78

- Human Resources and Payroll in China 2016-2017 (5th Edition)

Tax planning via year-end bonuses

A year-end bonus is a helpful tool to reduce an employee’s tax burden, as it is calculated separately

from salary income. An employer can therefore choose to pay out some of the employee’s salary

as a bonus to reduce the employee’s tax burden. As described above, the appropriate tax rate is

determined by dividing the bonus by 12 and applying the monthly tax rate and quick deduction

figures.

There are twomajor issues that an employer should keep inmind when planning year-end bonuses.

Firstly, employers should be wary of tax bracket thresholds. As illustrated in the following chart, a

small difference in the bonus amount can lead to vastly different tax outcomes.

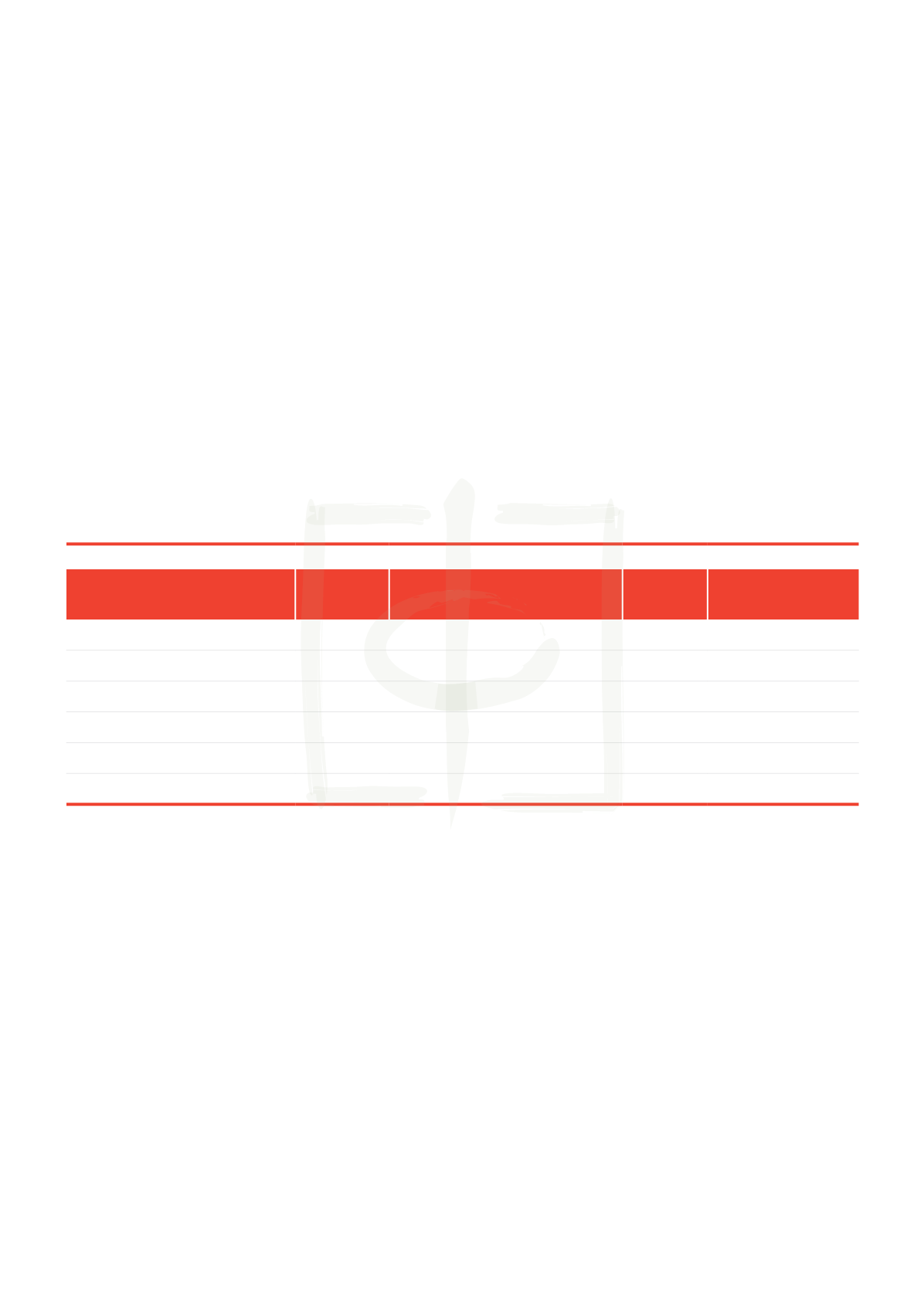

IIT Calculation for Annual Bonuses

Annual Bonus Amount (RMB)

Tax Rate

Applicable

Annual Bonus Amount (RMB)

Tax Rate

Difference in IIT

Amount

(RMB)

18,000 (i.e., 1,500x12)

3%

18,001 (i.e., 1,500.08x12)

10%

1,154.10

54,000 (i.e., 4,500x12)

10%

54,001 (i.e., 4,500.08x12)

20%

4,950.20

108,000 (i.e., 9,000x12)

20%

108,001 (i.e., 9,000.08x12)

25%

4,950.25

420,000 (i.e., 35,000x12)

25%

420,001 (i.e., 35,000.08x12)

30%

19,250.30

660,000 (i.e., 55,000x12)

30%

660,001 (i.e., 55,000.08x12)

35%

30,250.35

960,000 (i.e., 80,000x12)

35%

960,001 (i.e., 80,000.08x12)

45%

88,000.45