4

-

V

IETNAM

B

RIEFING

|

December 2014

With its rising costs, China is no longer the go to destination for

many businesses, and Vietnam has arisen as a serious competitor.

Recent trends show that the number of orders shifting from China

to Vietnam has seen a significant increase. For example, China’s

Pearl River Delta, long known as one of the key factory centers for

the world’s manufacturers (particularly those from Hong Kong) has

now become too costly for many companies to stay in the region.

In the past three years alone, a growing number of businesses have

relocated their operations from China to Vietnam in an attempt

to escape rising costs and an increasingly complex regulatory

environment. Located in a strategic position for foreign companies

with operations throughout Southeast Asia, Vietnam is an ideal

export hub to reach other ASEAN markets.

Compared with other developing markets in the region, Vietnam

is emerging as the clear leader in low-cost manufacturing and

sourcing, with the country’s manufacturing sector now accounting

for 25 percent of Vietnam’s total GDP. Currently, labor costs in

Vietnam are 50 percent of those in China and around 40 percent of

those reported in Thailand and the Philippines. With the country’s

workforce growing annually by around 1.5 million, Vietnamese

workers are inexpensive, young, and, increasingly, highly skilled.

Another driving force behind Vietnam’s growing popularity is the

country’s collection of free trade agreements (FTAs)—most notably,

the soon-to-be-signed Trans-Pacific Partnership (TPP) and EU-

Vietnam FTA. Additional FTAs currently under negotiation include

the Regional Comprehensive Economic Partnership (RCEP) and the

ASEAN Economic Community (AEC). When these trade agreements

come into force, Vietnamese exports will be freely accessible to

many of the world’s largest markets with few tariffs or restrictions.

In terms of regulatory and financial incentives, Vietnamhas become

increasingly investor-friendly in recent years –the government has

taken such actions as reforming its financial sector, streamlining

business regulations, and improving the quality of its workforce.

Since the mid-2000s, the Vietnamese government has offered

extremely competitive financial incentives to businesses seeking

to set up operations in the country, in addition to a zero percent

withholding tax on dividends remitted overseas and a low corporate

income tax (CIT) rate of only 22 percent (set to drop to 20 percent in

2016).These advantages have enabledVietnam to become a premier

“sourcing economy” in the eyes of many companies.

The current state of Vietnam’s economy

Vietnam is seeing strong growth on multiple fronts. Of particular

interest to investors has been the continuing growth of Vietnam’s

domestic consumer market, which has been developing by leaps

and bounds. This growth is expected to continue for some time to

come - domestic consumption is predicted to increase at a rate of 20

percent per year.With a population of over 90million and Southeast

Asia’s fastest growing middle class, Vietnam clearly represents an

important market for foreign goods. Following alongwith this trend,

in November, consumer confidence levels inVietnamexceeded 100

points for the first time since 2012.

An Introduction to Vietnam’s

Export & Import Industries

– By Dam Thi Phuong Mai and Edward Barbour-Lacey, HCMC Office

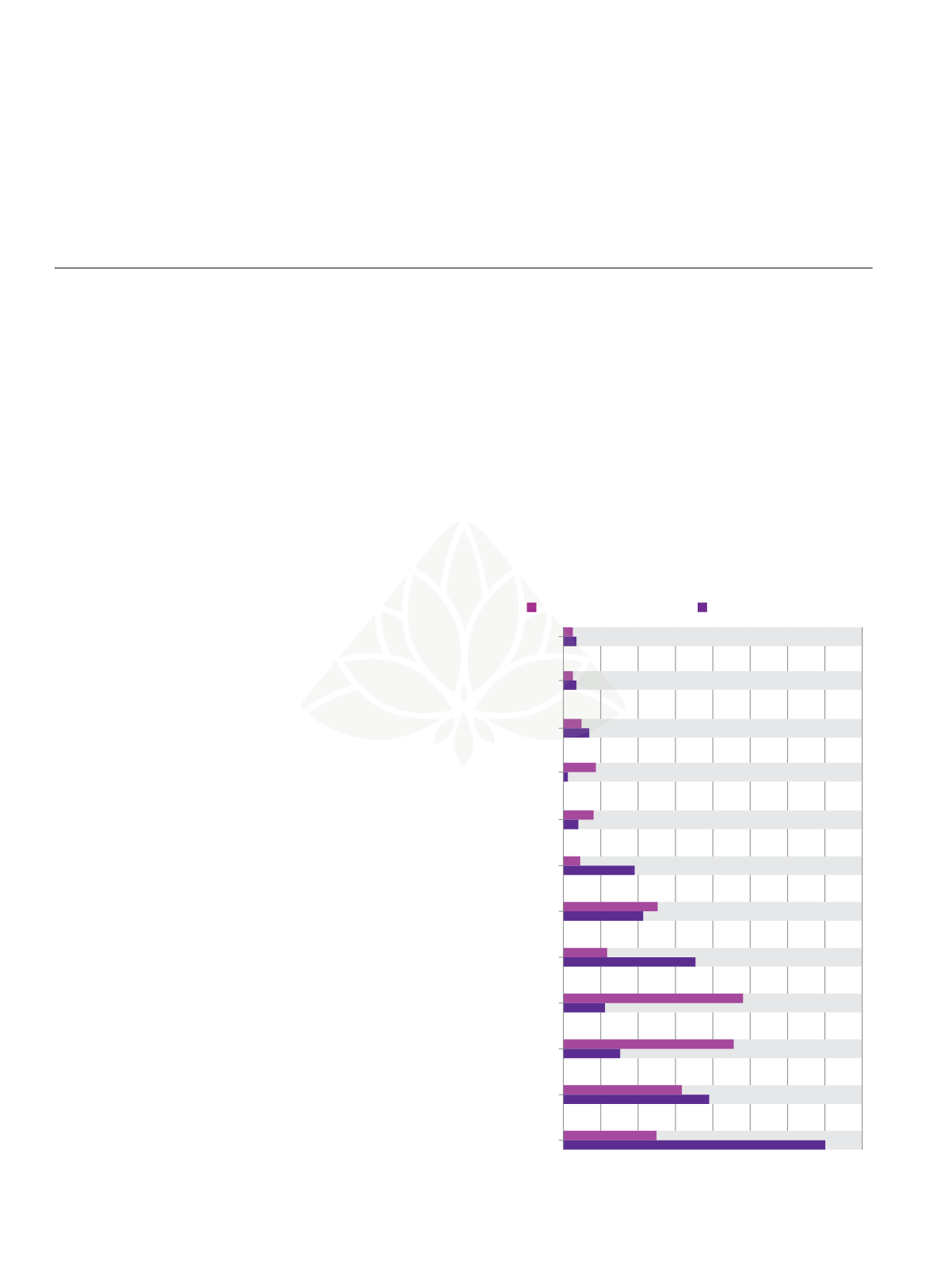

Brazil

United Arab

Emirates

India

Hong Kong

Australia

Taiwan

Japan

Korea

United States

EU

ASEAN

P.R. China

Top Importers/Exporters to Vietnam

Export from Vietnam Import into Vietnam

Source: General Statics O ce of Vietnam

40

30

20

35

25

15

10

5 0

First 10 months of 2014, US$ Billion