Singapore’s extensive free trade agreements (FTA), coupled with a transparent legal system and educated workforce, have been credited with accelerating the country’s transformation to a first-world economy.

The country’s 15 bilateral and 12 regional FTAs include some of the largest combined trade agreements in the ASEAN-China, ASEAN-India, and ASEAN-Hong Kong trade blocs — providing Singapore-based businesses with access to preferential markets, free or reduced import tariffs, as well as enhanced intellectual property regulations.

Despite regional players maintaining strong FTA networks, they are not as extensive as Singapore’s. Due to these factors, the country will continue to be the default location for businesses seeking to expand into Southeast Asia and neighboring regions.

Foreign investors should seek the help of registered advisors to understand how they can benefit from the incentives covered under Singapore’s FTAs.

What are the types of Free Trade Agreements?

There are two types of FTAs:

- Bilateral (agreements between Singapore and a single trading partner);

- Regional (signed between Singapore and a group of trading partners); and,

Singapore has also signed several Digital economy partnership agreements - a ‘digital only’ trade agreement that establishes digital trade rules and digital economy collaborations

|

List of Bilateral Free Trade Agreements |

|

|

China-Singapore Free Trade Agreement (CSFTA) |

Peru-Singapore Free Trade Agreement (PeSFTA) |

|

European Union-Singapore Free Trade Agreement (EUSFTA) |

Singapore-Australia Free Trade Agreement (SAFTA) |

|

India-Singapore Comprehensive Economic Cooperation Agreement (CECA) |

Singapore-Costa Rica Free Trade Agreement (SCRFTA) |

|

Japan-Singapore Economic Partnership Agreement (JSEPA) |

Singapore-Jordan Free Trade Agreement (SJFTA) |

|

Korea-Singapore Free Trade Agreement (KSFTA) |

Sri Lanka - Singapore Free Trade Agreement (SLSFTA) |

|

New Zealand-Singapore Comprehensive Economic Partnership (ANZSCEP) |

Turkey-Singapore Free Trade Agreement (TRSFTA) |

|

Panama-Singapore Free Trade Agreement (PSFTA) |

United Kingdom-Singapore Free Trade Agreement (UKSFTA) |

|

United States-Singapore Free Trade Agreement (USSFTA) |

|

|

List of Regional Free Trade Agreements |

|

|

ASEAN-Australia-New Zealand Free Trade Area (AANZFTA) |

ASEAN-China Free Trade Area (ACFTA) |

|

ASEAN-Hong Kong, China Free Trade Area (AHKFTA) |

ASEAN-India Free Trade Area (AIFTA) |

|

ASEAN-Japan Comprehensive Economic Partnership (AJCEP) |

ASEAN-Korea Free Trade Area (AKFTA) |

|

ASEAN Free Trade Area (AFTA) |

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) |

|

EFTA-Singapore Free Trade Agreement (ESFTA) |

GCC-Singapore Free Trade Agreement (GSFTA) |

|

Regional Comprehensive Economic Partnership (RCEP) |

Trans-Pacific Strategic Economic Partnership (TPSEP) |

Digital economy partnership agreement

Singapore’s Digital Economy Partnership Agreement (DEPA) with New Zealand and Chile came into effect January 7, 2021. DEPA was first signed in June 2020 and is the world’s first ‘digital only’ trade agreement that establishes digital trade rules and digital economy collaborations, representing a new form of economic engagement at a time when many business activities have gone online.

Through a digital only trade agreement, Singapore aims to develop international frameworks to support businesses engaging in cross-border digital trade and e-commerce.

Singapore and the European Union (EU) signed a digital trade agreement in February 2023 to allow consumers and businesses from Singapore and the EU to transact online more seamlessly. The EU-Singapore Digital Partnership (EUSDP) will see both jurisdictions collaborate on facilitating digital trade, electronic payments, digital identities, and 5G/6G communication networks, among others.

Digital economy agreements (DEA) will encourage greater cooperation in nascent areas, such as artificial intelligence (AI), and facilitate interoperability between digital systems, providing organizations the capacity to trial new technologies across different countries. In addition to DEPA and UKSDEA, Singapore has signed a DEA with:

- Singapore-Australia Digital Economy Agreement (SADEA);

- Korea-Singapore Digital Partnership Agreement (KSDPA); and,

- EU-Singapore Digital Partnership (EUSDP).

DEAs are part of the government’s strategy to strengthen underlying infrastructures to build up Singapore’s footprint as a global tech and e-commerce hub, as well as adding to the country’s extensive free trade agreement (FTA) network.

Major FTAs

China-Singapore Free Trade Agreement (CSFTA)

Under the CSFTA agreement, investors from both countries receive a ‘high-level’ of investment protection through the application of a ‘national treatment’ and the ‘most favored nation treatment status’ (MFN) for businesses.

This means businesses from either country are not treated less favorably than their own investors or investors from a third country with respect to operations, the management or other aspects related to their investments.

The GCC-Singapore Free Trade Agreement

Under the Gulf Cooperation Council and Singapore Free Trade Agreement (GSFTA), GCC countries and Singapore enjoy duty-free access to each other’s markets as well as reduced or eliminated tariffs on a large variety of goods and services. Since the inception of the FTA, trade between the GCC and Singapore continues to increase, reaching over US$43 billion over the past five years.

