Introduction to tax and accounting

The tax and accounting compliance environment in Vietnam is well structured and clear relative to many similarly developed emerging markets. Its related policies receive periodic or frequent revisions to support the country’s continued development of its economy and business environment.

Tax revenue is a major component of Vietnam’s state budget. Its tax policies include requirements that apply to both business and individual taxpayers. The tax system fundamentally requires that taxpayers self-assess their various tax liabilities and exposure while their resulting taxpayer filings are subsequently checked by the tax authorities. Vietnamese tax authorities enforce tax collection via tax audits and expect related areas of compliance to be in line with Vietnamese Accounting Standards and other policies.

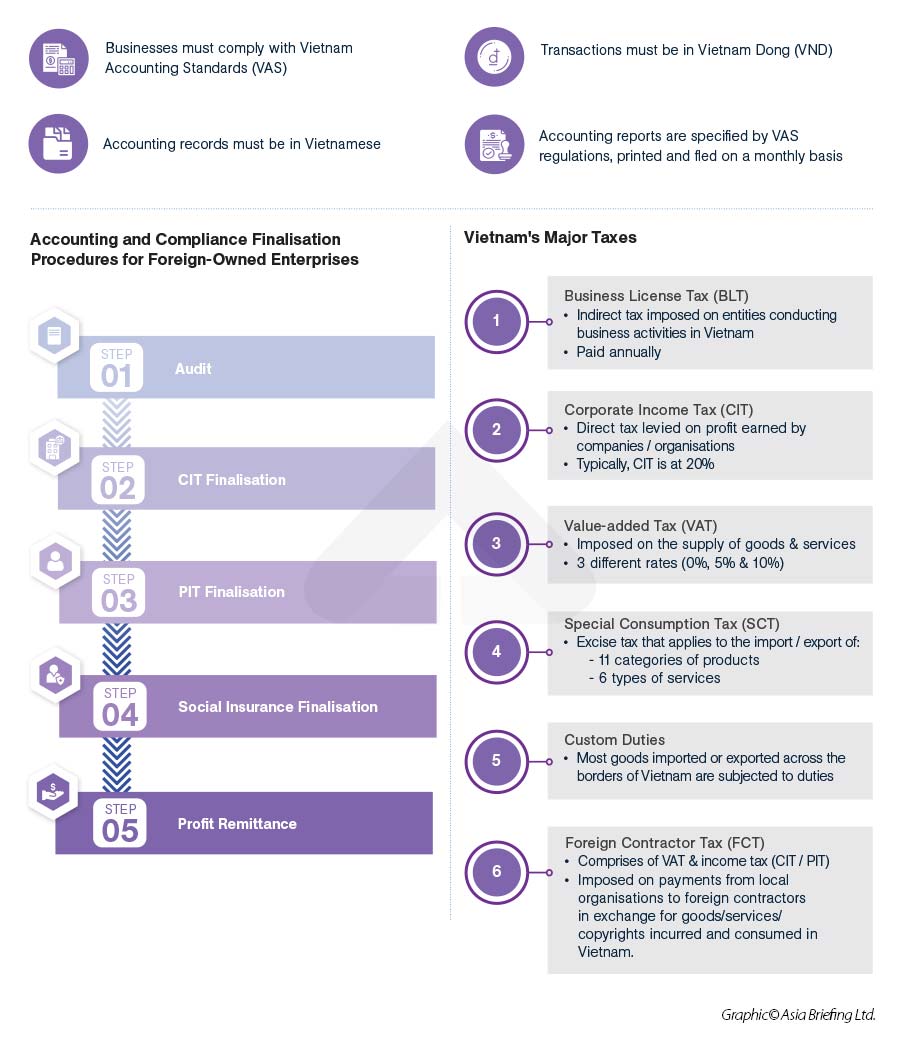

The below graphic highlights a few Vietnam accounting, audit, and tax key points:

Summary of tax rates

|

Tax |

Standard Rate |

Variation |

Abbreviation |

|

|

Corporate Income tax |

20% |

0% to 20% |

CIT |

|

|

Value-Added Tax |

10% |

0% or 5% |

VAT, Sales tax |

|

|

Foreign Contractors Tax |

VAT |

Varied |

2% to 10% |

FCT, Withholding tax |

|

CIT |

Varied |

1% to 10% |

||

|

PIT |

Varied |

0.1% to 5% |

||

|

Personal Income Tax |

Varied |

0% - 35% |

PIT or IIT |

|

Corporate Income Tax in Vietnam

Vietnam's standard corporate tax rate is 20% for most business types.

