Individual income tax (IIT) in India is based on resident-status and the source of the income. Under India’s individual tax regime, different tax rates are assigned to respective income brackets (tax slabs), which is the income earned by a taxable person.

The new income tax regime, which was introduced in 2021, is now made the default mode of taxation. Although the old tax regime will continue to be operational, the taxpayers will have to especially opt for it. It must be noted that no new changes have been made to the old income tax regime.

Taxpayers can opt for the new tax regime – where they pay income tax at lower rates but would have to forgo certain exemptions and deductions available to those taxpayers who paid taxes as per the existing tax regime.

Alternately, taxpayers could stick to the older tax regime and continue to avail respective exemptions and deductions.

New tax regime

The Indian income tax system imposes taxes on individual taxpayers based on their taxable income or profits earned. Taxpayers can choose to pay lower taxes by forgoing exemptions and deductions by opting for the new regime.

The 2023 budget extended the rebate for individuals subject to the new income tax regime for annual incomes up to INR 700,000, whereas those with incomes up to INR 500,000 previously paid no income tax under either the old or new schemes.

Moreover, the new income tax regime includes a standard deduction of INR 50,000, allowing salaried taxpayers to avail an upfront deduction of INR 50,000 from their total taxable income, which was previously only available under the old structure.

The government has also rationalized the tax slabs under the new income tax system, reducing the total number of taxable brackets to five.

|

New Income Tax Structure as per Union Budget 2024 |

|

|

Tax slab for different Incomes |

New income tax rates |

|

INR 0 – 300,000 |

No tax |

|

INR 300,000 – 600,000 |

5% (income limit for tax rebate increased to INR 700,000 from INR 500,000) |

|

INR 600,000 – 900,000 |

10% |

|

INR 900,000 – 1,200,000 |

15% |

|

INR 1,200,000 – 1,500,000 |

20% |

|

INR 1,500,000 and above |

30% |

|

Changes in Income Tax Slabs under New Regime |

||

|

Income tax rates (in %) |

Previous income slab |

New income slab |

|

NIL |

INR 0- 250,000 |

INR 0 – 300,000 |

|

5% |

INR 250,000 – 500,000 |

INR 300,000 – 600,000 |

|

10% |

INR 500,000 – 750,000 |

INR 600,000 – 900,000 |

|

15% |

INR 750,000 – 1,000,000 |

INR 900,000 – 1,200,000 |

|

20% |

INR 1,000,000 – 1,250,000 |

INR 1,200,000 – 1,500,000 |

|

25% |

INR 1,250,000 – 1,500,000 |

— |

|

30% |

INR 1,500,000 and above |

INR 1,500,000 and above |

Notes:

- For adopting New Regime, most of the deductions/exemptions such as section 80C, 80D, etc. are to be foregone. However, standard deduction of Rs. 50,000 against salary income is proposed to be allowed under New Regime. The aforesaid regime is optional. Accordingly, persons as mentioned above have the option to be taxed under either of the options. New Regime once exercised can be changed in subsequent years (not applicable for business income).

- Resident individuals having total income not exceeding Rs. 7,00,000 can avail rebate of 25,000 or actual tax liability whichever is lower.

- Rate of surcharge:

- 25 percent where specified income* exceeds INR 20 million

- 15 percent where total income exceeds INR 10 million but does not exceed INR 20 million

- 10 percent where total income exceeds INR 5 million but does not exceed INR 10 million

- In case of Association of Persons (AOP), consisting of only companies as its members, the rate of surcharge not to exceed 15 percent.

