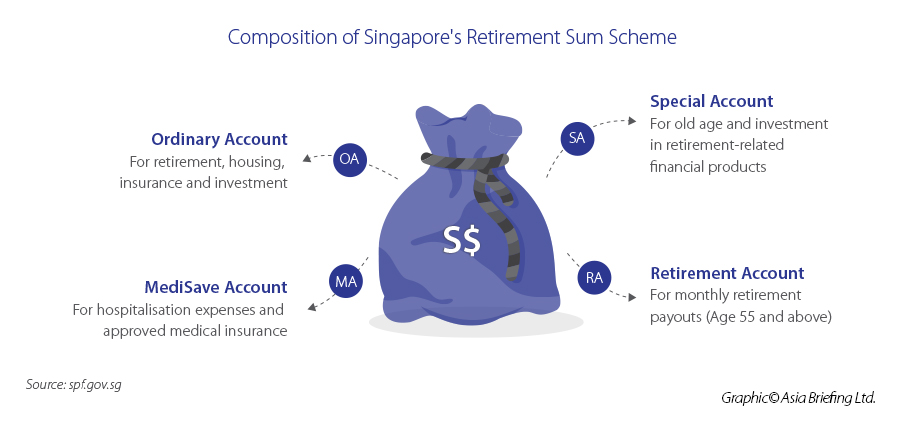

Individual CPF funds are further subcategorized into three savings accounts:

- Ordinary Account: Can be used at any time to purchase a home, make investments, and provide for education.

- Special Account: Serves as the income a retired person receives.

- Medisave Account: Used to pay for medical expenses, hospitalization expenses, and pay for approved medical insurance.

There are several resources available to Singaporean citizens and Singapore permanent residents to calculate their CPF contributions by inputting their wages on Singapore's Central Provident Fund Board.

Singapore's Individual income tax regime

Individual income tax rates in Singapore are progressive and range from 0% to a maximum of 22%.

Singapore’s tax system is progressive in nature, which means higher income earners pay a proportionately higher tax, with taxes currently ranging from zero to 22 percent. The headline individual income tax (IIT) rate will increase to 24 percent from 2024 onward.

IIT in Singapore is payable on an annual basis and is imposed only on the income sourced within the country. The income earned outside Singapore is exempt from taxation.

The tax rates are applicable to residents and non-residents based on their income levels and tax residency status. To determine tax residency status, factors such as the duration of stay, employment status, and economic ties to Singapore are considered. Individuals are required to file their income tax returns annually by April 15th and comply with the reporting requirements to avoid penalties.

Singapore residents enjoy personal reliefs and rebates, which help lower their taxable income. Notable personal reliefs include the Earned Income Relief, Parenthood Tax Rebate, and Course Fees Relief. Non-residents are taxed on their Singapore-sourced income.