Corporate income tax (CIT) is a direct tax levied on the profit earned by companies or organizations. In general, profits are considered gross revenue minus expenses. Taxpayers include business entities in all economic sectors, professional organizations, and foreign corporations with production and trading activities in Vietnam. Individuals and families conducting business are also subject to personal income tax (PIT) (discussed later in the PIT section).

Tax incentives

Among all the investment incentives available, tax breaks are regarded as the most prominent feature of the Vietnamese business landscape.

Tax incentives apply to investment projects in specific sectors and areas with different socio-economic conditions as well as those in high-tech zones and economic zones, in order to encourage the development of the economy, technology, and education of these regions.

Vietnam's Value-Added Tax

VAT is imposed on the supply of goods and services at three different rates: 0%, 5%, and 10% (the standard rate).

Value Added Tax (VAT) is a broadly based consumption tax assessed on the value of goods and services arising through the process of production, circulation, and consumption. It is applicable to the majority of goods and services bought and sold for use in Vietnam.

VAT is an indirect tax on domestic consumption applied nationwide rather than at different levels, such as state, provincial, or local taxes. It is a multi-stage tax that is collected at every stage of the production and distribution chain and passed on to the final customer.

International Taxation

Profit repatriation

In order to repatriate profits, a company must ensure that it has completed the declaration of CIT of the relevant financial year and issued audited financial statements. The company must then report its intention to repatriate its profits to the tax bureau.

If, within seven days, there is no notice from the tax bureau, the profits may be remitted out. Companies can expect it to be between the middle to the end of April before they are able to remit their profits out of the country. However, profit repatriation will not be allowed if the financial statements of the company show an accumulated loss.

Foreign contractor withholding tax

The standard rate for Foreign contractor withholding tax:

- CIT: 1-10%

- VAT: 2-10%

- PIT: 0.1-5%

Foreign contractor tax is a type of withholding tax. It is imposed on foreign contractors or foreign sub-contractors who are defined as foreign organizations or individuals carrying out business in Vietnam under the contract signed with a Vietnamese contracting party or signed with a main foreign contractor (not under a direct investment form in accordance with the investment law of Vietnam).

Customs duties

Most goods exported or imported across the borders of Vietnam or which pass between the domestic market and a non-tariff zone are subject to export or import duties. At present, export tariffs are codified under Circular 182/2015/TT-BTC and calculated by the per unit volume of each actually imported or exported goods item multiplied by the tax calculation price and the tax rate of each item stated in the tariff.

- Also Read: Customs Procedures in Vietnam: Documentation and Processing

- Also Read: An Introduction to Rules of Origin for Vietnamese Exports

- Also Read: A Guide to Import and Export Procedures in Vietnam

Transfer pricing

Transfer pricing generally concerns the prices of intercompany transactions that are charged between associated enterprises that are established in different tax jurisdictions.

Companies that are considering an investment in Vietnam, as well as those companies that are already operating in the country, are required to comply with the regulatory requirements set out in Decree 20, which are based on the Organization for Economic Cooperation and Development (OECD) and Base Erosion and Profit Shifting (BEPS) guidelines and actions.

Any Vietnam taxpayer who is engaged in related party transactions with other group entities is required to demonstrate that such transactions are conducted in a manner consistent with the “arm’s length standard,” which, in layman’s terms, means transacting with related parties in a manner similar to that of third parties in comparable conditions or scenarios.

This can also apply when a foreign business delocalizes their production facilities in Vietnam and charges an overseas entity-related party transactions for administrative, technical, financial, and commercial services; These, too, must comply with the arm’s length and substance-over-form principles.

Personal Income Tax

The rate for personal income tax varies between 0-35% in Vietnam.

Vietnam’s Law on Personal Income Tax recognizes ten different categories of income, with a host of different deductions, tax rates, and exceptions applying to each of them.

A tax resident is defined as someone residing in Vietnam for 183 days or more in either the calendar year or a period of 12 consecutive months from the date of arrival. Tax residents are subject to PIT on their worldwide employment income, regardless of where the income is paid or earned, at progressive rates from five percent to a maximum of 35 percent. Non-resident taxpayers are subject to PIT at a flat rate of 20 percent on their Vietnam-sourced income.

