4

-

V

IETNAM

B

RIEFING

|

September 2014

HRTrends inVietnam

Once a company has gone through all the legal procedures required

for the establishment of their business in Vietnam, the next big

hurdle is the process of actually hiring the staff that will be needed

and dealing with the associated payroll obligations. Hiring, and the

associated legal obligations that go alongwith it, can be a confusing

process. It is therefore strongly recommended that businesses take

a careful look at all relevant regulation and engage a

where appropriate to ensure proper compliance with all laws.

In recent years, Vietnamhas become an increasingly attractive place

for businesses of all types. The country has a fast growing consumer

class and a young and dynamic workforce that is continuing to build

its skills set. In fact, Vietnam’s labor force is growing by more than

one million people per year. Currently, the hottest hiring areas are

sales, IT & software, and marketing.

There are a number of important HR trends occurring in Vietnam.

While labor costs are still low (50 percent that of China and 40 percent

of those reported inThailand and the Philippines), wages are steadily

increasing. Over the past five years, this increase in salaries has come

without a corresponding increase in productivity. Compounding the

costs of employing staff in Vietnam are the country’s comparatively

high social contribution and income tax rates.

Due to the developing nature of the workforce in Vietnam, it is

natural that there exists some difficulty in finding highly skilled

employees. Skills and talent shortages are particularly acute in

industries such as

and banking. However, many

international companies, in partnership with the Vietnamese

government, are sponsoring training programs to ensure that there

are a growing number of highly skilled employees to choose from.

Additionally, some companies, such as ANZ, are looking to attract

Vietnamese expatriates back to the country since they tend to have

a higher skill set.

The country’s young and growingworkforce has newdemands and

high expectations for their futures. Vietnam is just now coming into

the full benefits of its demographic dividend – where the country

will see a massive influx of young people into the workforce over

the next few years. To understand what the next few years will

bring to Vietnam, it is instructive to look at China, which previously

went through its own demographic dividend and saw explosive

economic growth.

As the country’s workforce continues to grow there has been a

resulting rise in competitionwithin the jobmarket.This has increased

the rates of turnover at many companies as employees are often

shopping their skills around to other potential employers. It is

not unusual to see applicants who have worked at a multitude of

companies over a short span of time.

Company Considerations

– By

and

Dezan Shira and Associates

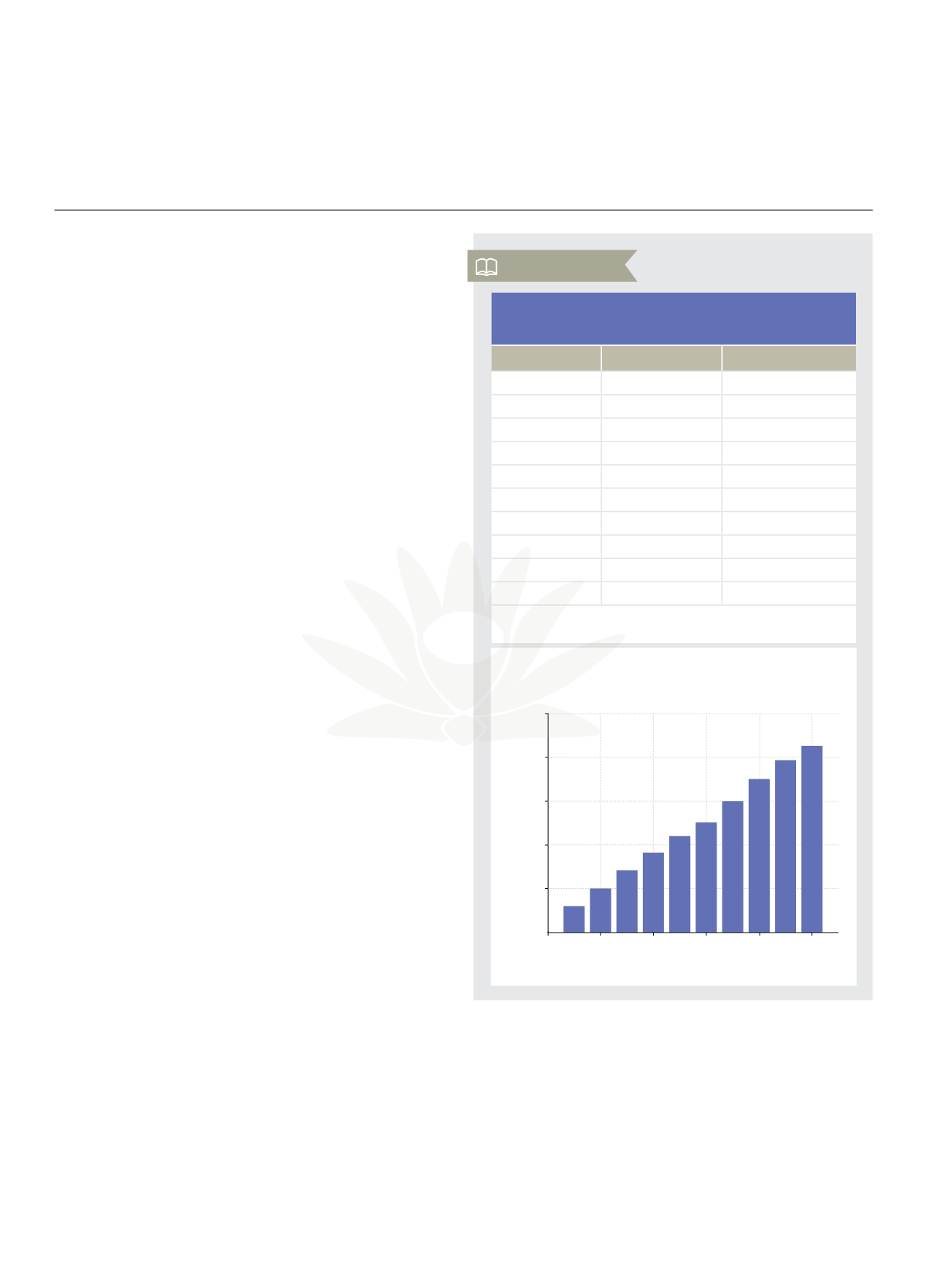

Average Annual Growth Rate of Labour Force,

ASEAN Member Countries (%)

