The Central Provident Fund (CPF) is a social security savings scheme funded by contributions from employers and employees. This mandatory program is an important pillar of Singapore’s social security system and aims to meet the retirement, housing, and healthcare needs of its people.

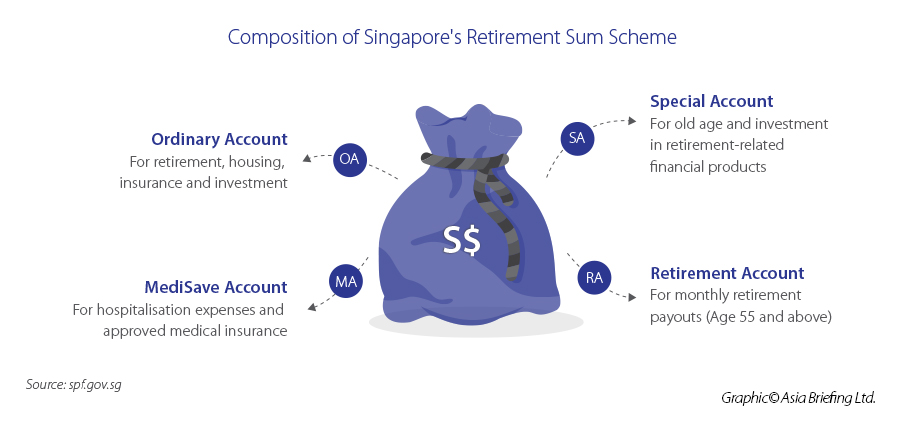

Individual CPF funds are further subcategorized into three savings accounts:

Ordinary Account

The ordinary account can be used at any time to purchase a home, make investments, and provide for education.

Special Account

The special account cannot be utilized until the account holder reaches retirement unless the money is used to purchase retirement-related financial products. This account will serve as the income a retired person receives.

Medisave Account

The Medisave Account is used to pay for medical expenses, hospitalization expenses, and pay for approved medical insurance.

Required employer contributions range from 7.5 percent to 17 percent depending on the age and wage of the employee. Required employee contributions range from 5 percent to 20 percent.

CPF earns risk-free interest on their savings. Interest rates vary for different CPF accounts and age groups and are updated on the CPF government website.

CPF contribution rate

The CPF rates for Singaporeans and Singapore Permanent Residents are as follows:

|

Employee’s age |

CPF contribution rates for 2023 |

||

|

|

By employer (% wages) |

By employee (% wages) |

Total (% wages) |

|

55 and below |

17% |

20% |

37% |

|

Above 55 to 60 |

14.5% |

15% |

29.5% |

|

Above 60 to 65 |

11% |

9.5% |

20.5% |

|

Above 65 to 70 |

8.5% |

7% |

15.5% |

|

Above 70 |

7.5% |

5% |

12.5% |

|

Employee’s age |

CPF contribution rates January 1 2024 onwards |

||

|

|

By employer (% wages) |

By employee (% wages) |

Total (% wages) |

|

55 and below |

17% |

20% |

37% |

|

Above 55 to 60 |

15% |

16% |

31% |

|

Above 60 to 65 |

11.5% |

10.5% |

22% |

|

Above 65 to 70 |

9% |

7.5% |

16.5% |

|

Above 70 |

7.5% |

5% |

12.5% |

Singapore’s CPF contribution rates differ for SPRs depending on the year of SPR status. The above rates apply to SPR’s from the third year i.e. the first day of the month after the second anniversary of SPR conversion.

Further, contribution rates may change depending on the monthly salary. The above rates apply to Singaporeans and SPRs earning more than $750 per month.

Key provisions under the Central Provident Fund (CPF) Act

The CPF is the obligatory savings and pension plan for Singaporeans and permanent residents that funds their retirement, healthcare, and housing needs in Singapore.

Increase in CPF monthly salary ceiling

The CPF monthly salary ceiling will be increased in stages from September 1, 2023, to Jan 1, 2026. The CPF contribution rates for employees aged 55 to 70 years will increase for those earning more than S$750 (US$558) per month

The CPF is the obligatory savings and pension plan for Singaporeans and permanent residents that funds their retirement, healthcare, and housing needs in the country.

The increased ceilings will be implemented in four stages:

- September 1, 2023 – the monthly salary ceiling will be increased to S$6,300 (US$4,700);

- January 1, 2024 – the monthly salary ceiling will be increased to S$6,800 (US$5,072);

- January 1, 2025 – the monthly salary ceiling will be increased to S$7,400 (US$5,519); and

- January 1, 2026 – the monthly salary ceiling will be increased to S$8,000 (US$5,965).

This means that employees earning above the ceiling rate will take home a lower net salary – to set aside more for their CPF.

CPF contributions submission

Employers can submit CPF contributions and make payments through the CPF EZPay system, which also automatically calculates the employer’s and employee’s contributions and updates the amount when the employer changes the age group. A Singpass login is required for employers to make payments through CPF EZPay.

Singaporean citizens and Singapore permanent residents of three years or above can calculate their CPF contributions by inputting their wages through this online form, while Singapore permanent residents of two years or below can calculate their contributions here.

Retirement and re-employment

The retirement and re-employment ages are 63 and 68, respectively, and will increase to 65 and 70 by 2030. Employers must offer re-employment to eligible employees who turn 63, up to age 68, to continue their employment in the organization.

When a worker turns 55, savings from their Special and Ordinary accounts are transferred to their Retirement Account when they turn 55, at which point they can start withdrawing their savings. Workers begin to receive monthly payouts of their savings at age 65.

Businesses can raise their retirement and re-employment ages ahead of the scheduled timeline.

Retirement payouts

Retirement Sum Scheme (RSS) members who have depleted the funds in their Retirement Account (RA) will automatically have payouts from their Ordinary Accounts (OA) and Special Accounts (SA).

The RSS is one of two retirement schemes under the CPF Board, the other being CPF LIFE. The RSS provides CPF members with monthly payouts during retirement until the savings in their RA runs out, or they turn 90. CPF LIFE offers monthly payouts for life.

Tax relief rules

Under the Retirement Sum Topping-Up (RSTU) scheme, a CPF member can top up their SA (if they are below the age of 55) or RA (if they are 55 or above) via CPF transfer or cash. The CPF member can also top the SA or RA savings of their family members.

The CPF member can also top the SA or RA savings of their family members. There is also a S$7,000 (US$5,204) per year tax relief if a CPF member is topping up for themselves and an additional S$7,000 (US$5,204) per year if they are top-up for parents, in-laws, grandparents, grandparents-in-law, spouse, and siblings.

In addition, the government has introduced a tax relief cap of S$8,000 (US$5,948) per year to CPF members who top up a MediSave account (the account used for healthcare needs).

Disbursement of CPF funds upon the death of a member

The duration in which the CPF funds are retained after death is six months.

This timeframe gives beneficiaries enough time to claim nominated monies from the CPF Board.

Suppose a CPF member did not designate a CPF nomination. In that case, relatives can appoint a ‘beneficiary representative’ who can submit a consolidated claim for the funds at a maximum amount of S$10,000 (US$7,435). If there are disputes among the beneficiaries after the funds have been disbursed, the beneficiaries can seek recourse under the law.