*Specified income – Total income excluding income by way of dividend on shares and short-term capital gains in case of listed equity shares, equity oriented mutual fund units, units of business trust and long-term capital gains.

|

Income Tax Slab for People Between 60 to 80 Years |

|

|

Tax Slabs |

Rates |

|

INR 300,000 |

NIL |

|

INR 300,000 - INR 500,000 |

5% |

|

INR 500,000 - INR 1,000,000 |

20% |

|

INR 1,000,000 and above |

30% |

|

Income Tax Slab for People Above 80 Years |

|

|

Tax Slabs |

Rates |

|

Up to INR 500,000 |

NIL |

|

INR 500,000 - INR 1,000,000 |

20% |

|

INR 1,000,000 and above |

30% |

Old tax regime

Under the old taxation system, the assessee can make use of deductions, exemptions, and other allowances to carefully organize their finances and reduce their tax burden.

The following expenses are deductible under the previous tax system:

- Public Provident Fund (PPF);

- Equity-Linked Savings Schemes (ELSS);

- Employees’ Provident Fund (EPF);

- life insurance premiums;

- Principal and interest payments on a mortgage;

- Health insurance premiums,

- Investments in NPS,

- Child tuition fees, and

- Interest on savings accounts.

The following items are exempt from this list:

- House Rent Allowance (HRA),

- Leave Travel Allowance (LTA),

- Reimbursement for mobile and internet,

- Food coupons or vouchers,

- Company-leased automobile,

- Standard deduction,

- Uniform allowance, and

- Leave encashment.

|

Income Tax Slabs for FY 2023-24 Under the Old Regime |

|

|

Income tax slabs |

Income tax rate (%) |

|

INR 0 – 250,000 |

0% |

|

INR 250,000 – 500,000 |

5% |

|

INR 500,00 – 1,000,000 |

20% |

|

INR 1,000,000 and above |

30% |

Notes:

- In case of a resident individual of the age of 60 years or above but below 80 years, the basic exemption limit is Rs. 3,00,000.

- In case of a resident individual of age of 80 years or above, the basic exemption limit is Rs 5,00,000.

- Rate of surcharge:

- 37 percent on base tax where specified income exceeds INR 50 million;

- 25 percent where specified income exceeds INR 20 million but does not exceed INR 50 million

- 15 percent where total income exceeds INR 10 million but does not exceed INR 20 million; and

- 10 percent where total income exceeds INR 5 million but does not exceed INR 10 million.

- In case of AOP, consisting of only companies as its members, the rate of surcharge not to exceed 15 percent.

- Health and Education cess at four percent on aggregate of base tax and surcharge.

- Resident individuals having total income not exceeding INR 500,000 can avail rebate of INR 12,500 or actual tax liability whichever is lower.

Taxation of individuals

The tax incidence on an individual is influenced by their residential status, which is determined by their actual presence in India according to the regulations outlined in the Income Tax Act.

Tax calculation

Total income tax is calculated in accordance with the tax rates and rules that stand on the first day of April of the assessment year.

Employment income includes all amounts, either in cash or in kind, that arise from an individual’s employment. Wages, pensions, bonuses, commissions, perquisites in lieu of salary, reimbursement for personal expenses, securities or sweat equity shares, contributions to superannuation funds, etc. are all included in employment income.

Obligations of the employee

Advance tax

Advance tax is a pay-as-you-earn system where taxpayers estimate their total income and tax payable for the year, and make advance tax payments at specified intervals during the financial year itself, as required by the Income-tax Act, 1961.

In such cases, although tax is deducted at source by the taxpayer in several cases, it may not cover the final tax amount that needs to be paid. Therefore, it's crucial for taxpayers to understand their obligation to pay advance tax and the consequences of non-payment or insufficient payment.

Who needs to pay advance tax?

Advance tax is payable during a financial year in every case where the amount of such tax payable by the taxpayer during that year is INR 10,000 or more.

Individuals not liable to pay advance tax

A resident senior citizen (an individual of the age of 60 years or above during the relevant financial year) not having any income from business or profession is not liable to pay advance tax.

While salaried taxpayers are also covered for payment of advance tax, they are generally not required to pay advance tax as their employers are obligated to deduct withholding tax or TDS on their salaries. However, such a salaried person would still be liable to make advance tax payment on income under other heads such as dividend income, interest income, rental income, shortfall of TDS for salary income, etc.

