In this section, we discuss the various options that a business has for market entry into Indonesia and overview the entity types, requirements, and processes, as well as some key considerations that will help ensure a company is set up for success.

Also find tips for what the procedures are for opening a bank account, managing IPR, or closing a business, should the need arise.

Establishing a company typically requires moderate or greater amounts of investment capital than other entry modes and can require several months to complete all steps in the process before the company becomes operational. This is an expected risk of a fixed investment strategy, and for these reasons, it is important that investors first understand the business, financial, consumer, or local cultural landscapes in the country and the options that might best help realize the goals of the investment.

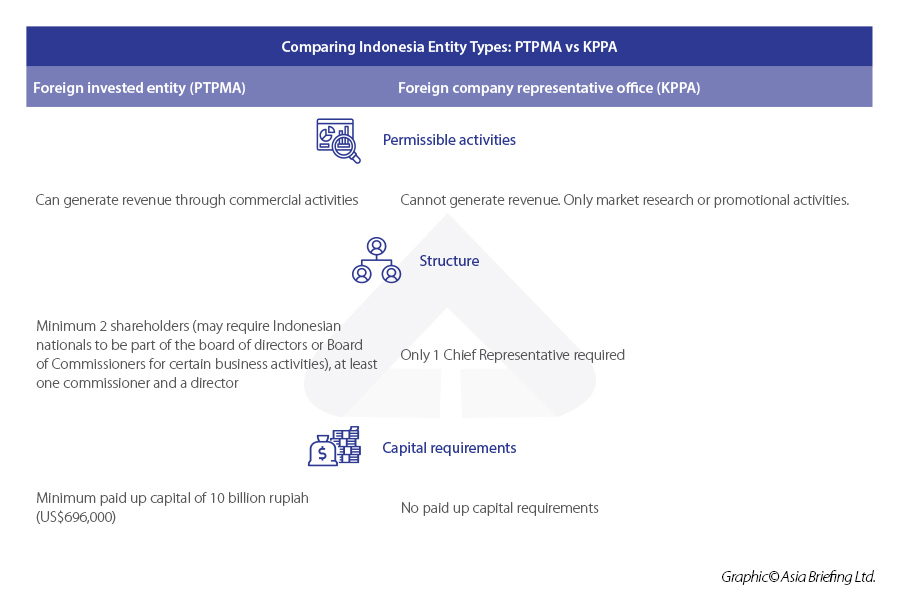

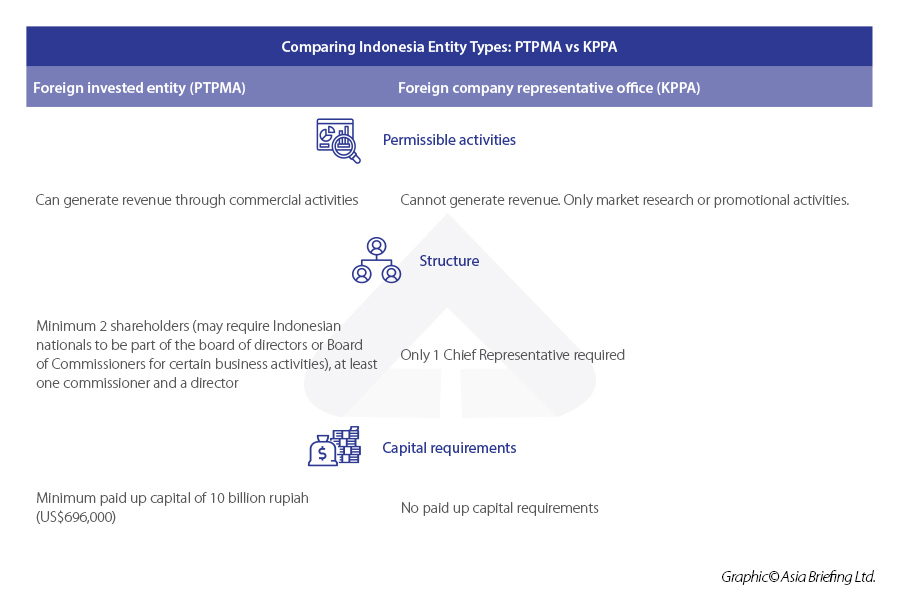

Foreign investors may create a legal presence in Indonesia in one of two ways: a Limited Liability Company (PT PMA) or a Representative Office. This is discussed in the choosing a corporate structure section.

