Vietnam's Free Trade Agreements

Vietnam’s accession to the World Trade Organization (WTO) in 2007 marked its ascension as a committed and robust trade partner for the global community. Since then, the country has entered into numerous Free Trade Agreements and Double Tax Avoidance Agreements.

A Free Trade Agreement (FTAs) is a type of agreement utilized by two or more countries in order to agree on the terms of trade between them. Such agreements determine the value of tariffs and duties that countries impose on imports and exports.

List of Vietnam’s Free Trade Agreements

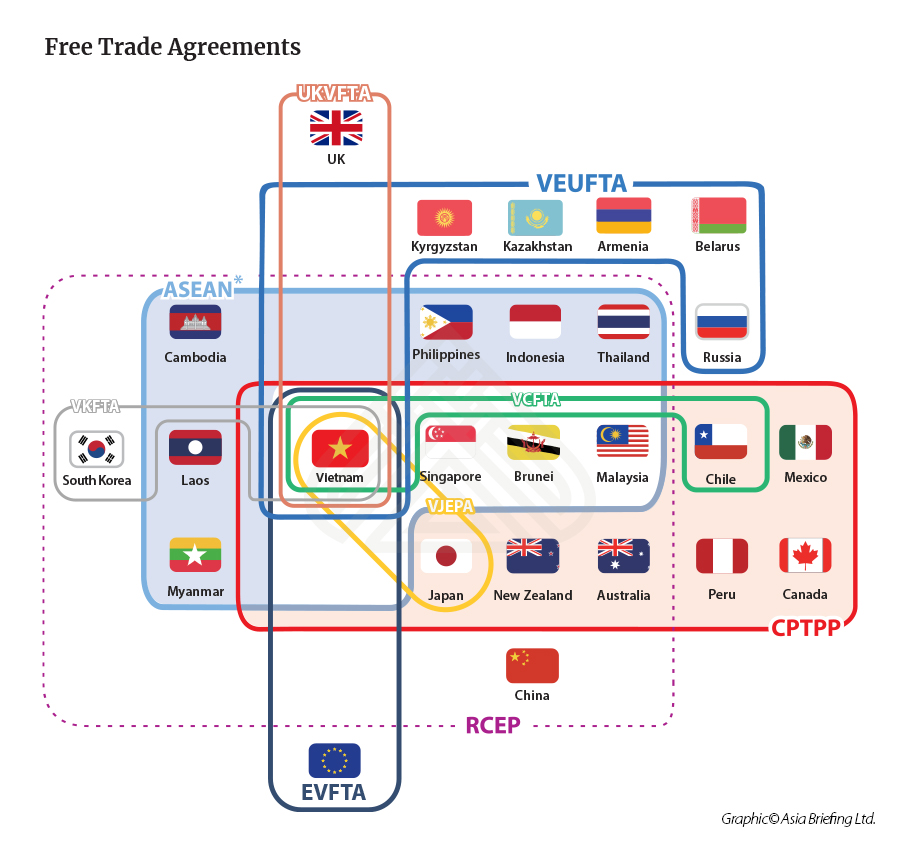

In all, Vietnam is a signatory to 18 active and planned, bilateral and multilateral Free Trade Agreements. These offer direct potential trade advantages with numerous partner countries and regions as listed below:

|

Free Trade Agreement |

Abbreviation |

Signatories |

Effective date |

|

ASEAN Free Trade Area |

ASEAN |

ASEAN Member States:

|

1993 |

|

ASEAN-China Comprehensive Economic Cooperation Agreement |

ACFTA |

|

2005 |

|

ASEAN-South Korea Comprehensive Economic Cooperation Agreement |

AKFTA |

|

2007 |

|

ASEAN-Japan Comprehensive Economic Partnership |

AJCEP |

|

2008 |

|

Japan-Vietnam Economic Partnership Agreement |

VJEPA |

|

2009 |

|

ASEAN-India Comprehensive Economic Cooperation Agreement |

AIFTA |

|

2010 |

|

ASEAN-Australia and New Zealand Free Trade Agreement |

AANZFTA |

|

2010 |

|

Vietnam-Chile Free Trade Agreement |

CVFTA |

|

2012 |

|

South Korea-Vietnam Free Trade Agreement |

VKFTA |

|

2015 |

|

Eurasian Economic Union-Vietnam Free Trade Agreement |

VEAEU |

|

2016 |

|

Comprehensive and Progressive Agreement for Trans-Pacific Partnership |

CPTPP |

|

2019 |

|

ASEAN-Hong Kong, China Free Trade Agreement |

AHKFTA |

|

2019 |

|

EU-Vietnam Free Trade Agreement |

EVFTA |

|

2020 |

|

United Kingdom – Vietnam Free Trade Agreement |

UKVFTA |

|

2021 |

|

Regional Comprehensive Economic Partnership |

RCEP |

|

2022 |

Planned Free Trade Agreements

Vietnam is negotiating future potential agreements with Israel (Vietnam-Israel FTA) and the European Free Trade Association comprised of Switzerland, Norway, Iceland, and Liechtenstein (Vietnam-EFTA).

|

Partnering Country |

Abbreviation |

Agreement Name |

Status |

|

Hong Kong SAR |

--- |

ASEAN-Hong Kong, China Free Trade Agreement |

Signed; Not in effect |

|

Israel |

VIFTA |

Viet Nam-Israel Free Trade Agreement |

Negotiations launched |

The effects of Free Trade Agreements in Vietnam

Free Trade Agreement advantages

Beyond the obvious benefits of helping to increase trade with other countries and making it a more attractive investment destination for exporters and importers, there are a number of strategic benefits towards Vietnam’s development as well.

Free trade agreements will enable Vietnam’s economic development to continue to shift away from exporting low-tech manufacturing products and primary goods to more complex high-tech goods like electronics, machinery, vehicles and medical devices.

This can occur first, by the country boosting its export competitiveness by diversifying its sourcing partners through larger trade networks and cheaper imports of intermediate goods from partner countries. For example, recent trade agreements like the RCEP and EVFTA extend Vietnam’s trade integration partners well beyond Asia, allowing Vietnam to take advantage of the reduced tariffs, both within the ASEAN Economic Community (AEC) and with the EU and US to attract exporting companies to produce in Vietnam and export to partners outside ASEAN.

Second – through partnership with foreign firms that can transfer the knowledge and technology needed to make the jump into higher value-added production. An example of this is the Vinfast electric automobiles manufactured by Vietnamese conglomerate Vingroup. While Vietnam is touted as a low-cost manufacturer, the pioneer player Vingroup has cooperated with global MNCs such as Intel (USA), LG (South Korea) and Contemporary Amperex Technology Company (China) to produce components for e-cars. Vinfast’s gains represent how Vietnam can develop its own products from transfer of know-how and technology. Such sophisticated business practices and technology will help boost Vietnamese labor productivity and expand the country’s export capacity.

Vietnam’s entry into these trade deals will also ensure alignment with national standards ranging from employee rights to environmental protection. Both the CPTPP and EVFTA require Vietnam to conform to the International Labor Organization’s (ILO) standards. The ILO has noted that this is an opportunity for Vietnam to modernize its labor laws and industrial relations systems. The standard of product quality, manufacturing, and employee rights guaranteed in these agreements will allow Vietnam to become a manufacturing hub and expand as an exporting base.

Free Trade Agreement challenges

FTAs are known to come with potential downsides like the possible triggering of aggressive competition from foreign rivals upon local businesses. In Vietnam, an example area of this type of concern is within the meat and dairy products agriculture sector, which reportedly faces strong competition from products imported by EU, Australia, and Canada based companies. To address such challenges, local firms in Vietnam must adapt and make use of new market opportunities as well as potential partnerships with foreign firms to remain competitive in the global and local market.

FAQ: The RCEP Advantage – New Trade Opportunities in Vietnam

What is the RCEP?