Due dates to pay advance tax

The due dates for payment of different instalments of advance tax for both corporate as well as non-corporate assessee for FY 2024 are as follows:

|

Due date |

Advance tax liability for FY 2024 |

|

June 15, 2023 |

15% of the tax liability |

|

Sept. 15, 2023 |

45% of the tax liability |

|

Dec. 15, 2023 |

75% of the tax liability |

|

March 15, 2024 |

100% of the tax liability |

Filing annual tax return

As per India’s domestic tax law, every individual is required to file a tax return for the respective financial year (FY) with the Indian tax authorities by July 31 in the following financial year (assessment year or AY) if they meet specified conditions.

Documents for filing the Income Tax Return (ITR)

Following are the basic documents mandatory to file an ITR in India:

- PAN (Permanent Account Number);

- Aadhar Number;

- Form 26AS;

- Bank Account Details;

- Challan of any advance tax or self-assessment tax (if paid during the year); and

- Details of the original return (if filing a revised return).

Income tax clearance

All individuals who are not domiciled in India / not a resident of India; who have come to India in connection with business, profession, or employment; and who have derived income from any source in India – are required to obtain an Income Tax Clearance Certificate from Indian tax authorities prior to exiting India. This puts on record that the non-resident has duly paid all taxes owed on income earned in India by means of employment or business – before leaving the country.

The non-domiciles may apply for an Income Tax Clearance Certificate (ITCC) by submitting an undertaking via Form 30A, which must be filed either by the employer or by the person from whom they have received the said income, as declared in the undertaking. Upon verification, the tax officials will issue an ITCC to the applicant via Form 30B.

e-Payment of Taxes

The taxpayers can pay advance tax, self-assessment tax online from the NSDL website. They should also have a net banking facility with an authorized bank.

Non-employment income

There are special tax rates for expatriates on income arising from non-employment sources that includes long and short-term capital gains earned on the disposal of capital assets situated in India, interests earned, and royalties payable by an Indian concern.

It should be noted that investments in shares by non-resident foreign nationals are governed by the Indian foreign direct investment policy.

Other taxes

There is also a health and education cess assessed at 4 percent of the income tax, and applicable surcharges will be levied if the annual income exceeds INR 5 million (US$67,196).

Double Taxation Avoidance Agreements

Most expatriates worry about “double taxation” – paying taxes to two different countries on the same income. A foreign taxpayer working in India may be able to reduce taxable income in their country of primary residence (and double taxation) under a double taxation avoidance agreement.

Quick facts about IIT

- The tax year, also referred to as the financial year, is from April 1 through March 31.

- The year in which income is paid known as the Previous Year or Financial Year and the year in which the income is reported is known as the Assessment Year.

- An individual’s tax return must be filed by July 31 immediately following the end of the Financial Year.

- Employers are required to obtain a Permanent Account Number (PAN). The PAN is a unique identification number allotted by the Indian tax authorities. The PAN is required to be quoted on all correspondence with the tax authorities.

- Tax is withheld at source on a wide range of incomes, such professional fees, rent, interest, dividends, etc. at the time such income is credited to the account of the payee or at the time of payment, whichever is earlier. On salary, tax is deducted at the time of payment only.

- All employers are mandatorily required to deduct and deposit tax from an employee’s taxable income promptly.

- All employees are expected to report their incomes from other sources to the employer so that the same can be taken into account while reckoning taxable income.

- At the end of the Financial Year, the employer is required to issue Form 16 to the employee declaring the Income and Tax deducted and deposited.