Also, prior to deciding upon a company or investment structure, it is important to understand the Positive Investment List (PIL) to verify whether your intended business sector(s) are available and unrestricted for foreign ownership. The general principle under the positive investment list is that a business sector is open to 100 percent foreign investment unless subject to a specific type of limitation. The regulation presents one of the greatest liberalizations in foreign ownership limitations in Indonesia since the negative investment list was first introduced in the 1980s. The positive list and restricted sectors are explained in this section.

Choosing a corporate structure

Establishing a foreign investment company or PT PMA, is the preferred structure for companies looking to have a legal presence in the country. Foreign investors will need to have a minimum paid-up capital equivalent of 10 billion rupiahs (US$696,000) currently, which is higher than it was at 2.5 billion rupiahs (US$174,135) in previous years, as the government aims to attract more high-value investments into the country.

Alternatively, foreign companies may open a representative office in one of Indonesia's provincial capital cities. Representative offices in Indonesia are restricted and not permitted to conduct business directly with other companies or people. However, they can serve other important functions, such as supervising and coordinating business activities, and applying for and obtaining a work permit and a visa for the expatriate manager.

Another important and new amendment is the introduction of individually-owned companies for Indonesian citizens. It is a new type of company category that can be incorporated by a single individual.

Comparing entity types at-a-glance:

Company set up process

A foreign-invested limited liability company, or PT PMA, generally requires 2-4 months to set up and be operational.

- Reserve a company name with the Ministry of Law and Human Rights (which should not be similar to the name of other companies or contain vulgar language), Further the company name shall consist of 3 words and can be in English;

- Determine the industrial business classification code (KBLI), based on the intended business activities;

- Establish a legal entity with the company’s activities stated in the Deed of Establishment (this must be done with a local notary and the Deed of Establishment will have to be ratified by the Ministry of Law and Human Rights);

- Obtain a taxpayer identification number from the local tax office and a domicile letter from the district government (businesses established in Jakarta do not require a domicile letter);

- Obtain a tax registration certificate through the tax office where the business is domiciled;

- Obtain a Business Identification Number (NIB) by applying through the Online Single Submission (OSS) system. The NIB applies as the company’s import identification number, customs ID, and registration certificate. Further, the NIB will also automatically register your company under the government’s health and social security scheme; and

- Some companies may need to apply for additional business licenses (such as for mining and fintech). Business licenses will now be issued based on the assessment of the ‘business risk level’ determined by the scale of hazards a business can potentially create.

A Representative Office, on the other hand, is the fastest and simplest way of establishing a legal entity in the country. A Rep Office set up is a temporary arrangement; As mentioned, an RO is not permitted to engage in any commercial activities, issue invoices, sign contracts, or earn any revenue. Foreign investors, however, can own 100 percent of this business entity and don’t have to contribute the same paid-up capital required by PT PMAs.

Requirements for setting up a business

Investors looking to incorporate a PT PMA need to adhere to the following requirements:

- A minimum paid-up capital of 10 billion rupiah (US$696,000);

- Appointment of two shareholders (these can be foreign individuals or corporations - the percentage of local involvement will depend on the foreign ownership limitation based on the PIL);

- The appointment of at least one commissioner and a director (these can be held by foreign individuals); and

- The director will be responsible for running the day-to-day activities of the company.

A Representative Office has simpler requirements, two of the main being:

- Can only be set up in the capital of any Indonesian province; and.

- Must be located in an office building.