FAQ: How BEPS 2.0 is Reshaping the Global Tax Landscape

Can you tell us about the recent tax developments in Vietnam?

Most recently, Vietnam has brought out new regulations on the enforcement of tax administration and new rules on transfer pricing.

The tax administration regulations as outlined in Decree 126, mainly affect online traders and those in digital commerce such as Netflix, movie streaming websites, and gaming platforms. Previously the government only imposed withholding tax on Vietnamese companies who were involved with overseas companies.

Now overseas companies have to register to get a tax identification number and pay taxes on Vietnam-sourced revenue. The tax authorities have also imposed enforcement measures to enforce tax administration on e-commerce activities. Banks are obligated to report on payments made to overseas entities, particularly to foreign contractors and companies. While we are not sure of the consequences if companies do not comply, the government might take severe measures like blocking the IP address of the website that flouts the rules. The government is also likely to carry out tax audits and tax inspections of e-commerce entities that do not comply.

The second major development is new rules on transfer pricing regulations. The main purpose of the new regulations is to tighten the arm’s length range from the 35th percentile to the 75th percentile and also retrospectively apply back to the 2020 financial year. In addition, the net interest deductions (net of interest expenses less interest income) are capped at 30 percent. The OECD advises between 10 percent and 30 percent rules apply to all local and FDI companies. In fact, FDI companies are subject to stricter scrutiny than local companies due to the tax authority’s limited ability to exchange information with other tax jurisdictions.

What’s the impact of BEPS 2.0 on common structures?

To address the base erosion and profit shifting (BEPS) risks arising from the digitalization of the global economy, the Organization for Economic Cooperation and Development (OECD) issued a statement on July 1, 2021, on reworking the framework for international tax reform.

Commonly referred to as BEPS 2.0, the new framework aims to ensure a fairer distribution of taxing rights is established with respect to the profits of large MNEs and to set a global minimum tax rate.

The BEPS 2.0 package consists of two parts, which are also called the two pillars:

- Pillar One is focused on profit allocation and nexus; and

- Pillar Two is focused on a global minimum tax.

There are three types of common structures that may no longer be tax-efficient due to BEPS rules in Vietnam.

The first is a Phoenix company which is used to exploit certain tax benefits. A Phoenix company is set up to avail tax incentives for a certain amount of time. It is then closed down and set up again with the same business structure to obtain time-based taxed incentives such as four years of tax exemption. However, BEPS would make this redundant.

The second is tax havens. Tax havens are jurisdictions that have very low rates of taxation for investors, such as Panama. However, with BEPS, you would still need to pay taxes in the country where business is carried out. Pillar one of BEPS 2.0 necessitates that MNE groups pay taxes where they have users regardless of commercial presence.

The third is tax incentive regimes. With BEPS, if a business enjoys tax incentives in Vietnam, they would still be subject to taxes where the parent country is headquartered.

Can you give us an overview of tax incentives in Vietnam?

Vietnam has several tax incentives that appeal to investors. Location-based incentives apply to qualifying economic and high-tech zones, certain industrial zones, and areas with difficult socio-economic conditions. Industry-based incentives are applied to several industries, such as education, software, high technology, renewable energy, and others.

Vietnam also has preferential tax rates, such as a flat lifetime tax rate of 10 percent for socialized projects in certain areas with difficult socio-economic conditions as well as a flat lifetime tax rate of 15 percent for agribusinesses. Businesses can also obtain tax holidays such as four years of tax exemption and a 50 percent reduction for the next nine years.

Audit and compliance

The Accounting Law governs the principles for accounting, audits, and organizational structure, for businesses to stay compliant in Vietnam.

The tax year in Vietnam is determined according to the calendar year, and a Vietnamese-based auditing company must conduct the audit. The financial reports should then be submitted to the local tax authority, the Ministry of Finance, and the statistics office 90 days before the end of the fiscal year.

Vietnamese Accounting Standards

In addition to the Accounting Law, local and international companies are obligated to adhere to the Vietnamese Accounting Standards (VAS), which has been developed by the Vietnam Ministry of Finance, when documenting financial transactions. The VAS provides the guidelines for bookkeeping, financial reporting, and financial statement preparations.

There are industry-specific accounting guidelines for businesses engaging in insurance, securities, as well as funds management.