Vietnam’s business environment, free trade costs, and its ideal location as a China plus one destination make it favorable among foreign investors looking to relocate or diversify their operations.

However, as Vietnam’s economy continues to grow, increasing wages will be an unavoidable feature of doing business in the country and is increasingly important for companies to understand how to navigate.

Vietnam is set to implement a 6 percent increase in the minimum wage starting from July 2024, following a unanimous decision by the National Wage Council. This adjustment represents a compromise between the 6.48 to 7.3 percent requested by the Vietnam General Confederation of Labor and the 4.5 to 5 percent suggested by the Vietnam Chamber of Commerce and Industry. The impending hike comes after a two-year hiatus in minimum wage adjustments despite rising inflation rates, which may necessitate further increases shortly.

What are the minimum wage rates in Vietnam?

There are two kinds of minimum wages in Vietnam.

The first type is the common minimum wage of VND 1,800,000 (US$76.6) which is used to calculate salaries for employees in state-owned organizations and enterprises, as well as to calculate the social contribution for all enterprises (i.e., the maximum social contribution is 20 times the common minimum wage).

The second type of minimum wage is the Regional Minimum Wage used for employees in all non-state enterprises based on zones as defined by the government.

| Current (2022) | Change (6%) | New (2024) | ||||

| Region | VND | US$ | VND | US$ | VND | US$ |

| 1 | 4,680,000 | 192.33 | 280,800 | 11.54 | 4,960,800 | 203.87 |

| 2 | 4,160,000 | 170.96 | 249,600 | 10.26 | 4,409,600 | 181.22 |

| 3 | 3,640,000 | 149.59 | 218,400 | 8.98 | 3,858,400 | 158.57 |

| 4 | 3,250,000 | 133.56 | 195,000 | 8.01 | 3,445,000 | 141.58 |

In addition, the labor code also ensures minimum hourly wage rates for the relevant regions. These are:

- Region I – VND 22,500 (US$0.97)

- Region II – VND 20,000 (US$0.86)

- Region III – VND 17,500 (US$0.75)

- Region IV – VND 15,600 (US$0.67)

Wages for employees who are paid daily or on a weekly basis must not be lower than the minimum wage when converted to monthly or hourly rates.

Who is eligible?

The wage increase applies to employees who work under labor contracts under the labor code, including businesses, organizations, cooperatives, households, and individuals who hire employees on labor contracts.

List of regional administrative units in Vietnam

Region I

- Gia Lam, Dong Anh, Soc Son, Thanh Tri, Thuong Tin, Hoai Duc, Thach That, Quoc Oai, Thanh Oai, Me Linh, and Chuong My, and Son Tay Town of Hanoi City

- Thuy Nguyen, An Duong, An Lao, Vinh Bao and Tien Lang of Hai Phong City

- Cu Chi, Hoc Mon, Binh Chanh and Nha Be of Ho Chi Minh City

- Bien Hoa City, Long Khanh Town and Nhon Trach, Long Thanh, Vinh Cuu and Trang Bom suburban districts of Dong Nai Province

- Thu Dau Mot City, Thuan An, Di An, Ben Cat and Tan Uyen Towns, and Bau Bang and Bac Tan Uyen suburban districts of Binh Duong Province

- Vung Tau City and Tan Thanh suburban district of Ba Ria – Vung Tau Province

Region II

- Remaining suburban districts of Hanoi City

- Remaining suburban districts of Hai Phong City

- Hai Duong City of Hai Duong Province

- Hung Yen City and My Hao, Van Lam, Van Giang and Yen My suburban districts of Hung Yen Province

- Vinh Yen City, Phuc Yen Town and Binh Xuyen and Yen Lac suburban districts of Vinh Phuc Province

- Bac Ninh City, Tu Son town and Que Vo, Tien Du, Yen Phong and Thuan Thanh suburban districts of Bac Ninh Province

- Ha Long City, Cam Pha City, Uong Bi City and Mong Cai City of Quang Ninh Province

