September 2014

|

C

HINA

B

RIEFING

-

5

Revised Negative List

Of all the subsequent reforms introduced in the FTZ since its opening, by far the most anticipated and potentially furthest reaching has

been the Revised Negative List unveiled on June 30 of this year. To recap, the Negative List is an innovative approach to foreign investment

adopted exclusively in the Shanghai FTZ, under which foreign investors enjoy equal treatment as Chinese domestic enterprises in any

industry not explicitly restricted or prohibited on the List. As such, it is the cornerstone of the FTZ’s broader package of economic reforms.

The Revised Negative List lowered the number of industries restricted for foreign investment by 27 percent to 139 from a previous total

of 190. The majority of these changes were concentrated in the categories of Manufacturing and Transportation, Warehousing, and Postal

Services, and to a lesser extent Wholesale & Retail. Additionally, the Revised Negative List clarified many of the restrictions stipulated by

the original Negative List on investment in specific industries, for example, mandatory Sino-foreign investment ratios.

The most significant changes were made to the financial industry, whereby foreign investment is now freely permitted into investment

banks, financial companies, trust companies, and currency brokerage companies. As mentioned above, for foreign investment into China’s

booming healthcare industry, restrictions were removed on theminimum investment (previously RMB 20million) andmaximumoperation

period (20 years) of medical institutions. Lastly, foreign investment is now freely permitted into cybercafés in China—unfortunately at a

time in which their importance is eroding against widespread mobile internet use.

Other highlights included relaxed restrictions on the manufacturing of printing inks, pigments and similar products; certain previously

restricted chemicals and vitamins; synthetic fibers; construction cranes; and electronic automobile components; as well as liberalization

of the railway freight; international maritime transportation; cargo and container handling; and aircraft repair industries.

An initial wave of surprise spread out among industry observers to see the gambling and pornography industries removed from the Revised

List. Later, however, it was confirmed that despite their apparent liberalization, these industries remain barred to foreign investment by

virtue of their illegality under Chinese law.

Investors registered in Hong Kong and Macau were given special priority by the revised list, for example, via freer investment into the

construction and operation of movie theaters, as well as a wide range of aviation transport ground-based services. This opens the possibility

of foreign investment channeled through Hong Kong into these industries.

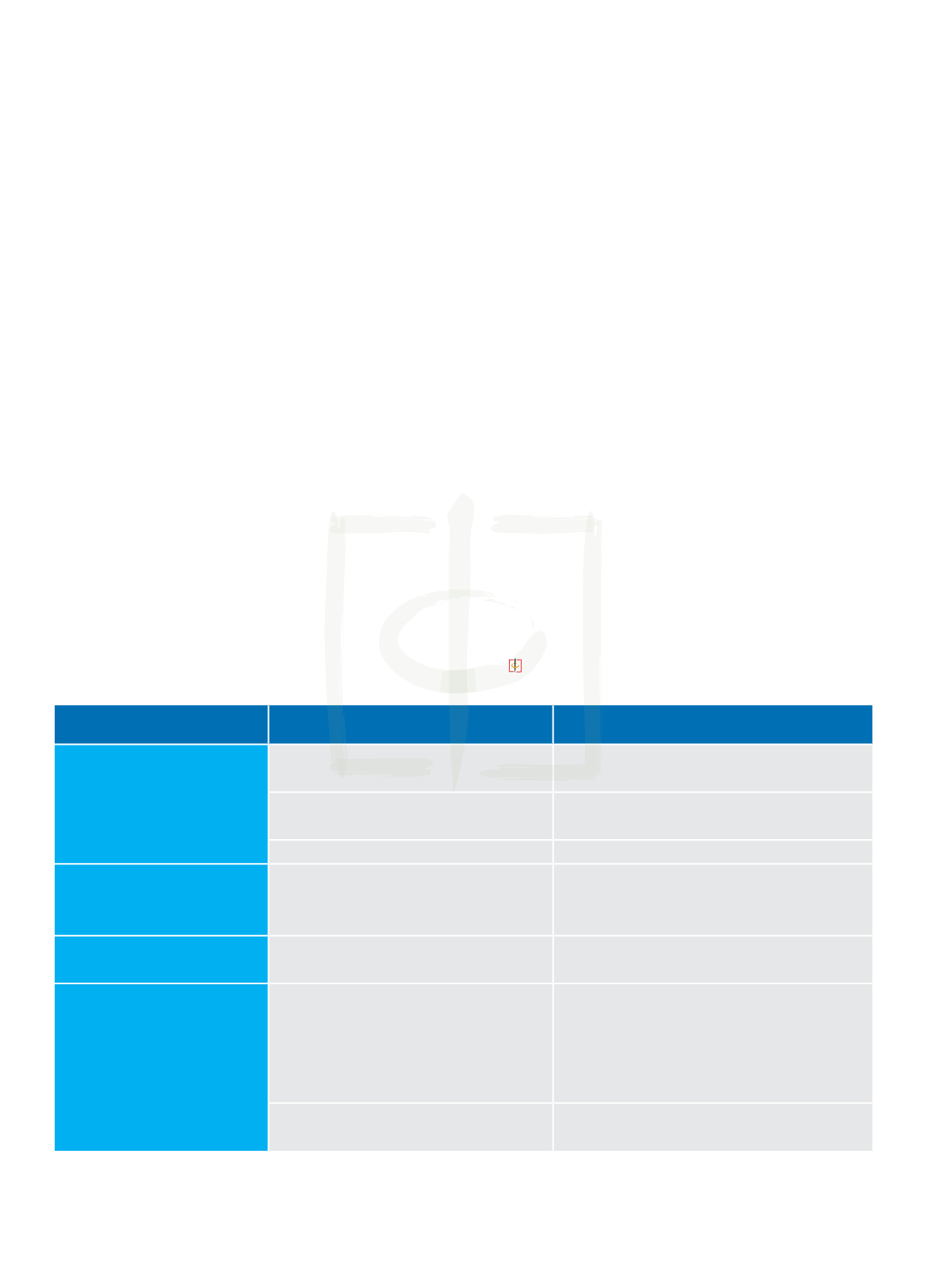

Industry Category

Specific Industry

Revised Terms

[C] Manufacturing

C153 Green tea production and processing

JVs newly permitted with Chinese equity controlling

partner

C343 Wheeled or crawler crane manufacturing Removed from Revised List

C373 Luxury ocean liner design

Removed from Revised List

[J] Financial services

J66 Investment banks, financial companies,

trust companies, and currency brokerage

companies

Removed from Revised List

[Q] Health and social activities

Q83 Medical institutions

Restrictions removed on total investment and

operations period.

[R] Culture, sports,

and entertainment

R861 Movie theater construction and operation

Restrictions removed for investment from Hong Kong

and Macau. Otherwise restricted to JV with Chinese

equity controlling partner.

R891 Cybercafés (places for the provision of

internet service)

Removed from Revised List