FAQ: IIT in India: Commonly Asked Questions

Which allowances in India are tax exempt?

|

Fully taxable |

Partly taxable |

Fully exempt |

|

Entertainment Allowance |

House Rent Allowance [u/s 10(13A)] |

Allowance granted to Government employees outside India. |

|

Dearness Allowance |

Special Allowances [u/s 10(14)] |

Allowance granted to High Court Judges. |

|

Overtime Allowance |

|

Sumptuary allowance granted to High Court or Supreme Court Judges |

|

Fixed Medical Allowance |

|

Allowance paid by the United Nations Organization |

|

City Compensatory Allowance (to meet increased cost of living in cities) |

|

Compensatory Allowance received by a judge |

|

Interim Allowance |

|

|

|

Servant Allowance |

|

|

|

Project Allowance |

|

|

|

Tiffin/Lunch/Dinner Allowance |

|

|

|

Any other cash allowance |

|

|

|

Warden Allowance |

|

|

|

Non-practicing Allowance |

|

|

What are the common deductions from salary and pension income?

|

Section |

Nature of Expenses |

Amount (INR) |

|

80C |

LIC/ PPF/ KVP/ EPF/ SSY/ NSC/ HOME LOAN PRINCIPAL/ SCHOOL FEES/ ELSS/ STAMP DUTY |

1,50,000 |

|

80CCD (1B) |

NPS |

50,000 |

|

80DD |

Expenses of disabled dependent (40%/ 80% disability) |

75,000/ 1,25,000 |

|

80U |

Own physical disability (40%/ 80% disability) |

75,000/ 1,25,000 |

|

80TTA |

Interest on Savings Account. Only available to Persons other than Senior Citizen/ Very Senior Citizen |

10,000 |

|

80TTB |

Interest on Savings Account and Interest on deposits with Post Offices, Banks, Cooperative bank. Only available to Senior Citizen & Very Senior Citizen |

50,000 |

|

80G |

Donation/ Contributions made to certain relief funds and charitable institutions. Contributions made to certain relief funds and charitable institutions (Only if paid by Cheque/ Bank Mode) |

50% of Donation or 10% of Total Income, whichever is higher. |

|

80GG |

Deduction for the rent paid (available to all Individuals except to those who gets HRA from Employment). Eligibility will be least amount of the following: 1) Rent paid minus 10% of the adjusted total income. 2) Rs. 5,000 per month 3) 25% of the adjusted total income |

|

|

80D |

Health Insurance policy contribution for self, spouse and dependent children (only if paid by cheque/ bank Mode). |

25,000/ 50,000 (for senior citizen) |

|

80E |

Interest on loan taken for higher education of Spouse, Children or Student for whom the individual is the legal guardian |

|

|

80EE |

Interest for Home Loan 1. Sale Deed value of Rs. 50 lakhs or less 2. Loan sanction in FY 2016–017 3. The individual should not own any house before 4. Loan < Rs. 35 lakhs 5.Maximum Rs.50,000 over Section 24 - i.e. Rs. 2,00,000 |

50,000 |

|

80DDB |

Medical treatment of Specified Ailments for Dependents |

40,000/ 1,00,000 (for senior citizen) |

|

80CCD(1)* |

Employee’s contribution to NPS |

10% of salary or 20% of Gross Total Income |

|

80CCD(2) |

Employer’s contribution to an employee’s NPS account Contribution made by employer |

Maximum contribution of employee’s salary (14% in case of Central Government employee is allowed in a financial year) |

*The maximum deduction available for aggregate contributions u/s 80C, 80CCC and 80CCD(1) is Rs. 1.5 lakh.

Tax deduction under Chapter VIA will not be available to a taxpayer opting for the New Tax Regime u/s 115BAC, except for deduction u/s 80CCD(2).

Rebate u/s 87A: The rebate is available to a resident individual if his total income does not exceed Rs. 5,00,000. The amount of rebate shall be 100% of income-tax or Rs. 12,500 whichever is less.

Forms for filing income tax return

ITR-1: An individual whose total income is less than Rs. 50 lakh and the sources of income are from salaries, one house property, other sources like interest from bank deposit and agricultural income up to Rs. 5000. If there are any capital gains, then the individual cannot file ITR-1.