- Thai Nguyen City, Song Cong City and Pho Yen Town of Thai Nguyen Province

- Viet Tri City of Phu Tho Province

- Lao Cai City of Lao Cai Province

- Nam Dinh City and My Loc suburban district of Nam Dinh Province

- Ninh Binh City of Ninh Binh Province

- Hue City of Thua Thien Hue Province

- Hoi An City and Tam Ky City of Quang Nam Province

- Urban/suburban districts of Da Nang City

- Nha Trang City and Cam Ranh City of Khanh Hoa Province

- Da Lat City and Bao Loc City of Lam Dong Province

- Phan Thiet City of Binh Thuan Province

- Can Gio suburban district of Ho Chi Minh City

- Tay Ninh City and Trang Bang and Go Dau suburban districts of Tay Ninh Province

- Dinh Quan, Xuan Loc and Thong Nhat suburban districts of Dong Nai Province

- Remaining suburban districts of Binh Duong Province

- Dong Xoai Town and Chon Thanh suburban district of Binh Phuoc Province

- Ba Ria City of Ba Ria – Vung Tau Province

- Tan An City and Duc Hoa, Ben Luc, Thu Thua, Can Duoc and Can Giuoc suburban districts of Long An Province

- My Tho City of Tien Giang Province

- Suburban districts of Can Tho City

- Rach Gia City, Ha Tien Town and Phu Quoc suburban districts of Kien Giang Province

- Long Xuyen City and Chau Doc City of An Giang Province

- Tra Vinh City of Tra Vinh Province

- Ca Mau City of Ca Mau Province.

Region III

- Remaining provincial cities (except provincial cities of region I and region II)

- Chi Linh Town and Cam Giang, Nam Sach, Kim Thanh, Kinh Mon, Gia Loc, Binh Giang and Tu Ky suburban districts of Hai Duong Province

- Vinh Tuong, Tam Dao, Tam Duong, Lap Thach and Song Lo suburban districts of Vinh Phuc Province

- Phu Tho Town and Phu Ninh, Lam Thao, Thanh Ba and Tam Nong suburban districts of Phu Tho Province

- Gia Binh and Luong Tai suburban districts of Bac Ninh Province

- Viet Yen, Yen Dung, Hiep Hoa, Tan Yen and Lang Giang suburban districts of Bac Giang Province

- Quang Yen Town, Dong Trieu Town and Hoanh Bo suburban district of Quang Ninh Province

- Bao Thang and Sa Pa suburban districts of Lao Cai Province

- Remaining suburban districts of Hung Yen Province

- Phu Binh, Phu Luong, Dong Hy and Dai Tu suburban districts of Thai Nguyen Province

- Luong Son suburban district of Hoa Binh Province

- Remaining suburban districts of Nam Dinh Province

- Duy Tien and Kim Bang suburban districts of Ha Nam Province

- Gia Vien, Yen Khanh and Hoa Lu suburban districts of Ninh Binh Province

- Bim Son town and Tinh Gia suburban district of Thanh Hoa Province

- Ky Anh Town of Ha Tinh Province

- Huong Thuy Town, Huong Tra Town and Phu Loc, Phong Dien, Quang Dien and Phu Vang suburban districts of Thua Thien Hue Province

- Diem Ban Town and Dai Loc, Duy Xuyen, Nui Thanh, Que Son, Thang Binh and Phu Ninh suburban districts of Quang Nam Province

- Binh Son and Son Tinh suburban districts of Quang Ngai Province

- Song Cau Town and Dong Hoa suburban district of Phu Yen Province

- Ninh Hai and Thuan Bac suburban districts of Ninh Thuan Province

- Ninh Hoa Town and Cam Lam, Dien Khanh and Van Ninh suburban districts of Khanh Hoa Province

- Dak Ha suburban district of Kon Tum Province

- Duc Trong and Di Linh suburban districts of Lam Dong Province

- La Gi Town and Ham Thuan Bac and Ham Thuan Nam suburban districts of Binh Thuan Province

- Phuoc Long Town, Binh Long Town and Hong Phu, Hon Quan, Loc Ninh and Phu Rieng suburban districts of Binh Phuoc Province

- Remaining suburban districts of Tay Ninh Province

- Remaining suburban districts of Dong Nai Province

- Long Dien, Dat Do, Xuyen Moc, Chau Duc and Con Dao suburban districts of Ba Ria – Vung Tau Province

- Kien Tuong Town and Duc Hue, Chau Thanh, Tan Tru and Thanh Hoa suburban districts of Long An Province

