Social insurance overview

Mandatory minimum contributions are required of both employer and employee. There are three types of mandatory social security in Vietnam and all domestic and foreign companies are required to pay:

- Social insurance for Vietnamese and foreign employees under labor contracts with a definite term of over one month or labor contracts with indefinite terms.

- Health insurances for Vietnamese and foreign employees under labor contracts with a definite term of over three months or labor contracts with indefinite terms.

- Unemployment insurance for Vietnamese employees under labor contracts with a definite term of over three months or labor contracts with indefinite terms.

Social insurance is compulsory for foreign staff as well, in accordance with Vietnam’s Labor Code. Employers register and pay insurance contributions monthly on behalf of their employees at the provincial Department of Labor, Invalids and Social Affairs (DoLISA).

Social insurance rates

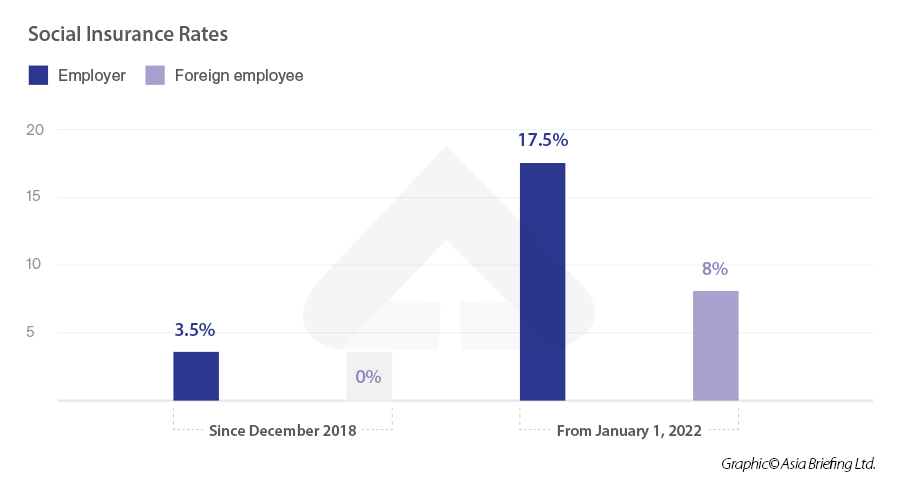

Vietnamese employees and foreign employees have the same insurance rates. Employees will have to pay an eight percent rate, while employers contribute 17.5 percent to the social insurance fund.

As with Vietnamese employees, the mandatory social insurance scheme for foreign employees covers sickness, maternity, occupational diseases, accidents, retirement, and death.

Social insurance was made mandatory for all working foreigners as of December 1, 2018, under Decree 143/2019/ND-CP.

How is social insurance calculated?

Contributions are determined based on employees’ monthly salary or wage. While payable amounts will differ depending on the compensation of an employee, it should be noted that a wage ceiling for calculation of contributions is imposed at 20 times the common minimum wage for social and health insurance (Currently VND 36 million (US$1,527.27)) and 20 times the regional minimum wage for unemployment insurance.

The salary subject to social insurance contribution is what is defined as per the labor contract, but this is capped at 20 times the minimum salary for social insurance contributions set by the government.

The minimum salary for the social insurance contributions is the regional minimum wage, which is as follows:

|

Region |

Minimum salary for the social insurance contributions (since July 1st, 2022) |

|

Region I |

VND 4,680,000 |

|

Region II |

VND 4,160,000 |

|

Region III |

VND 3,640,000 |

|

Region IV |

VND 3,250,000 |

|

For a full list of Vietnam's administrative regions, read our minimum wage guide. |

|

Once a foreign worker’s employment in Vietnam expires, the foreign worker can claim a one- off payment on the contributed amount from the social insurance agency depending on the following circumstances.

- Reach retirement age, but have not contributed social insurance for the full 20 years;

- Suffer from a fatal disease such as cancer, polio, HIV or other diseases regulated by the Ministry of Health;

- Satisfied conditions for pension, but are not living in Vietnam anymore; and

- Their employment contract is terminated or work permit expires without renewal.

What does social insurance cover?

Social insurance covers employee benefits including sick leave, maternity leave, allowances for work-related accidents and occupational diseases, pension allowance, and mortality allowance. Health insurance entitles employees to a medical examination and inpatient and outpatient treatments at authorized medical establishments.

Unemployment insurance, which takes the place of severance pay, is paid out to employees in quantities depending on the period of time for which they and their previous employers contributed. The monthly unemployment allowance is equal to 60 percent of the persons’ average salary of the last six months of employment.

What are the criteria for social insurance contribution for foreign workers?

As per the Ministry of Labor, Invalids and Social Affairs (MoLISA), foreign workers are subject to mandatory social insurance when they meet all the following conditions:

- Working in Vietnam with a work permit;

- Employed under a Vietnamese labor contract with an indefinite or definite term of one year or more;

- Below 60 years of age for men or 55 years of age for women; (Please note that the retirement age is being gradually increased as per the new labor code to 62 for men and 60 for women by 2028 and 2035 respectively); and

- Are not an intra-company transferee (must be a manager/executive/expert/technician employed by the overseas entity for at least 12 months before being assigned to the company’s operations in Vietnam).

Once a foreign worker’s employment in Vietnam expires, the foreign worker can claim a one-off payment on the contributed amount from the social insurance agency in the following circumstances:

- Reach retirement age, but have not contributed social insurance for the full 20 years;

- Suffer from a fatal disease such as cancer, polio, HIV, or other diseases regulated by the Ministry of Health;

- Satisfying conditions for pension, but are not living in Vietnam anymore; and

- Their employment contract is terminated or their work permit expires without renewal.

- Foreign employees should make the allowance request within 30 days before their contract or work permit expires. The insurance authority is required to settle and pay the allowance to the employee within 10 days from the date of receipt.