July 2014

|

I

NDIA

B

RIEFING

-

5

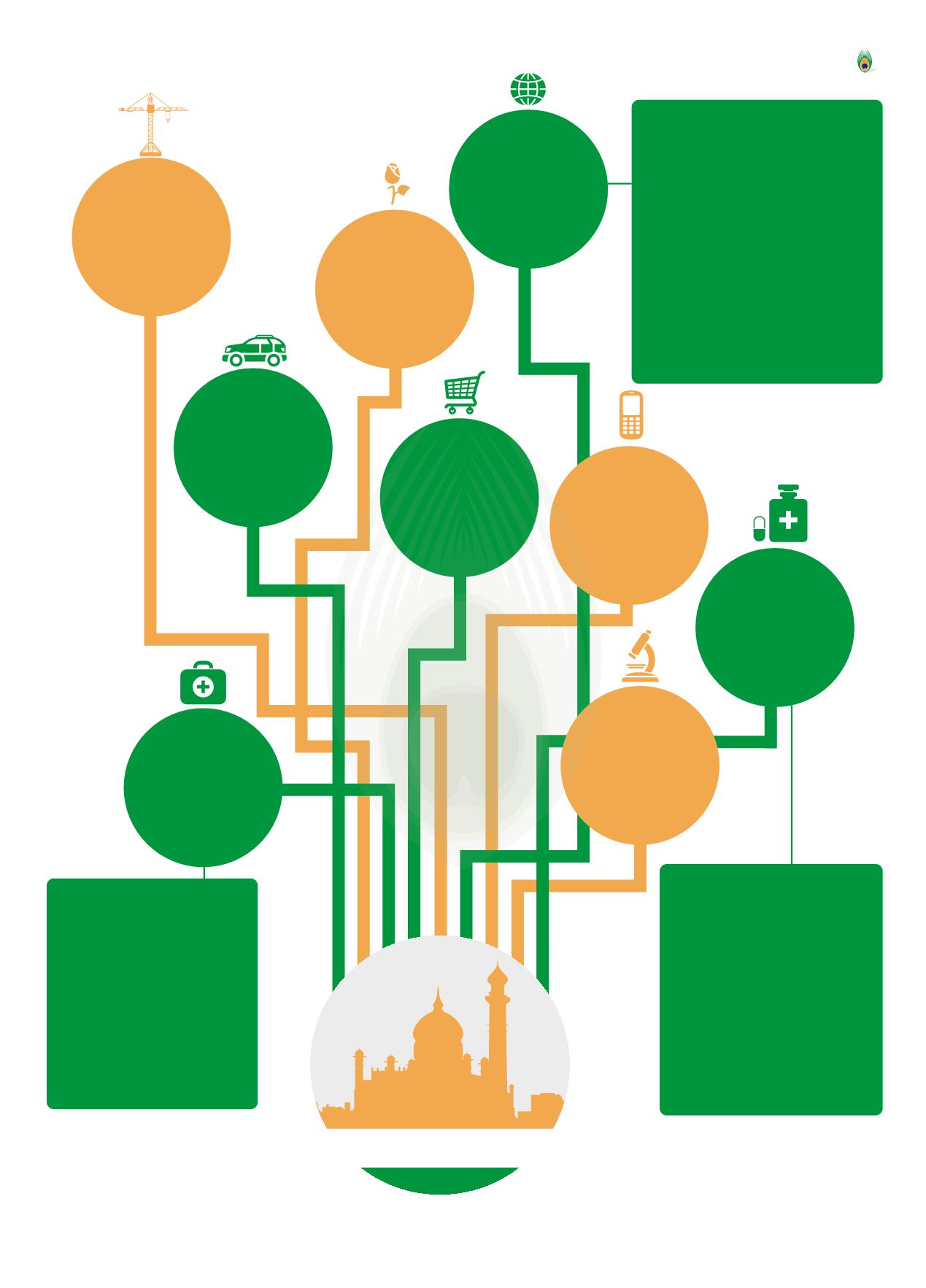

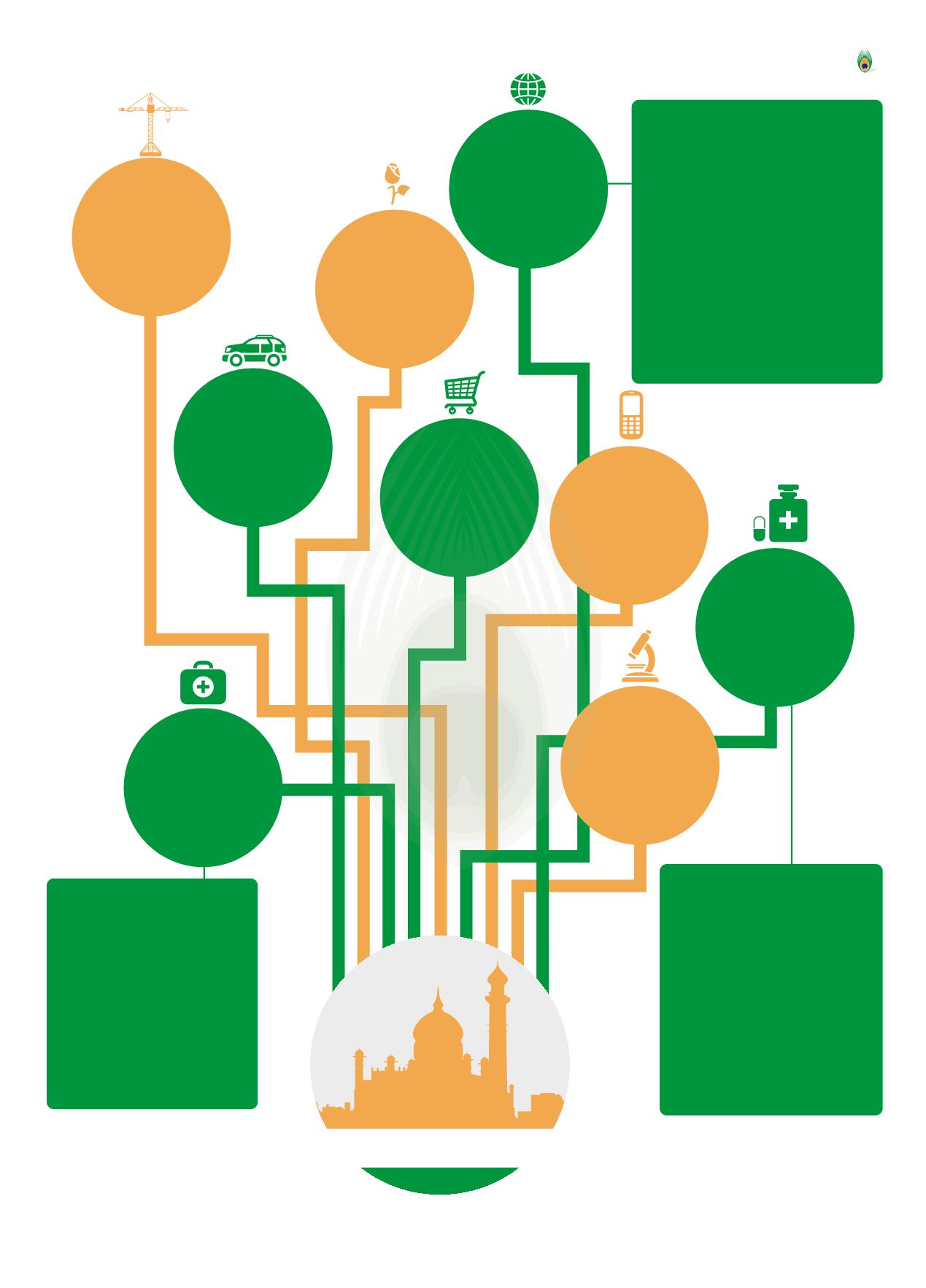

Evaluating the Market: Key Sectors

108

US$

Billion

Information &

Communications

Technology (ICT)

13.1%

CAGR

FY08-13

151.8

US$

Billion

Agriculture

3.3%

CAGR

FY07-12

6.4

US$

Billion

Construction

Equipment

24.1%

CAGR

FY11-15

7.3

US$

Billion

Consumer

Durables

14.8%

CAGR

FY03-12

64.1

US$

Billion

Telecommunications

10.4%

CAGR

FY06-13

4.3

US$

Billion

Biotechnology

22.2%

CAGR

FY06-13

18

US$

Billion

Pharmaceuticals

13%

CAGR

FY09-13

India’s market for pharmaceuti-

cals has grown around 15

percent annually for the past

ve years—a trend that is

projected to continue through

2020. While low-priced,

domestically produced products

currently control a 60 to 70

percent market share, the US$18

billion industry is experiencing a

growing demand for high-

quality, internationally produced

products.

With nearly 75 percent of Indian

medical devices imported from

overseas, India’s market for

medical devices ranks among

the largest in the world and is

expected to grow 16 percent

this year. Medical devices

imported and marketed in India

must meet India’s device

classi cation standards and are

usually subject to a 10 percent

import duty.

Information and Communications

Technology (ICT) is among the fastest

growing sectors in India and was a top

performing sector last year. By most

estimates, India’s ICT sector is projected

to reach US$200 billion by 2020.

Demand in the ICT sector is greatest for

IT services (US$56 billion), business

processing management (US$21

billion), and software products and

engineering services (US$17.9 billion).

Currently, FDI in India’s telecommuni-

cations services sector is capped at 74

percent with government approval

and 49 percent without.

Key Industries

72

US$

Billion

Automobiles

13%

CAGR

FY05-13

78.6

US$

Billion

Medical Devices &

Healthcare

15.1%

CAGR

FY11-17, projected

CAGR = Compound Annual Growth Rate