8

-

V

IETNAM

B

RIEFING

|

December 2014

If a business wishes to engage in import and export activities as

well as domestic distribution (i.e., retail, wholesale, and franchising

trade activities) in Vietnam, the most common method chosen is

establishing a trading company.

Generally, a trading company is inexpensive to establish and can be

of great assistance to foreign investors by combining both sourcing

and quality control activities with purchasing and export facilities,

thus providing more control and quicker reaction times compared

to sourcing purely while based overseas.

Trading companies are also the ideal choice for foreign companies

that need to source inVietnam in order to resell inVietnam. Without

aVietnamese trading company, the alternativewould be to buy from

overseas, and have the goods shipped out of Vietnam before then

reselling back intoVietnamvia local distributors (which wouldmean

additional logistical costs, customs duties, and VAT).

Trading and distribution is still a sensitive sector for foreign investors.

Therefore, the licensing process can vary 4-6 months from the date

of submitting the application dossier to the licensing authority, until

the Investment Certificate can be issued.

To set up a trading company (distribution company) without a

retailing outlet or a trading company with its first retailing outlet,

the investor must prepare an application dossier to apply for an

Investment Certificate and submit to the licensing authority at the

provincial level. The application dossiers after that will be submitted

by the provincial licensing authority to the Ministry of Industry and

Trade (MOIT) for approval. Once receiving the approval by MOIT, the

provincial licensing authority will grant the Investment Certificate

to the investors. In case the licensed foreign trading company want

to have a second retailing outlet or more, they will be required to

complete the procedure for setting up a retail establishment.

Under World Trade Organization (WTO) commitments, around 95

percent of goods can be distributed by businesses that are 100

percent foreign owned. For certain types of investment projects, such

as those that are deemed to have a significant impact on Vietnam’s

national policies, environment, etc., the government must issue an

official investment policy on the project.

Relevant Applications

The application for the Investment Certificate must contain the

following documents:

1. Application letter

2. Copy of Identity Card/Passport of individual; Copy of Business

License or other equivalent documents

3. Investment analysis with the following contents: information of

investors, target of investment, scale of investment, investment

capital and planning of capital contribution, location, duration,

schedule of investment, labor demand, investment incentives,

impact assessment, economic-social efficiency of the project

4. A copy of one of the following documents: financial statements

from the investors for the two most recent years; commitment of

financial support by the parent company; commitment of financial

support from a financial institution; guarantee of the financial

capacity of the investors; bank reference letters explaining the

financial capacity of the investors

5. Proposal for land use or copy of land leasing contract/office

leasing contract

6. Business Cooperation Contract (BCC) for projects invested under

a BCC contract

How to Establish a Trading

Company in Vietnam

– By

Hoang Thu Huyen and Edward Barbour-Lacey , HCMC Office

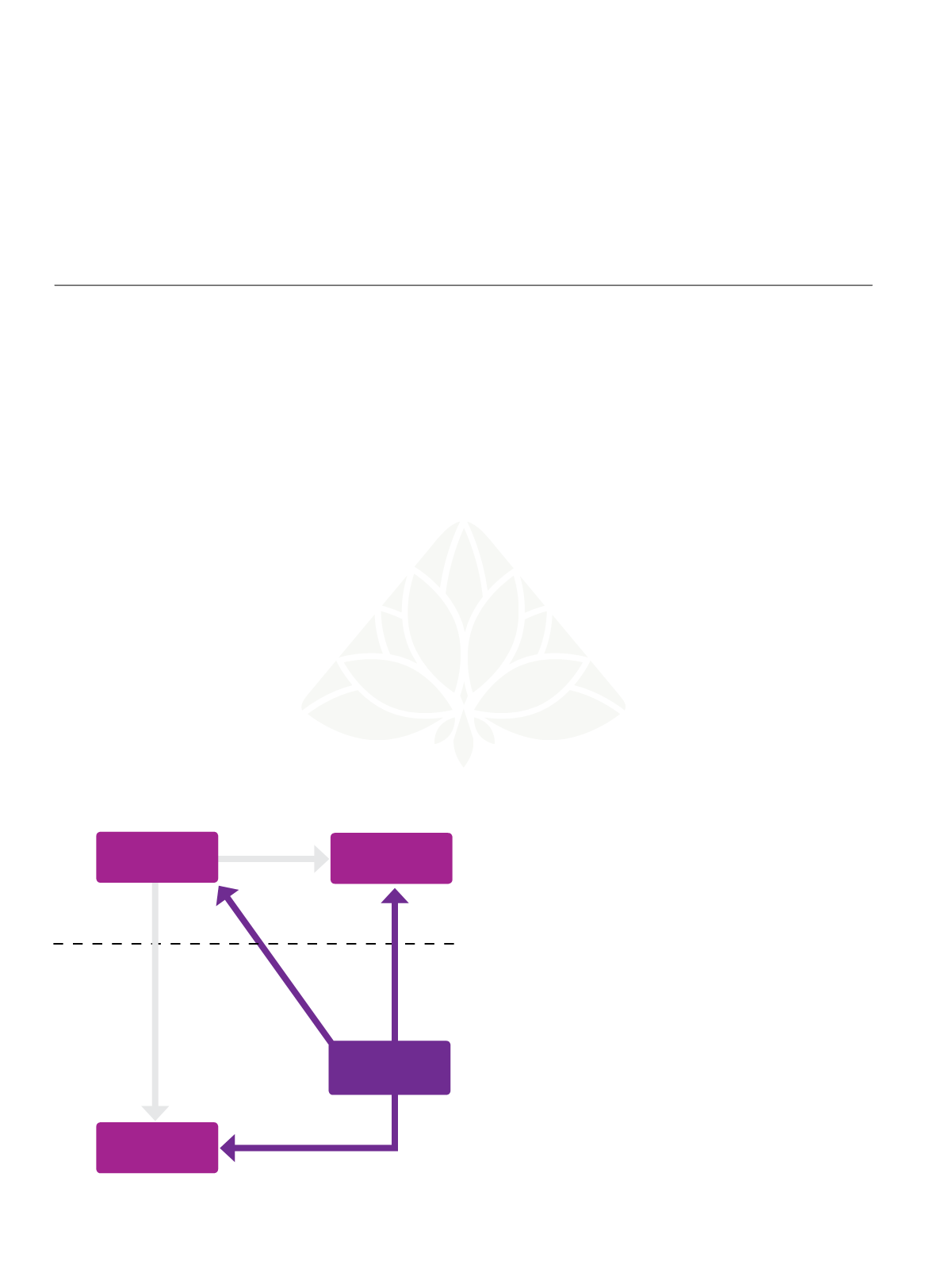

Other

Customers

Trading

Company

HQ

Vietnam

Customers

Overseas

Vietnam

Can provide

service & receive

payment in

foreign currency