The simplified procedure for setting up a PTPMA or an RO can be seen below and read about in more detail in our Types of Businesses guide:

Indonesia’s Positive Investment List for Foreign Investment

Further, prior to setting up we also recommend studying the new Positive Investment List (PIL) to see which business sectors are unavailable or restricted for foreign ownership. The general principle under the positive investment list is that a business sector is open to 100 percent foreign investment unless subject to a specific type of limitation. The regulation presents one of the greatest liberalizations in foreign ownership limitations in Indonesia since the negative investment list was first introduced in the 1980s.

The government has classified business fields into four categories:

- Priority sectors;

- Business fields that stipulate specific requirements or limitations;

- Businesses fields open to large enterprises, including foreign investors, but are subject to a compulsory partnership with cooperatives and micro, small, and medium-sized enterprises (MSMEs); and

- Business fields that are fully open to foreign investment.

Business fields that are fully open to foreign investment

The following business fields are open to 100 percent foreign investment.

- Oil and gas construction;

- Onshore upstream oil installation;

- Onshore and offshore distribution pipelines;

- Onshore and offshore oil and gas drilling service;

- Oil and gas well maintenance service;

- Electricity generation;

- Construction of electricity installation;

- Geothermal electricity generation;

- Supermarkets (with areas less than 1,200 sqm);

- Department store (with areas between 400 – 2,000 sqm);

- Ports;

- Airport and airport supporting services;

- Maritime cargo handling;

- Telecommunications;

- E-commerce;

- Pharmaceutical industry; and

- Hospitals.

Priority sectors – 245 business lines open for foreign investment

To classify as a priority sector, business enterprises must meet the following criteria:

- Must be labor intensive;

- Must be capital intensive;

- Must be part of a national project/program;

- Must be export-oriented;

- Must involve a pioneer industry (renewables, oil refining, metals, etc.);

- Must utilize advanced technologies; and

- Must implement research and development and innovation activities.

245 business fields under this category can be found under Exhibit 1 of the positive investment list. Moreover, businesses in priority sectors are eligible for a range of fiscal and non-fiscal incentives.

Fiscal incentives include a 50 percent corporate income tax reduction for investments between 100 billion rupiahs (US$6.9 million) and 500 billion rupiahs (US$34.8 million) for five years and 100 CIT reduction for investments over 500 billion rupiahs (US$34.8 million) for a period between five and 20 years.

In addition, there are tax allowances available in the form of a reduction in the taxable income of 30 percent of the total investment for six years, a special withholding tax rate on dividends of 10 percent, and tax losses carried forward for up to 10 years.

Examples of non-fiscal incentives are the provision of supporting infrastructure, simplified business licensing procedures, and the guaranteed energy supply or raw materials. We explore a few examples of the prioritized business lines and their incentives below.

|

Examples of Priority Business Sectors and their Incentives |

|

|

Business line |

Incentive type |

|

Textile and garment industry |

Tax allowance and investment allowance |

|

Pharmaceutical industry |

Tax allowance |

|

Digital economy (hosting, data processing etc.) |

Tax holiday |

|

Geothermal (exploring and drilling) |

Tax allowance |

|

Cooking palm oil industry |

Tax allowance |

|

Iron and steel industry |

Tax allowance |

|

Automotive industry |

Tax allowance |

|

Oil and gas refinery |

Tax holiday |

|

Cosmetics industry |

Tax allowance |

|

Coal gasification |

Tax allowance |

Business fields that stipulate specific requirements or limitations — 37 business lines open

Under this category, business fields are open to foreign investments but are subject to the following types of restrictions:

- Lines of business reserved for domestic investors;

- Lines of business subject to foreign ownership limitations; and

- Lines of business that require special licenses.

