Human Resources and Payroll in China 2016-2017 (5th Edition) -

81

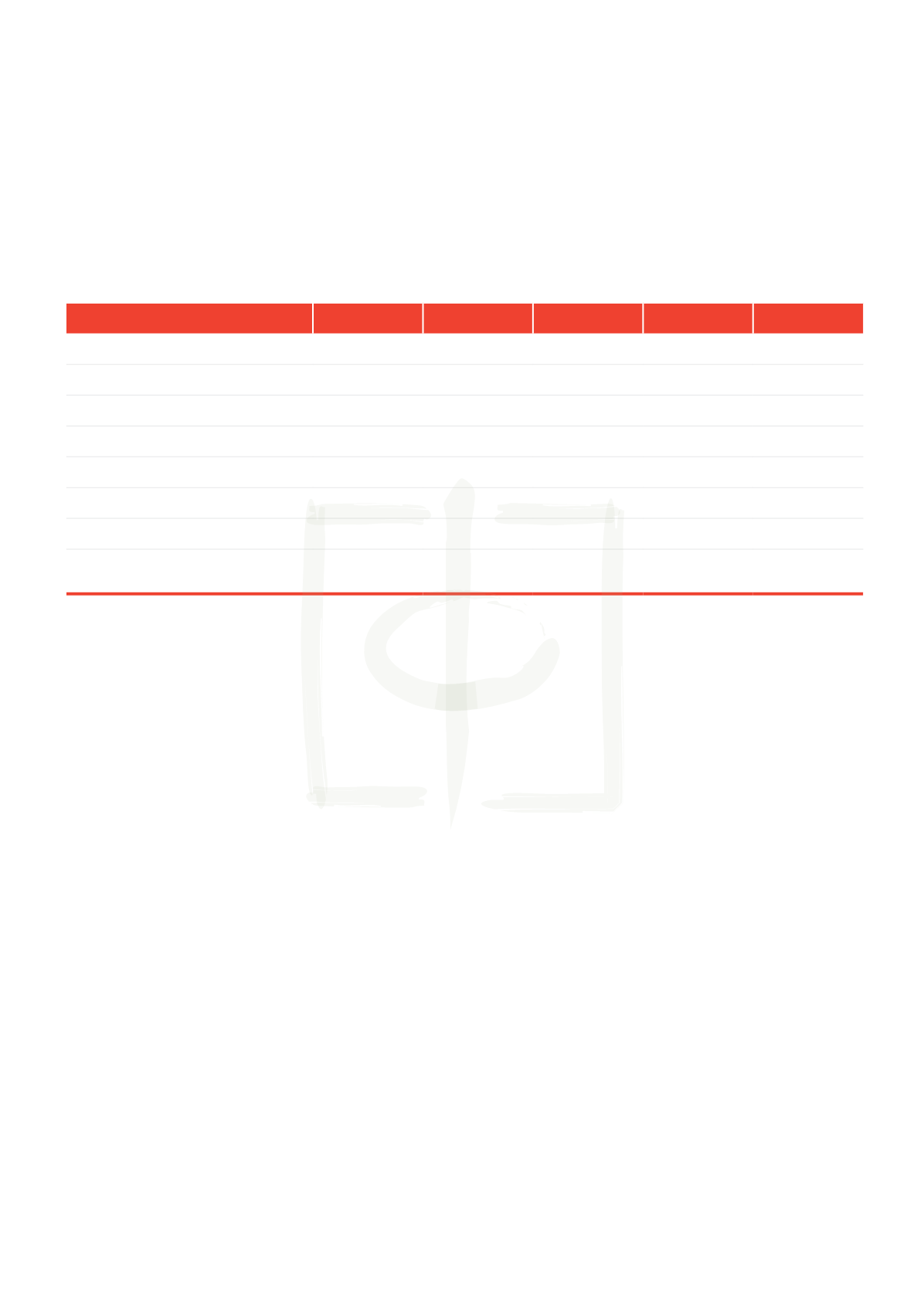

Scenario 1

Scenario 2

Scenario 3

Scenario 4

Scenario 5

Monthly salary

10,000

9,000

8,000

7,000

5,000

Annual salary

120,000

108,000

96,000

84,000

60,000

Annual bonus

0

12,000

24,000

36,000

60,000

IIT on monthly salary

485

315

215

115

6

IIT on annual salary

5820

3780

2580

1380

72

IIT on annual bonus

0

360

2295

3495

11445

Total IIT

5280

4140

4875

4875

11517

Actual percentage of tax paid over total

annual income

4.85%

3.45%

4.0625%

4.0625%

9.5975%

Physical filings

Depending on the city, physical filings of IITmight be necessary. Assuming online filings have already

been made by the company, all that is required for the physical filing is:

• Print out the details of the IIT payments from the Tax Bureau software for each individual and for

each of the months required.

• Stamp each document with the company chop.

• Take to the local Tax Bureau for submission.

It is possible that companies can onlymake physical filings instead of online filings, which is obviously

more time consuming.

The person delivering the filings to the Tax Bureau will be able to see the salaries of each staff

member.Wetherefore advise that companies either send their HRmanager or use someone outside

the organization to do it for confidentiality reasons.

If physical filings are made, the tax payment generally cannot be deducted directly from the

company’s bank account, and a visit to the bank with a form issued and stamped by the Tax Bureau

will be necessary. The bank should receive this form and the payment. The formwill not include the

details of each individual’s tax burden, so no particular confidentiality risk exists for the company

at this stage.