ITR-2: Individuals having income from capital gains and not having business income and not eligible for ITR-1(Sahaj).

ITR-3: Individuals having business income apart from other heads of income but not eligible for ITR-1, 2 or 4(Sugam).

ITR-4: Individuals having income up to Rs. 50 lakh and includes business income under presumptive taxation scheme. However, not applicable for an Individual who is either a director of a company or has invested in unlisted shares of a company.

Verification from Form 26AS

Form 26AS is an annual consolidated tax credit statement that taxpayers can access, view or download from the Income Tax Department’s e-filing website. It is one of the most important documents taxpayers should verify before filing their ITR.

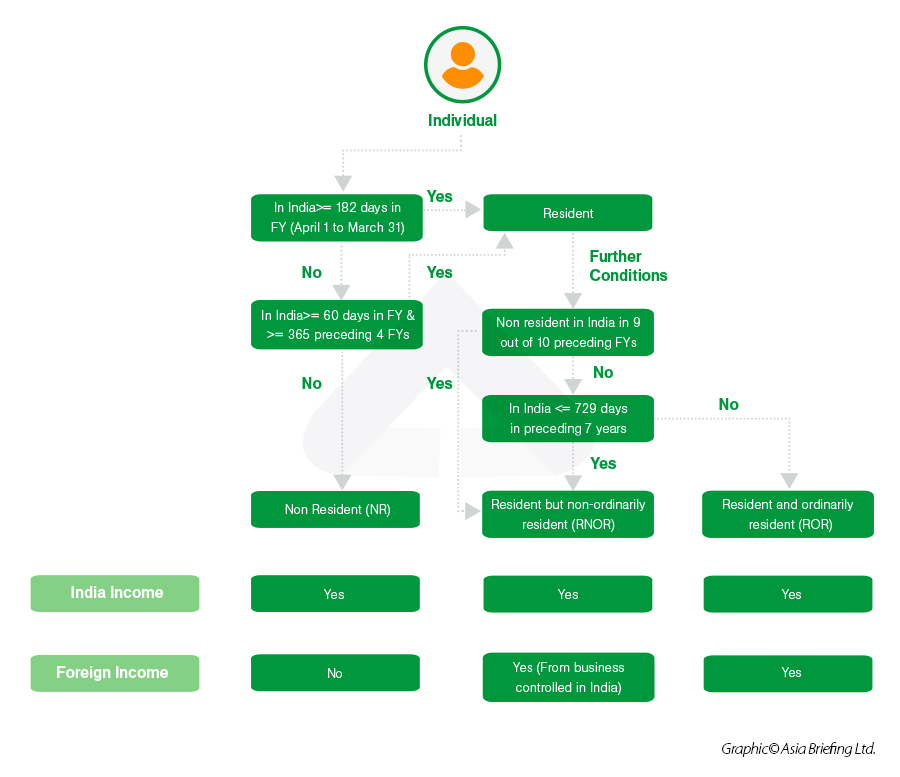

Who is a foreign national in India? Are foreign nationals liable to pay taxes in India?

- Any individual who is not a citizen of India is considered a foreign national;

- Taxation of Individuals (incl. foreign nationals) is based on source of income and the residential status (irrespective of citizenship);

- Residential status is determined based on number of days of stay in India during previous financial years (financial year April 1 to March 31), regardless of the purpose of stay.

What is the concept of residential status for determining tax liability under the Indian Income Tax Act, 1961?

Income tax for expats in India is determined based on their residency status. Individuals can be divided into following categories based on their residency:

Resident - An individual is said to be a resident in the tax year if he/she is:

- physically present in India for a period of 182 days or more in the tax year (182-day rule), or

- physically present in India for a period of 60 days or more during the relevant tax year and 365 days (or more) in aggregate in four preceding tax years (60-day rule)

If none of the above two conditions are met, the individual is said to be a Non-Resident (NR) in that tax year.