The FTA also offers increasing opportunities for businesses in the GCC to expand into ASEAN, a fast-growing economic bloc that is predicted to have the world’s fourth-largest GDP by 2030.

The UK-Singapore Free Trade Agreement

The UKSFTA mirrors the FTA Singapore signed with the EU, providing preferential tariffs and a reduction of non-tariff barriers in key sectors, such as electronics and pharmaceuticals.

The UK also grants Singapore enhanced access to bid for more UK government projects at the city and municipal level.

EU-Singapore Free Trade Agreement (EUSFTA)

The EU reduced tariffs to 0 within 5 years after the EUSFTA coming in force in 2019– cutting 75% of the tariff lines to 0% and the remaining tariff lines within three to five more years. On the Singaporean side, more than 99% of all goods from the EU are already allowed duty-free access.

How to apply for FTA tariff concessions

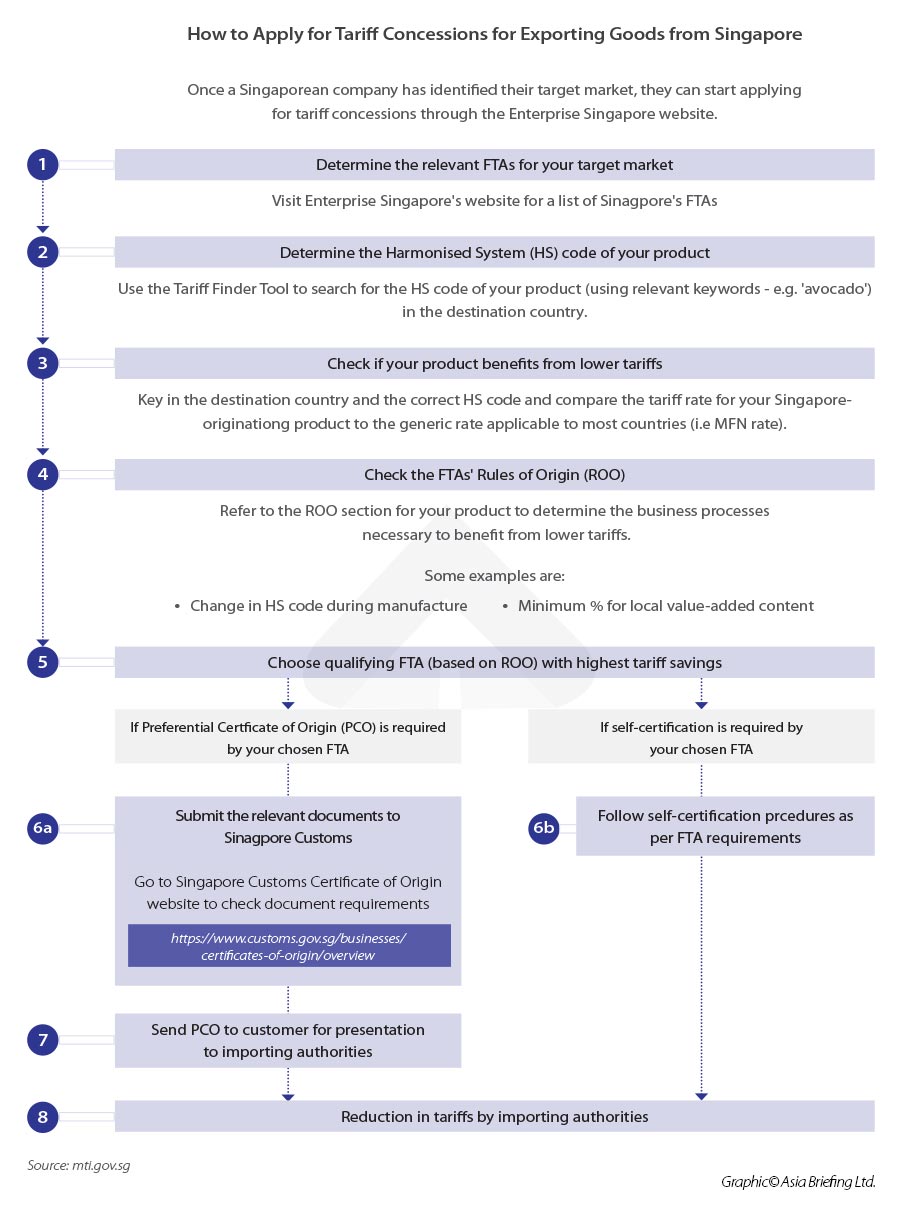

Once a Singaporean company has identified its target market, it can start applying for tariff concessions through the Enterprise Singapore website.

Singapore’s DTA network

Singapore has one of the world’s most extensive double tax agreement (DTA) networks, attracting international businesses from a multitude of conventional and nuanced industries. DTAs eliminate instances of double taxation from cross-border activities, such as trade, knowledge sharing, as well as investments between two countries.

Singapore has signed around 100 DTAs with various countries and the full list can be found on the website of the Inland Revenue Authority of Singapore, or IRAS, the main tax authority in the country. Foreign investors should seek the help of registered tax advisors to better understand how they can benefit from Singapore’s vast DTA network.

These DTAs also include treaties with ASEAN’s 10 member states – Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam – providing businesses with a greater competitive edge when entering this market.