The Regional Comprehensive Economic Partnership (RCEP) is an agreement between ASEAN member countries and its free trade agreement (FTA) members. The agreement includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, Vietnam, China, Japan, South Korea, and Australia. The RCEP is a mix of high-, middle- and low-income countries. It is important to note that ASEAN was the initiator of this partnership.

The objective of the RCEP is to eliminate close to 90 percent of tariffs within 20 years. The aim is to also reduce tariffs and red tape with unified rules of origin facilitating international supply chains with trade within the region. One of the drawbacks that has been highlighted is the absence of a focus on labor unions, environment protection, or government subsidies compared to more established FTAs such as the CPTPP and the EVFTA. There are no unified standards on labor and the environment.

Nevertheless, the RCEP is an important agreement as it represents about 30 percent of the world’s population and 30 percent of global GDP making it the largest trade bloc in history.

Can you tell us the impact of the RCEP on Vietnam?

The RCEP is Vietnam’s most recent trade agreement and will allow for more development and trade in the form of integrated markets for Vietnamese goods. Vietnam was already well integrated in the region; therefore most benefits will not come from tariff reductions alone but from other elements such as trade facilitation measures like unified rules of origin.

After 15 to 20 years, Vietnam will have removed 90 percent of tariff lines for partner countries which, in return, will have removed up to 92 percent of tariff lines for Vietnam. For example, Vietnam has imposed high tariffs on motor parts, non-metallic minerals, and animal products among others. However, with the RCEP, tariffs on such products will be reduced by 2040 significantly.

What are some benefits that we can expect in Vietnam?

The RCEP brings further development and trade opportunities for Vietnam. This includes an integrated market for Vietnamese goods and the elimination of tariffs in certain sectors. For example, regarding tariffs faced by Vietnam, the sectors with the highest reductions are food and beverage, petroleum, coal products, and meat.

With an integrated market, the simplification of customs procedures and common rules of origin makes it easier for businesses to trade within the region. Common rules of origin are particularly helpful as businesses can manufacture their products while obtaining raw materials from RCEP members and sell to RCEP members with reduced tariffs and costs.

The RCEP solidifies Vietnam as a manufacturing hub in Asia. Vietnam is a market-driven export-oriented model. The agreement helps Vietnam become more attractive as an investment destination particularly from within the region due to the RCEP.

Which industries in Vietnam are expected to benefit most from the RCEP?

As the RCEP is focused on trade facilitation, the blue-collar sector is expected to benefit the most. In addition, consumer sectors like tourism, education, entertainment, healthcare, and retail are also expected to benefit as the middle class expands. Further, Vietnam’s export-oriented industries such as IT, agriculture, automobiles, footwear, and telecommunications are expected to see gains.

What challenges are posed by the RCEP agreement to Vietnam?

The RCEP will pose a higher level of competition for Vietnam. This will not only be in manufacturing but also in services due to the decreased level of protection of goods traded within the bloc. However, local businesses in Vietnam may also face challenges in keeping clients if they are not able to adapt and meet RCEP requirements.

As mentioned earlier, the RCEP does not include provisions on environment, labor, or intellectual property and thus falls short of such commitments.

Double Tax Avoidance Agreements

Double Tax Avoidance Agreements treaties effectively eliminate double taxation by identifying exemptions or reducing the amount of taxes payable in Vietnam.

Global investors often find themselves in an unfavorable position of having to face being double taxed – taxed by two different countries on the same income – unless there is a double tax avoidance agreement in places. For example, a company might be subject to taxes in its country of residence and also in the countries where it raises income through foreign investments for the provision of goods and services.

It is therefore extremely worthwhile for foreign investors to be aware of which double taxation avoidance agreements (DTAAs) between Vietnam and other countries might be applicable to their situation, as well as understand how these agreements are applied.

As of 2022, Vietnam has signed DTAs with more than 80 countries and territories, including France, China, and Canada. These treaties eliminate double taxation through identifying exemptions or reducing tax payable in Vietnam for residents of the signatories of the agreements.