|

Business Fields with Specific Requirements |

|

|

Business fields |

Requirements |

|

Publishing of newspapers, magazines (press) |

100 percent domestic capital is required for establishment, and up to 49 percent foreign capital ownership for business development and expansion |

|

Private broadcasting agency |

100 percent domestic capital is required for establishment, and up to 20 percent foreign capital ownership for business development and expansion |

|

Subscription-based broadcasting agency |

100 percent domestic capital is required for establishment, and up to 20 percent foreign capital ownership for business development and expansion |

|

Community radio agency |

100 percent domestic capital is required for establishment, and up to 20 percent foreign capital ownership for business development and expansion |

|

Community television agency |

100 percent domestic capital is required for establishment, and up to 20 percent foreign capital ownership for business development and expansion |

|

Postal services |

Maximum foreign capital ownership of 49 percent |

|

Domestic scheduled air transportation |

Foreign capital ownership of 49 percent. However, domestic capital ownership needs to be the single majority |

|

Domestic non-scheduled air transportation |

Foreign capital ownership of 49 percent. However, domestic capital ownership needs to be the single majority |

|

Air transport activities |

Foreign capital ownership of 49 percent. However, domestic capital ownership needs to be the single majority |

|

Domestic passenger liner and tramp activities |

Maximum foreign capital ownership of 49 percent |

|

Domestic sea transport for tourism |

Maximum foreign capital ownership of 49 percent |

|

Domestic liner and tramp sea freight for goods |

Maximum foreign capital ownership of 49 percent |

|

Domestic sea transportation for special goods |

Maximum foreign capital ownership of 49 percent |

|

Pioneer domestic sea transportation of goods |

Maximum foreign capital ownership of 49 percent |

|

Domestic sea transportation using public shipping |

Maximum foreign capital ownership of 49 percent |

|

Overseas liner and tramp sea freight for goods |

Maximum foreign capital ownership of 49 percent |

|

Overseas sea transportation for special goods |

Maximum foreign capital ownership of 49 percent |

|

Interprovincial sea public transport |

Maximum foreign capital ownership of 49 percent |

|

Interprovincial sea public transport (pioneering) |

Maximum foreign capital ownership of 49 percent |

|

Interprovincial city/regency public transport |

Maximum foreign capital ownership of 49 percent |

|

Interprovincial city/regency public transport (pioneering) |

Maximum foreign capital ownership of 49 percent |

|

Inter-city and regency public transport |

Maximum foreign capital ownership of 49 percent |

|

River and lake transportation with non-fixed and irregular routes |

Maximum foreign capital ownership of 49 percent |

|

River and lake transportation with non-fixed and irregular routes for tourism |

Maximum foreign capital ownership of 49 percent |

|

River and lake transportation for general goods and/or animals |

Maximum foreign capital ownership of 49 percent |

|

River and lake transportation for special goods |

Maximum foreign capital ownership of 49 percent |

|

River and lake transportation for dangerous goods |

Maximum foreign capital ownership of 49 percent |

|

Weapons equipment industry |

Capital ownership based on approval from the Ministry of Defense |

|

Horticulture |

Maximum foreign capital ownership of 30 percent |

|

Traditional medical products (for humans) |

100 percent Domestic capital |

|

Fish processing industry |

100 percent Domestic capital |

|

Wood-based building products |

100 percent Domestic capital |

|

Coffee processing industry |

100 percent Domestic capital |

|

Rendang industry |

100 percent Domestic capital |

|

Ship industry

|

100 percent Domestic capital |

|

Traditional handicrafts |

100 percent Domestic capital |

|

Traditional cosmetics |

100 percent Domestic capital |

|

Raw materials for traditional medicine (for humans) |

100 percent Domestic capital |

|

Batik industry |

100 percent Domestic capital |

|

Crackers and chips industry |

100 percent Domestic capital |

|

Hajj and Umrah activities |

100 percent Domestic capital and must be Muslim |

The foreign ownership limitations (bullet point 2) do not apply in the following circumstances:

- The investments are conducted in special economic zones;

- Investments are in the form of non-direct investments taken through the Indonesian stock exchange;

- Investments subject to more favorable treatment under a treaty between Indonesia and the investor’s country of origin; or

- Any investments approved before the issuance of the positive investment list. The positive investment list provides for this through a ‘grandfathering policy’.

