A highly dynamic international city, Hong Kong serves as a primary gateway to Mainland China and Asia and a hub for global and regional business, helping to make it one of the most competitive and top international cities for companies, investors, and professionals.

In this guide, we discuss why Hong Kong is a hotbed for companies looking to leverage market advantages such as:

- An open, fair, and efficient business environment

- Competitive tax regime

- Excellent legal and dispute resolution services under the rule of law

- Closer proximity to markets in Asia, including mainland China

- Leading global financial services center

- Network of international free trade and tax agreements

- World-class infrastructure with sophisticated support services

- Highly skilled and multicultural talent pool and a liberal Immigration policy

Efficient business landscape

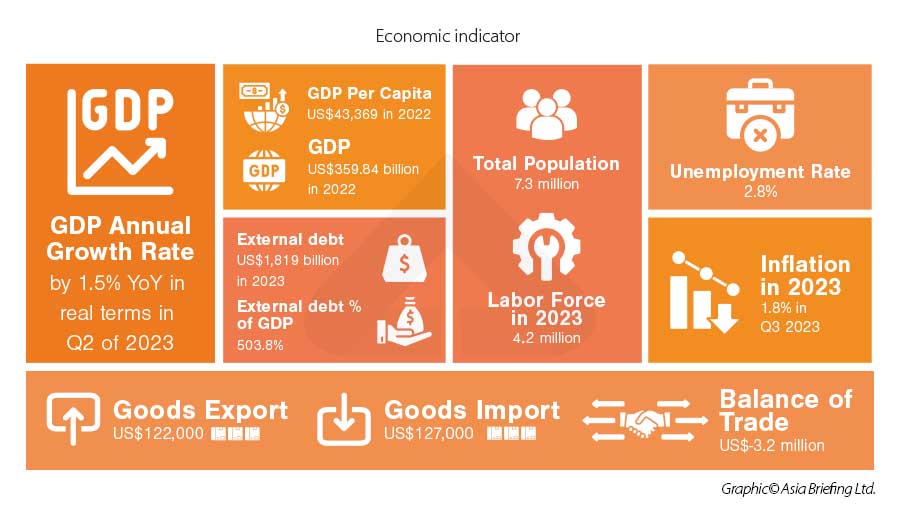

Hong Kong’s economic system is defined as a free-market economy characterized by minimum intervention from the government, low taxation, free port trade, and a highly internationalized and modernized financial market.

The city’s service-oriented economy (with services accounting for more than 90 percent of its GDP) is especially powerful in financial services, international trade, and tourism. Additionally, it has strong economic links to mainland China and other major economies in the Asia Pacific region.

As one of the most Laissez-faire economies in the world, the government’s policy is strictly non-interventionist.

The absence of exchange controls, corruption-free government, and free flow of information, capital, and talents has enabled Hong Kong to maintain a free and efficient business environment for business activities and commerce.

In addition, Hong Kong enjoys a strong reputation as a "free port" with streamlined customs clearance processes. The city imposes no tariffs on imported goods, has no import quotas, and applies excise duties to only four specific commodities: hard alcohol, tobacco, oil, and methyl alcohol.

Ease of doing business

Hong Kong rose to 3rd place in the World Bank Group’s latest Ease of Doing Business Ranking 2020, a jump from the previous year’s 4th place, with ease of dealing with construction permits ranked 1st, paying taxes ranked 2nd, and ease of starting a business ranked 5th.

Further, the Fraser Institute has ranked Hong Kong as the world's freest economy in the Economic Freedom of the World Annual Report every year since the inception of the report.

Competitive tax regime

Businesses and individuals enjoy one of the most tax-friendly systems in the world.

Hong Kong imposes only three kinds of direct taxes – profits tax (for incorporated bodies), salaries tax (for personal income), and property tax (for income sources from Hong Kong property).

There are also generous allowances and deductions, which can reduce the taxable amount.

- 25 percent profits tax for the first HK$2 million (US$255,000), with profits above that amount subject to a 16.5 percent tax rate.

- For unincorporated businesses (e., partnerships and sole proprietorships), the two-tiered profits tax rates are set at 7.5 percent and 15 percent.

- 15 percent salary tax rate

- 15 percent property tax

Hong Kong has no turnover taxes (like value-added or sales tax), making it a favorable location for profit shifting and re-invoicing.

Legal and dispute resolution services

Hong Kong is home to some 850 local solicitor firms and more than 70 global law firms. Legal advisors based in Hong Kong are familiar with different countries' legal and regulatory landscape worldwide. Benefiting from a sound and independent legal system, Hong Kong has long been a regional hub for dispute resolution, with the Hong Kong International Arbitration Centre rated the most preferred seat of arbitration outside Europe.

Due to its previous status as a British colony, Hong Kong’s legal system is influenced by English common law. The constitutional framework for its legal system is provided by the Basic Law approved by the National People’s Congress, which supplements the common law.