- Go Cong Town, Cai Lay Town, Chau Thanh and Cho Gao suburban districts of Tien Giang Province

- Chau Thanh suburban district of Ben Tre Province

- Binh Minh Town and Long Ho suburban district of Vinh Long Province

- Suburban districts of Can Tho City

- Kien Luong, Kien Hai and Chau Thanh suburban districts of Kien Giang Province

- Tan Chau Town and Chau Phu, Chau Thanh and Thoai Son suburban districts of An Giang Province

- Nga Bay Town and Chau Thanh, Chau Thanh A suburban districts of Hau Giang Province

- Duyen Hai Town of Tra Vinh Province

- Gia Rai Town of Bac Lieu Province

- Vinh Chau Town and Nga Nam Town of Soc Trang Province

- Nam Can, Cai Nuoc, U Minh and Tran Van Thoi suburban districts of Ca Mau Province

Region IV

Region IV includes the remaining subregions

How are minimum wage rates applied?

All contracts must use the minimum wage rates as the lowest amount of compensation for any commercial arrangement between an employer and an employee. Companies should ensure that the correct wage rate is applied, especially in certain special circumstances, including:

- If the company has any branches or affiliate companies in a different subregion, the region-based minimum wage will be applied to all employees of those offices.

- For companies located in an industrial park or the export processing zone that spans two or more, the highest minimum wage rate will apply.

Salary components

In general, an employee’s typical monthly salary package includes their gross salary and mandatory insurance contributions. Personal income taxes (PIT) will be levied on the balance after mandatory insurance contributions have been deducted.

In some cases, the gross salary may also include overtime pay, allowances, and bonuses, as well as additional benefits.

Further, Vietnamese employees must receive compensation in Vietnamese Dong, even if they work for foreign companies. Foreign employers may base salary rates in either Vietnamese Dong or US Dollars, but salaries that are based in US Dollars must be converted into Vietnamese Dong. However, if the company bases the salary rate on US dollars, then the compulsory social insurance, personal income tax, and trade union payment must be converted into Vietnam Dong based on the Vietnamese government's foreign exchange rate.

Are employees eligible for overtime pay in Vietnam?

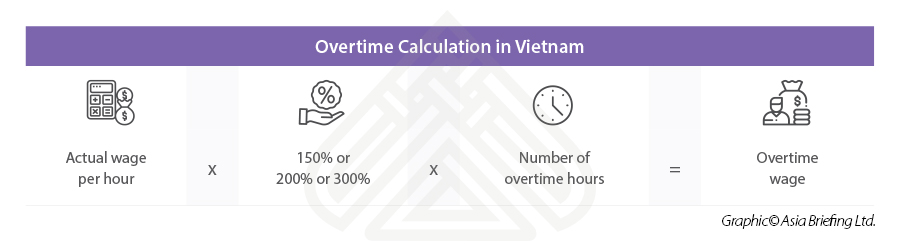

Employee consent must be obtained if the employer plans overtime work regarding the terms, locations, and overtime work. Employees who work extra hours are also paid for those extra hours based on their current hourly wages, as outlined above.

In cases where an employee works overtime hours at night, they are paid extra according to the applicable regulations. Further, employees who are given time off in compensation for working extra hours should be paid the difference between their wages during normal working hours and overtime work. Finally, employees who work night shifts should be paid at least 30 percent higher than normal.

Salaries paid to Vietnamese staff working for foreign companies must be denominated in Vietnamese Dong. Foreign employers may base salary rates in either Vietnamese Dong or US Dollars, but salaries that are based in US Dollars must be converted into Vietnamese Dong.

In general, an employee’s typical monthly salary package includes their gross salary and mandatory insurance contributions. Personal income taxes (PIT) will be levied on the balance after mandatory insurance contributions have been deducted.

