Human Resources and Payroll in China 2016-2017 (5th Edition) -

117

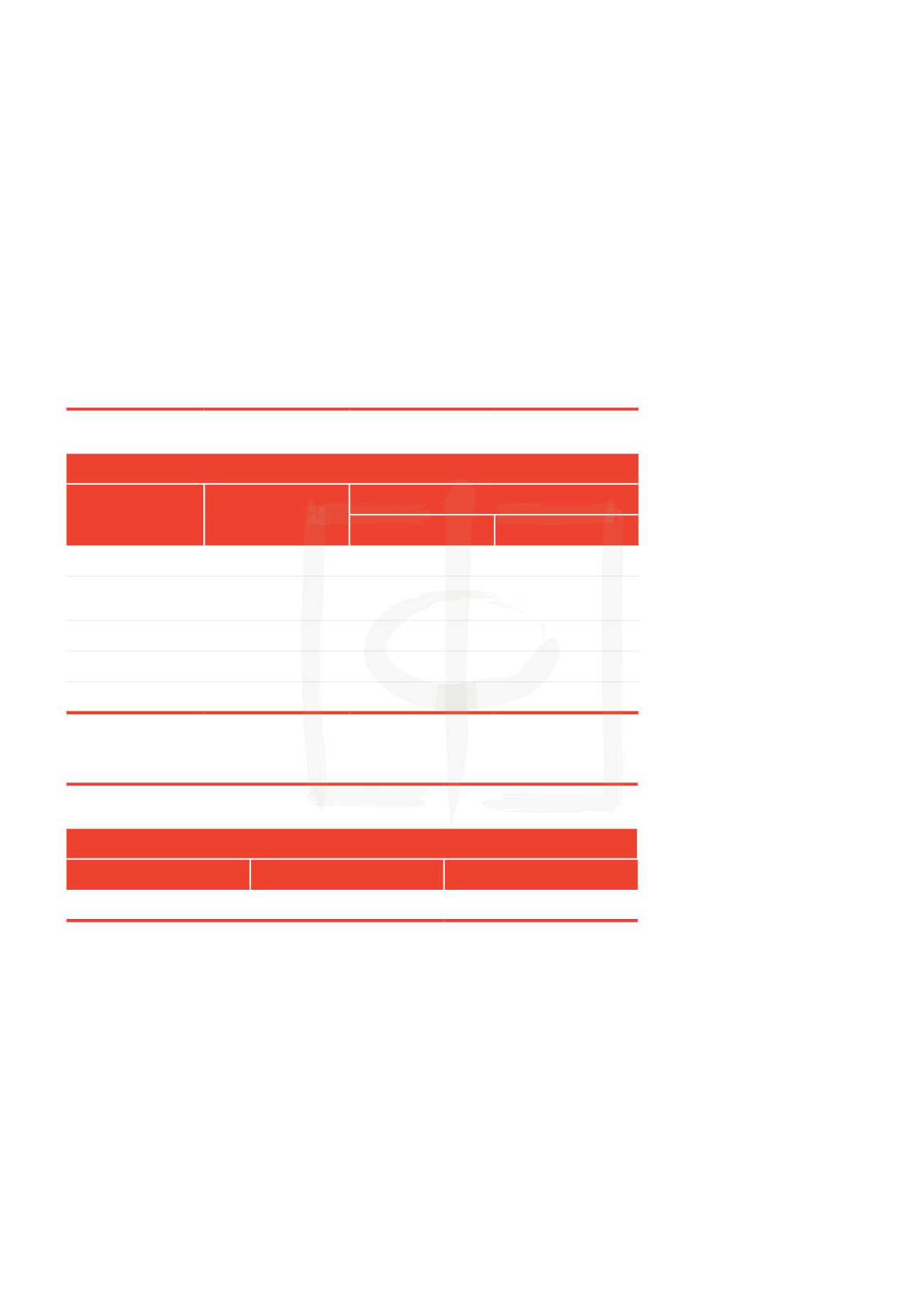

Changchun

Social Welfare Contribution Details

Social Insurance

Data valid since August 1, 2015

Contribution Base RMB 2,800.70 -14,003.49

Employer

Employee

City Hukou

Rural Hukou

Pension

20%

8%

8%

Medical

7%

2% (monthly) +

RMB 100 (annual)

2% (monthly) +

RMB 100 (annual)

Unemployment

1.5%

0.5%

0.5%

Injury

0.5% -2%

N/A

N/A

Maternity

0.7%

N/A

N/A

* Social insurance payments are tax exempt.

Housing Fund (Chinese Only)

Data valid since August 1, 2015

Contribution Base RMB 1,320-21,485

Employer

Employee

Rate

7% -12%

7% -12%

* Employer and employee can pay different rates within the range.

** Minimum salary = RMB 1,480 ( Adjusted December, 2015); average monthly salary = RMB 4,667.83 (2014)