The independent judiciary under the Basic Law ensures that Hong Kong remains within the common law system. The Court of Final Appeal is the highest in HKSAR and is headed by the Chief Justice. Furthermore, reflecting its status as a Special Administrative Region, the HKSAR legal system is separated from the one governing the PRC under the principle of “One Country, Two Systems.”

Proximity to mainland China, Asian markets

Hong Kong enjoys an ideal location in Asia that enables businesses to tap into the various opportunities in the Guangdong-Hong Kong-Macao GBA and throughout the rest of the region.

Hong Kong and Mainland China signed the Mainland and Hong Kong Closer Economic Partnership Agreement (CEPA) in 2003. This agreement facilitates easier access to the vast mainland market for Hong Kong products and services. It goes beyond China's commitments under the World Trade Organization (WTO), as it eliminates tariffs and grants earlier or preferential access to certain service sectors.

Overseas companies can also reap the benefits of CEPA. In terms of trade in goods, foreign investors can establish production lines in Hong Kong to manufacture goods that meet CEPA's rules of origin (ROO) requirements. For trade-in services, companies incorporated in Hong Kong by foreign investors can utilize CEPA, provided they meet the eligibility criteria of a "Hong Kong Service Supplier."

Additionally, unveiling the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) outline in 2019 further strengthens the ties between Hong Kong and the mainland.

The Guangdong-Macao-Hong Kong Greater Bay Area (GBA) is a mega-city cluster located in the Pearl River Delta comprised of nine cities in the south of Guangdong province and the special administrative regions of Hong Kong and Macao. The nine Guangdong cities include some of the largest and most economically active cities on the Chinese mainland, such as Guangzhou and Shenzhen's manufacturing and technology powerhouses. Hong Kong’s inclusion in the GBA provides streamlined access for Hong Kong and international investors to invest in Mainland China.

Leading financial services center

As one of the leading international financial centers, Hong Kong is a prime location for financial services and home to many financial institutions. Its financial markets operate under effective and transparent regulations that align with international standards.

Located at the heart of Asia, Hong Kong thrives on close financial integration with Mainland China, extensive networks with the rest of the world, a sound legal system, a low and simple tax regime, a free flow of capital, and a large pool of financial talents.

Looking forward, with new opportunities arising from the Greater Bay Area Outline Development Plan (GBA Outline), the Belt and Road Initiative (BRI), fintech, infrastructure investments and financing, and green finance, Hong Kong’s status as a leading financial hub is expected to be further strengthened.

- Unique access channels to and from China: Hong Kong and Mainland China have made remarkable progress in opening new channels to enhance their financial connectivity. Examples of this are the Qualified Foreign Institutional Investor (QFII), Renminbi Qualified Foreign Institutional Investor (RQFII), Shanghai-Hong Kong Stock Connect, Shenzhen-Hong Kong Stock Connect and Bond Connect, Mainland-Hong Kong Mutual Recognition of Funds arrangement, and the most recent two-way cross-boundary Wealth Management Connect in the GBA.

- Largest offshore RMB center: Offers a wide range of RMB financial services, including clearing and settlement, financing, asset management, risk management, etc. The highly efficient and robust market infrastructure in Hong Kong, including the RMB Real-Time Gross Settlement (RTGS) system, allows market participants from around the world to handle RMB transactions with Mainland China and among offshore markets.

- Banking hub: Hong Kong is Asia's most prominent banking hub for Chinese and international banks, with various initiatives to harness rapid technological advancements to move Hong Kong into a new era of Smart Banking.

- Corporate Treasury Center (CTCs): Being an international financial center with a full range of services, Hong Kong has been an ideal hub for corporate treasury activities. The government has also introduced tax incentives to encourage more corporations to set up their CTCs in Hong Kong.

- Capital market: Hong Kong’s highly liberal, liquid, and deep securities market has attracted many international banks and securities houses to build their presence here, providing another critical channel for companies to raise funds in the form of equity and debt.

- Asset management: Hong Kong is a hub for fund management, private wealth management, hedge funds, and private equity. Specifically, Hong Kong is the largest international asset management hub in Asia. It is also Asia’s largest global private wealth management and hedge fund center and the second-largest private equity center after China.

- Fintech hub: Hong Kong is dedicated to building itself as a fintech hub in Asia. The Hong Kong Monetary Authority promotes fintech development via Smart Banking Initiatives, the “Fintech 2025” strategy.

- Infrastructure investments: Hong Kong, an international financial center and China’s global financial center, is uniquely positioned to facilitate the linkage between the significant funding needs of infrastructure projects, especially in emerging market economies, and the vast pool of global capital that seeks to invest.

- Green finance: Having a deep, liquid bond market, Hong Kong is well-positioned to grasp the opportunities brought about by green and sustainable finance. Several initiatives have been launched to promote the development of the green bond market, including the Government Green Bond Program and the Green and Sustainable Finance Grant Scheme.