Country

2010-2014

2015-2020

Brunei Darussalam

1.88

1.46

Cambodia

2.03

1.67

Indonesia

1.48

1.24

Lao PDR

2.48

1.97

Malaysia

2.01

1.85

Myanmar

1.38

0.97

Philippines

2.46

2.31

Singapore

1.44

0.91

Thailand

0.83

0.48

Vietnam

1.56

0.86

Source: Compound average annual growth rates are estimated from ILO, Economically

Active Population. Estimates and Projections (6th edition October 2011)

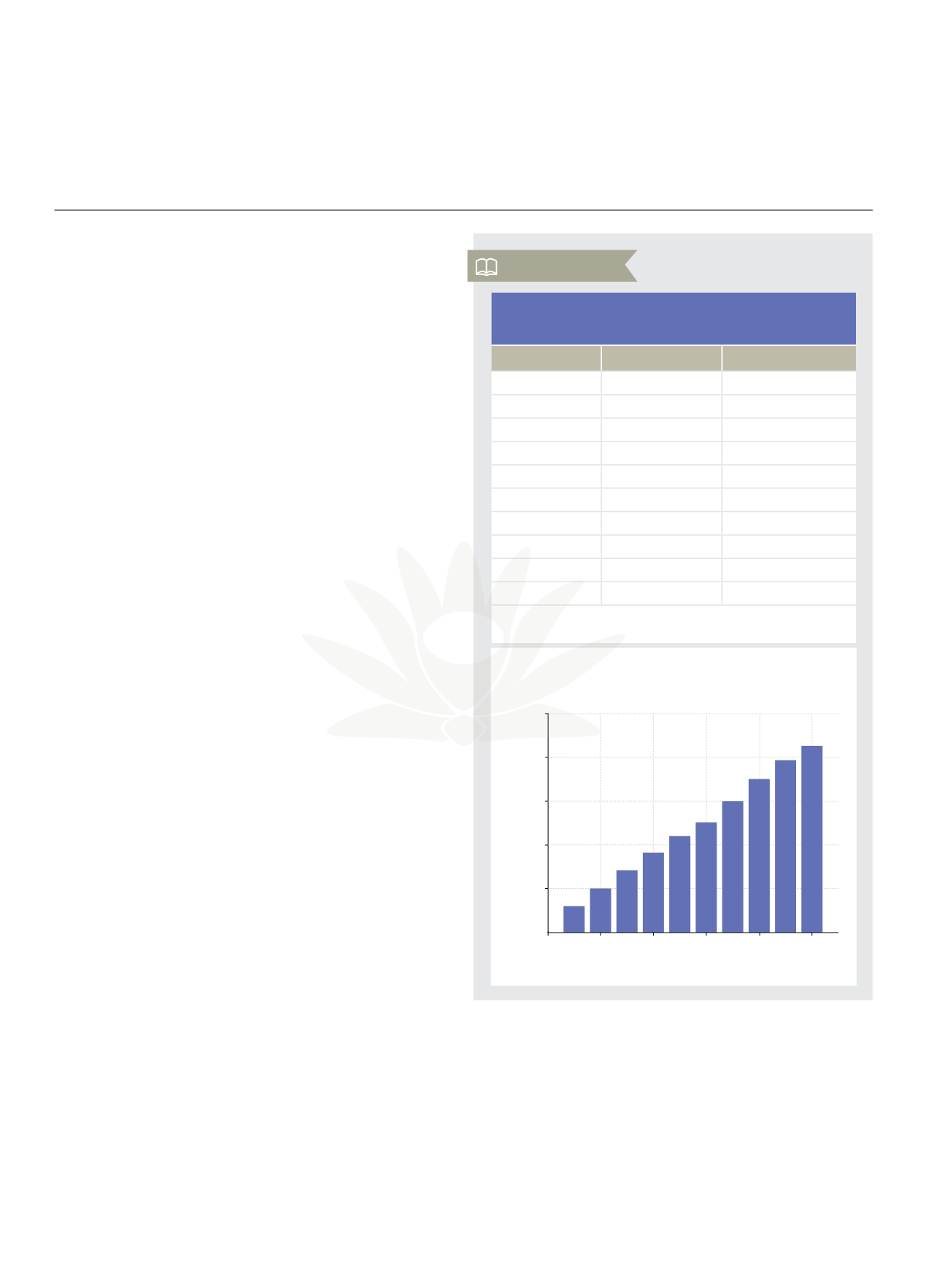

Vietnam GDP per Capita

GDP per Capita in US Dollars at Constant Prices Since 2000

2004

600

700

800

900

1000

1100

2006 2008 2010 2012 2014

658.03

699.49

740.04

784.25

819.88

85507

900.49

946.8

Source:

| World Bank

986.01

1023.63

Key Information