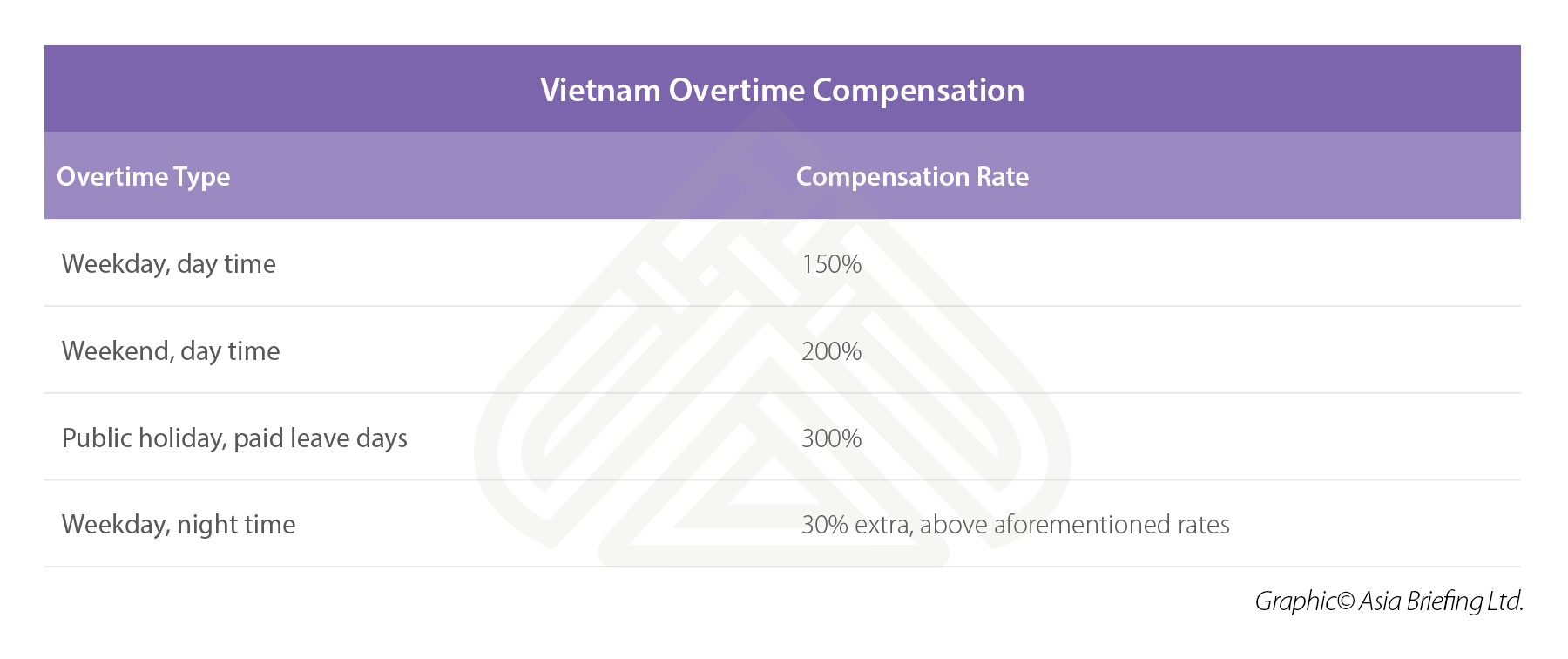

Overtime compensation

If a company triggers overtime, they will be obligated to compensate employees beyond the wages that are outlined in their contract. This is applicable to all employees regardless of the wages that are offered. The following are the percentages in excess of the standard that are to be applied in the event that certain work-related thresholds are crossed.

There are limitations on the number of overtime hours an employee is allowed to work. As per the labor code, overtime hours cannot exceed 40 hours per month. The code also supplements cases where employers are permitted to organize overtime work for up to 300 hours per year; these include manufacturing and exporting electrical and electronic products as well as work requiring high technical qualifications.

If the employer and employee agree on an overtime deal, employers are permitted to assign their employees to work overtime for over 200 hours but not exceeding 300 hours per year, except in the following cases:

- Employees aged between 15 and under 18;

- Employees having mild disabilities with work capacity reduction of at least 51% or employees with severe disabilities or extremely severe disabilities;

- Employees doing arduous, hazardous, dangerous or extremely arduous, hazardous or dangerous work;

- Female employees in their 7th month of pregnancy onward (or the 6th month of pregnancy onward in case they work in the highlands, remote areas, bordering areas, or islands);

- Female employees nursing children aged under 12 months.

Employers that are permitted to assign their employees to work overtime for up to 300 hours per year may assign their employees to work overtime for more than 40 hours but not exceeding 60 hours per month if this is agreed upon by both the employer and the employees.

