4

-

R

USSIA

B

RIEFING

|

February 2014

On January 1, 2010, the Russia-Kazakhstan-Belarus Customs Union

came into effect and as of July 1, 2011, all customs borders between

these three states were removed.

As a result, customs clearance of goods originating in any of these

three states, along with goods that have been imported into one

of these three states from other countries and released for free

circulation, may be transferred between the three states without

undergoing customs clearance and customs control procedures.

In August 2012, Russia joined the WTO which created customs

tariff changes for the Customs Union. In the end, it is believed

that Russia’s entrance into the WTO will equalize trade among the

Customs Union and its trading partners. It is interesting to note

that Russia was granted a 3 – 7 year transition period to make a full

integration. But some of the most protected industries, such as the

automotive market, will not transition to the new rates until the

end of this period.

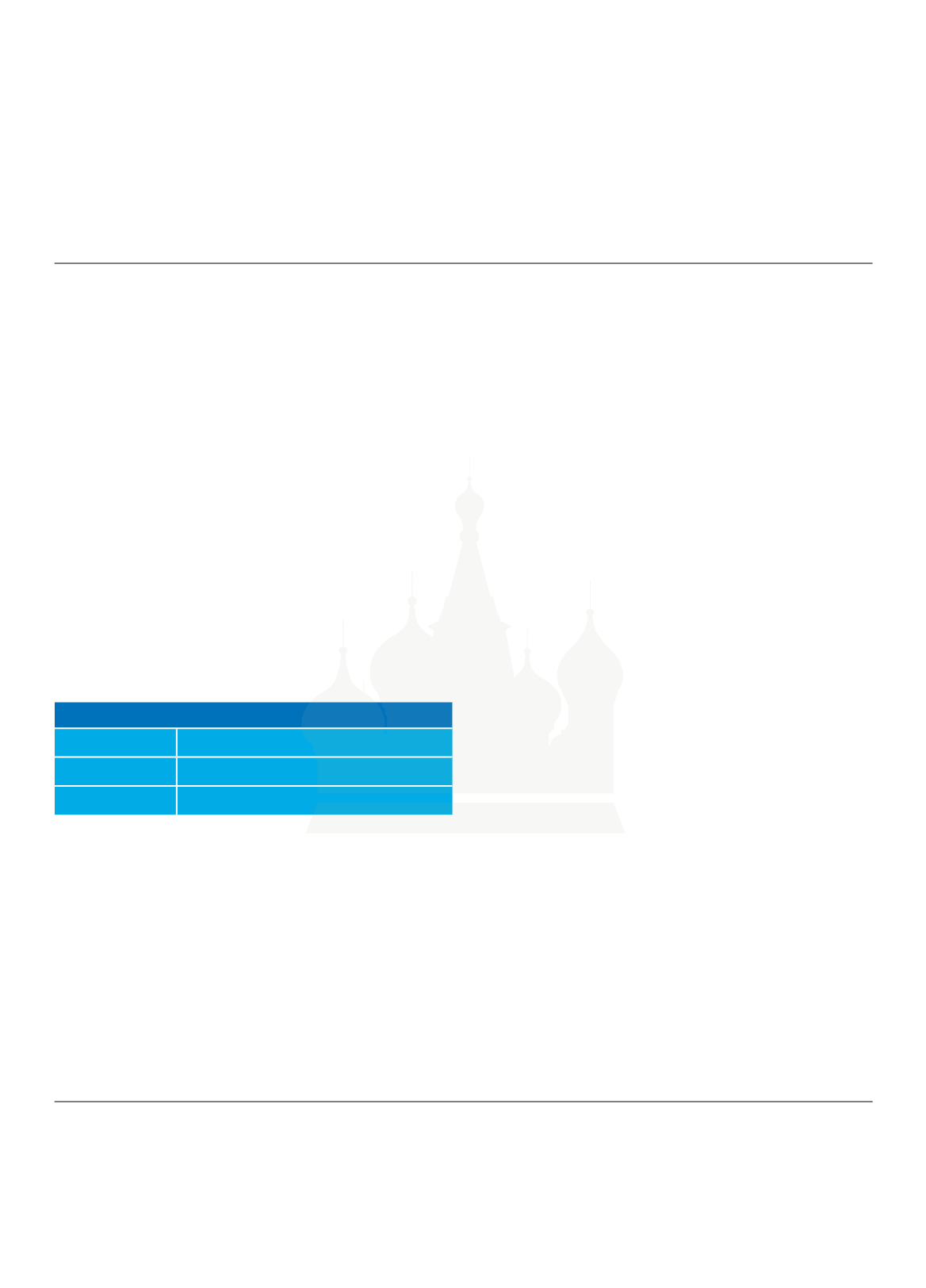

The key aspects in the legislation of the Customs Union include:

Customs Duties by Location

Russia

87.97 %

Belarus

7.33 %

Kazakhstan

4.70 %

1) A Common Economic Space – an economic union which is the

ultimate integration of the three countries to achieve common

economic development goals followed by the harmonization of

the three countries’ various policies, including their economic

policy and industrial support policies. The formal establishment

of the Economic Union will take some time and effort.

2) Customs duties are posted to a general account and then

distributed among the member states of the Customs Union

according to a national budget:

Regarding VAT related to trade between the member states, VAT is

refunded to the seller of goods in one country (the exporter) while

the purchaser in the other country (the importer) pays VAT to the

tax authorities of its country. VAT rates are 18 percent in Russia, 20

percent in Belarus and 12 percent in Kazakhstan. It is unlikely that

these rates will be unified in the foreseeable future.

Prospects for the future of the Customs Union

The pace of integration towards a unified economic zone has

been accelerated through the political leadership of the member

states with a long term goal of creating a free space similar to the

European Union.

After 16 years of accession negotiations, Russia finally joined theWTO

in August 2012 which will have a positive impact on the economy

in the long term. The membership of Kazakhstan in theWTO could

take place in 2014.

Other countries have expressed an interest in joining the union

including Kyrgyzstan and Tajikistan.

The CustomUnion’s unified economic zone is becoming increasingly

salient in global trade relations, particularly between Europe and

Asia. European Union standards have been evident in the emerging

technical regulations and rules of the Customs Union and the Single

Economic Space right from the start. Experts believe that this will

lead to the establishment of an EU-associated free trade area in a

portion of the CIS territory as early as 2015 – 2020.

General Introduction

into Customs Union

– By Paul Sprague

Russia’s Accession to

The WTO – One year later

– By Bettina Wisthaler

On August 22, 2012, when Russia became the 156th member state

of the WTO, it was the end of long lasting talks and the beginning

of high expectations. Now, one year later, we are drawing the first

conclusions.

Entering theWTO, Russia agreed to adhere to the obligations under

the signed protocol which foresees among other provisions, that

the import tariff rates should not exceed the rates provided for by

the WTO. The requirements regarding the regulation of the import