Human Resources and Payroll in China 2016-2017 (5th Edition) -

125

Tianjin

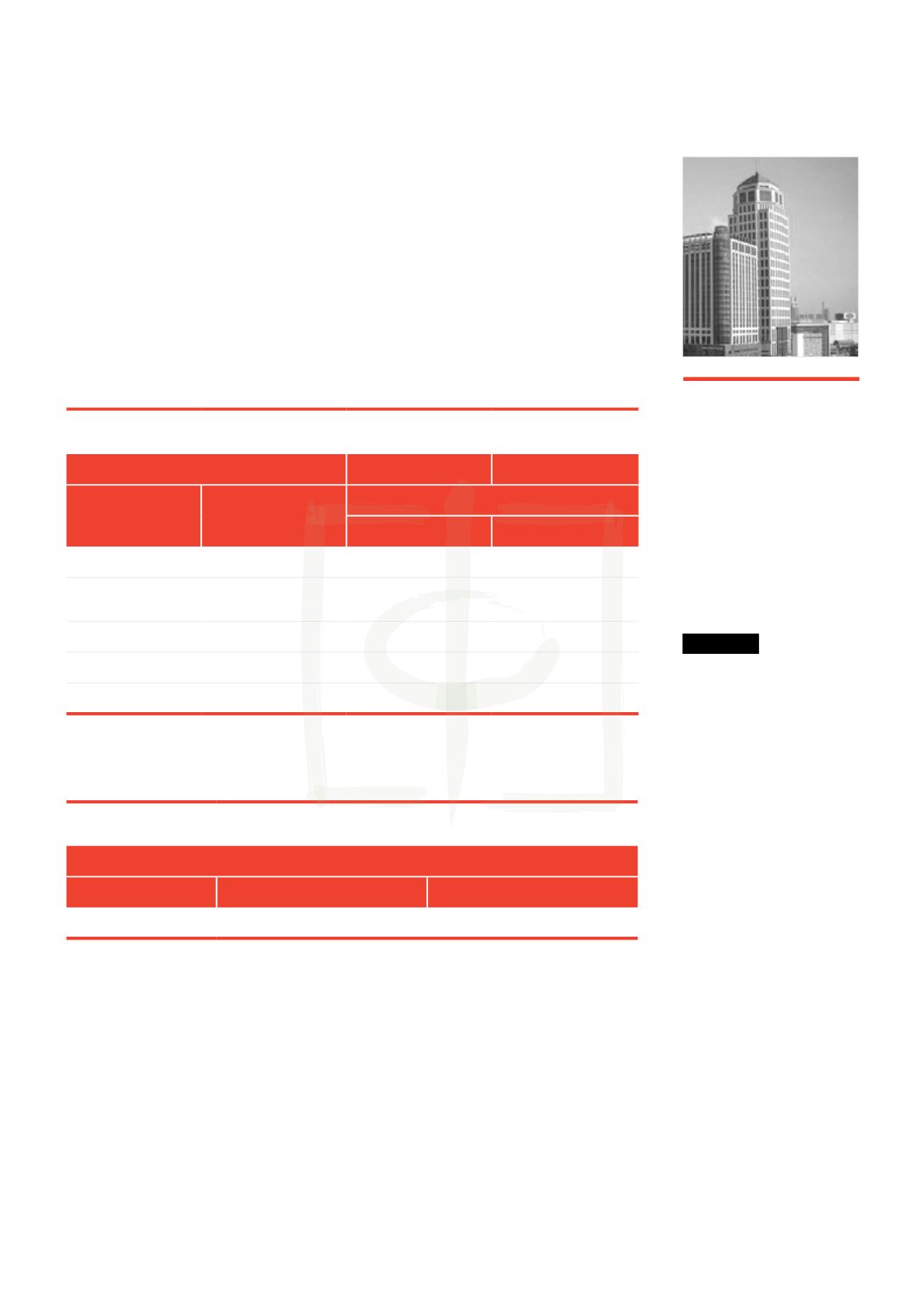

Social Welfare Contribution Details

Housing Fund (Chinese Only)

Data valid to June 2017

Contribution Base (RMB 1,950-21,048)

Employer

Employee

Rate

5% -12%, 11% is the general rate

* Employer and employee pay same rate for housing fund.

** Minimum salary = RMB 1,950 (Adjusted in 2016); average monthly salary = RMB 6,350 (Adjusted in 2016)

Social Insurance

Data valid to December 2016

Contribution Base

RMB 2,966-14,832

RMB 2,472-14,832

Employer

Employee

City Hukou / Foreigner

Rural Hukou

Pension

20%

8%

8%

Medical

11%

2% (Monthly) +

RMB 260 (annual)

2% (Monthly) +

RMB 260 (annual)

Unemployment

1%

1%

1%

Injury

0.5% -2%

N/A

N/A

Maternity

0.8%

N/A

N/A

* Social insurance payments are tax exempt. Social insurance payments compulsory for foreign employees at the time of

writing

.

Dezan Shira & Associates Tianjin Office Tel: +86 (0)22 5830 7666 Fax: +86 (0)22 2318 5001 Email: Tianjin@dezshira.com Unit 20, 29F, The Exchange Tower 2, 189 Nanjing Road, Heping District CONTACT US