Free trade and tax agreements network

Hong Kong has been actively seeking to expand its Free Trade Agreement (FTA) and Double Taxation Avoidance Agreement Network to secure favorable conditions for businesses operating in the SAR.

Free trade agreements

So far, Hong Kong has signed eight FTAs, respectively with

- The Mainland of China (June 2003);

- New Zealand (March 2010);

- The Member States of the European Free Trade Association (EFTA) (June 2011);

- Chile (September 2012);

- Macao (October 2017);

- The Association of Southeast Asian Nations (ASEAN) (November 2017)

- Georgia (June 2018); and

- Australia (March 2019).

It has also concluded the FTA negotiation with the Maldives and started negotiations with Peru.

Double Taxation Avoidance Agreements

Hong Kong has signed comprehensive DTAs with 46 countries and is negotiating agreements with 14 others. The DTAs specify the tax rates for dividends, interest, royalties, and technical fees these countries can charge Hong Kong residents. The methods for eliminating double taxation are outlined in each DTA or the other country's domestic law, with the tax credit method being the most common.

Hong Kong's Double Taxation Agreement (DTA) network provides a mechanism to mitigate the challenge of double taxation faced by global investors. Hong Kong follows a territoriality-based taxation system, taxing only income sourced within the SAR, thus avoiding double taxation for its residents.

Additionally, Hong Kong offers unilateral tax credit relief to its residents who operate businesses in other countries, ensuring they avoid issues with double taxation.

To further reduce tax burdens for companies, the Advance Pricing Arrangement (APA) program allows taxpayers to engage transparently with tax authorities to determine appropriate criteria for pricing-related party transactions over a fixed period.

World-class infrastructure and support services

Hong Kong provides some of the most advanced business infrastructure in the world. The city is easily accessible with one of the world’s most efficient and affordable public transport systems.

The multi-award-winning Hong Kong International Airport is the world’s busiest cargo gateway and one of the busiest passenger airports. The Guangzhou-Shenzhen-Hong Kong Express Rail Link runs from the terminus at Hong Kong West Kowloon Station to the Shenzhen boundary in 14 minutes, shortening the time to Guangzhou to 46 minutes. The 55 km-long Hong Kong-Zhuhai-Macao Bridge is the longest sea-crossing bridge in the world. It connects Guangdong, Hong Kong, and Macao and brings the Western Pearl River Delta region within a three-hour drive of Hong Kong.

Highly skilled talent and liberal immigration policies

Hong Kong has a diverse talent pool equipped with the skills and knowledge to drive business in Hong Kong and beyond. The city is home to 22 degree-awarding higher education institutions. Four Hong Kong universities are featured in the Quacquarelli Symonds (QS) World University Rankings top 100 list. Many business professionals here are bilingual or trilingual, mostly speaking English, Cantonese, and Mandarin.

Further, Hong Kong has all along adopted an open immigration policy. About 170 countries and territories are allowed visa-free visits to Hong Kong from 7 to 180 days.

Why do foreign companies relocate to Hong Kong?

When considering Hong Kong, or any other destination, as a potential location for relocation, foreign investors must conduct thorough research across various critical factors relevant to their specific needs.

These factors encompass infrastructure, geographical locations, the availability of skilled talent, access to raw materials, incentive programs, logistical capabilities, and several other considerations. A diligent analysis of these factors is essential for making informed decisions regarding relocation.

Here are some top reasons why companies choose to relocate to Hong Kong:

- All of the stated Top Reasons to Invest in Hong Kong

- Government support for businesses

- Structured system for business registration

- Cost-efficient operations due to simple and low taxes

Summary: Top 10 Reasons to Invest in Hong Kong

|

1. |

Proximity to China and Asia markets |

Ideal location in Asia that enables businesses to tap into the various opportunities in the Greater Bay Area and throughout the rest of the region. |

|

2. |

Competitive tax regime |

Offers one of the most tax-friendly systems in the world with low profits tax and not |

|

3. |

Ease of Doing Business |

Hong Kong’s economic system is defined as a free-market economy characterized by minimum intervention from the government. |

|

4. |

Network of DTA's |

Hong Kong's Double Taxation Agreement (DTA) network provides a mechanism to mitigate the challenge of double taxation faced by global investors. |

|

5. |

Leading global financial services center |

Financial markets operate under effective and transparent regulations that align with international standards. |

|

6. |

World-class infrastructure |

Some of the most advanced business infrastructure in the world. The city is easily accessible with one of the world’s most efficient and affordable public transport systems. |

|

7. |

A highly-skilled talent pool |

Hong Kong has a diverse talent pool equipped with the skills and knowledge to drive businesses. |

|

8. |

Improving data privacy protection |

Hong Kong has been ramping up efforts to improve data privacy protection within the jurisdiction. |

|

9. |

Excellent legal and dispute resolution |

Hong Kong is China's only common law jurisdiction and has built well-established commercial case law. |

|

10. |

Thriving services industry |

Hong Kong is one of the most services-oriented economies globally. The sector accounted for over 90 percent of the GDP in 2022. |