Resident and Ordinarily Resident (ROR) - If a taxpayer qualifies as a resident, the next step is to determine if she or he is a ROR or Resident but not ordinarily resident (RNOR). These individuals are taxed on their worldwide income. An individual would be ROR if both of the following conditions are met:

- Has been a resident of India in at least 2 out of 10 years immediately previous years; and

- Has stayed in India for 730 days or more in 7 immediately preceding year

Resident but Not Ordinarily Resident (RNOR) - If the individual qualifies as a resident only and does not satisfy the above conditions, she or he will be known as a resident but not ordinarily resident (RNOR). These individuals are taxed on their income sourced or received from India, or from an income derived from a business set up or controlled in India. Further, with effect from FY 2020-21, the Finance Act, 2020 has inserted the following two more situations wherein a resident person is deemed to be ‘Not Ordinarily Resident’ in India:

- An Indian Citizen (passport holder) or a person of Indian origin whose total income exceeds INR 15,00,000 (other than income from foreign sources) during the previous year and who has been in India for a period of 120 days or more but less than 182 days;

- Deemed Resident: Effective 01 April 2020, a concept of deemed residency has been introduced. An Indian citizen having India-sourced taxable income exceeding INR 15,00,000 during the relevant tax year will be deemed to be a resident of India if one is not liable to tax in any other country by reason of domicile or residence or any other criteria of similar nature. Further, such an individual will qualify as RNOR in India for the relevant tax year.

Non-resident - If none of the conditions specified for residency are met, then the individual will qualify as a non-resident.

Which categories of income are taxable in India?

All income received or accrued in India is subject to taxation. Below are the types of incomes that are taxable in India:

- Employment income: Salaried income relating to services rendered in India is considered to accrue or arise in India regardless of where it is received or the residential status.

- Business income tax rules for expats: All individuals who are self-employed or involved in business controlled or setup in India are subject to tax in India.

- Expat investment income: Investment income earned by the foreign nationals are taxed in the following manner (all must be declared via expatriate tax returns):

- Dividends earned from Indian companies is taxable in the hands of the individual shareholders

- Dividends received from foreign companies are subject to taxation in the hands of shareholders at the normal tax rates

- Expat Directors' Fees: Directors' fee is taxed at the usual progressive rates. Tax is required to be withheld at source from directors' fees paid to residents.

- Expat rental income: Rental income received by an individual from leasing of the house property is taxable at the value determined in accordance with specific provisions subject to deductions.

What is the concept of Double Taxation and how can it be avoided?

Expatriates often worry about “double taxation”, which means paying taxes in two different countries on the same income.

The Double Tax Avoidance Agreement (DTAA) is a tax treaty signed between two or more countries to help taxpayers avoid paying double taxes on the same income. A DTAA becomes applicable in cases where an individual is a resident of one nation but earns income in another.

Taxpayer can take the help of Double Tax Avoidance Agreement (DTAA) for incomes that can be taxable in both the countries that is India and the other country and avoid paying tax in one of the countries. He or she will then only be liable to pay tax for that income in one country.

India’s Double Taxation Avoidance agreement is with over 88 countries, however, 85 are in force presently.

What do we need to keep in mind while filing taxes?

Filing of taxes may be challenging for foreign nationals due to the presence of multiple tax regimes and a different tax system from their home country. It is advisable for individuals to not wait for the last minute in order to file their returns, as it might turn out to be a lengthy process depending upon the particulars of a case (sources of income, exemptions types and proofs, correctness of data, among others), and hurrying may lead to unnecessary mistakes leading to possible penalties.

Few points to keep in mind while filing an income tax return:

- Proper calculation and declaration of taxable income is important to avoid any discrepancy

- Correct Income Tax Return form needs to be filled with accurate information

- Timely preparation and filing of all the mandatory documents is vital

Foreign Nationals in India should be aware of the basic provisions affecting their taxation and should plan in advance to reduce their tax burden.

If you are looking for assistance in your India taxation matters, please do not hesitate to contact us.