In cases where an employee works extra hours at night, they are paid extra in accordance with the applicable regulations. Further, employees who are given time off in compensation for working extra hours will need to be paid the difference between their wages during normal working hours and overtime work. Finally, employees who work night shifts should be paid at least 30 percent higher than normal.

There are special situations which may trigger other regulations within the code for overtime:

- Pregnant women: Women who are in their 7th month of pregnancy and women with babies under 12 months are not allowed to work overtime, work at night, or take long-distance business trips. Pregnant women who are performing heavy work must either be transferred to lighter work or decrease daily work time by an hour while maintaining the same total pay.

- Minor employees:

- Workers under the age of 18: Prohibited from working in dangerous conditions or with potential exposure to toxic substances. The Ministry of Labor, Invalids and Social Affairs (MoLISA) also establishes a limit on which industries and what kind of work minors can undertake.

- Minor employees between the ages of 15 and 18: May work a maximum of eight hours a day and 40 hours a week. They are only permitted to do overtime and night work in certain industries, as specified by the Ministry.

- Workers under the age of 15: Regulations establish a maximum of four hours a day and 20 a week, with no overtime or night work permitted. Working hours for those under 13 years of age are further reduced to one hour per day.

Performance and earnings-based bonuses for employees

Bonuses are given to employees based on company earnings and performance and as a way of boosting company morale and productivity. There are various kinds of bonuses that a company may grant its employees throughout the year.

All salaries and bonuses are subject to PIT in Vietnam.

13th-month salary

A 13th month’s salary is usually given as an “annual bonus” by both local and foreign companies in Vietnam to employees who have worked with the company for at least one year. Employees who have worked at a company for less than one year are typically given a bonus that is prorated and based on their actual employment period.

Lunar New Year or Tet bonus

A special bonus called the “Lunar New Year” bonus (or “Tet Bonus”) is often paid to employees prior to their leaving for the Lunar New Year holiday.

The amount of any Tet Bonus will be dependent on both company and employee performance but typically ranges from smaller amounts of money (up to an entire month’s salary) to larger amounts of money (up to an entire year’s salary) depending on the company's progress and goals.

Additional bonuses

Employees may also be given smaller bonuses for public holidays or other special days (e.g., International Labor Day or National Day). Senior management and other valued employees may be given bonuses during these days as well, including in the form of share certificates with a vesting period, for which the corresponding stock can be sold only after the employee has worked for the company for a certain amount of time.

Allowances and benefits

An employee may be entitled to several kinds of allowances and monetary or non-monetary benefits designed to retain staff. Some of these benefits are non-taxable, including:

- Payments for housing rent, power, water, and associated services for employees that amount to more than 15 percent of their total taxable income;

- Life insurance and optional insurance;

- Payment for a membership card, which does not include the user's name, of golf clubs, tennis courts, and other exclusive clubs;

- Payment for a membership card, which does not include the user's name, of health care, entertainment, etc. services;

- Telephone allowance;

- Stationery allowance;

- Uniform allowance in kind or in cash not exceeding 5 million VND;

- Lunch allowance not exceeding 730,000 VND;

- Funeral payment not exceeding any month's actual salary in the year;

- Wedding payment not exceeding any month's actual salary in the year;

- Transportation allowances;

- Training allowances;

- Employer support for fatal disease or illness;

- Round-trip flight ticket to return home country once a year for foreign employees or Vietnamese employees working abroad;

- Tuition fees for children of foreign workers working in Vietnam study in Vietnam, children of Vietnamese workers working abroad study overseas from kindergarten to high school;

- Personal incomes received from any associations and organizations if the employees receiving the grant are members of these associations and organizations and these associations and organizations’ funding is used from the State budget or managed according to the State's regulations;

- Payments paid by the employer for the deployment, rotating foreign workers to work in Vietnam according to regulations in the labor contract, and complying with the standard labor schedule according to the international practices of some industries such as oil and gas and mining.

Prefixed lump sum amounts (or “khoan chi” amounts) for telephone calls and services, stationery, uniforms, and per diem allowances are not subject to taxes if the amounts are within the levels set out under the relevant regulations.

Foreigners who work in Vietnam are also exempted from PIT on various benefits such as relocation allowances for moving into the country, airfare to their home country, and education fees for their children.