Businesses fields open to large enterprises, including foreign investors, but are subject to a compulsory partnership with cooperatives and micro, small, and medium-sized enterprises (MSMEs)

Business fields under this category are open to foreign investors or large-scale enterprises through a compulsory partnership agreement with an MSME. There are 106 business lines for this category, being:

- Business lines that do not use advanced technology;

- Are labor-intensive businesses, characterized by a special cultural heritage; or

- The capital for the business activities does not exceed 10 billion rupiah (US$647,016).

Further, they cover businesses that are commonly carried out by MSMEs and/or sectors that have the potential to enter the larger supply chain. The partnership arrangement can be in the form of operational cooperation, profit sharing, subcontracting, outsourcing, or distribution.

Foreign investors may create a legal presence in Indonesia in one of two ways: a Limited Liability Company (PT PMA) or a Representative Office.

What business activities are closed for investments?

There are six business sectors closed for investments for both domestic and foreign companies. These are:

- Class-I narcotics and cultivation;

- All forms of alcohol production and distribution activities;

- All forms of gambling activities;

- Fishing of endangered species;

- Utilization of corals found in nature for the production of jewelry, souvenirs, building materials, etc.;

- Chemical weapons production;

- Alcoholic beverage manufacturing;

- Manufacturing of beverages containing alcohol-Wine;

- Manufacturing of Beverages Containing Alcohol-Malt; and

- Industrial ozone-depleting substances industries and industrial chemicals.

FAQ: Other considerations when setting up a business in Indonesia

How can I choose the right way to enter Indonesia?

Start With the Right Plan and Support. As with any foreign country, Indonesia’s legal entity requirements, options, and processes are unique, and establishing a legal entity requires the various costs of such an investment, and time, and can bear other investment risks. Once investments are made, reversing strategies can be more challenging so it is vital that a company avoid missteps from the outset.

To optimize the chances for success, a business would do well to have a better

- Informed and guided business model;

- Selection of business partners or suppliers to work with;

- Options for initial service lines, products, and pricing models;

- Options to set up in the right locations and more.

Obtaining on-the-ground information and practical experience in the market, can significantly help in these areas, and help position an enterprise for successes in Indonesia. Besides researching this Doing Business in Indonesia guide thoroughly, it is advisable to leverage professional assistance for further guidance with pre-market entry, investment decisions, entity set up, and all business, operational and financial factors that will arise along the path to achieving your investment objectives. In this respect, the contributors of this Guide are available to provide this expertise, via the Chat or Contact us link buttons.

How can I open a bank account?

Corporate bank accounts are essential for any company in Indonesia as it is part of the incorporation process. A company cannot share its corporate account with another company.

In Indonesia, there are various sorts of accounts that can be opened depending on the use but businesses will generally be required to open a corporate bank account. Understanding which actions require the use of a foreign currency account, where restrictions are placed upon these types of accounts, and what documents must be prepared will all ensure that operations are optimized effectively.

How do I manage Intellectual Property in Indonesia?

Indonesia has ratified various international agreements on intellectual property rights such as the Madrid Protocol, the Agreement on Trade-Related Aspects of Intellectual Property Rights, the Berne Convention, the Paris Convention, and the WIPO Copyright Treaty. Indonesia is also a signatory to the ASEAN Patent Examination Cooperation.

The following types of intellectual property are protected:

- Trademarks;

- Patents; and

- Copyrights.

How can I close a business in Indonesia?

The company dissolution process in Indonesia can be voluntary or non-voluntary. Voluntary dissolution occurs when the owners or investors of the business choose to close the business, due to a variety of reasons from low cash flow to the mismanagement of business operations to excessive company liabilities.

According to the Article 142, paragraph 1 of the Company Law, liquidation of the company occurs if one of the following cases is met:

- Based on a resolution of the GMS (General Meeting of Shareholders) – In other words, voluntary winding-up

- Due to the expiry of the company, as prescribed in the articles of association.

- Based on a court order (because of any non-compliance with the law)

- Due to a revoked bankruptcy statement, etc.; or

- Due to the revocation of the company’s business permit, so that the company is obliged to conduct liquidation according to prevailing regulations.

The procedure for winding up of a RO is a much simpler process compared to a limited liability company.