C

hina

B

riefing

·

Issue 167

·

August

2016

8

This alsoapplies to the aforementioned international

schools for children of foreigners. Correspondingly,

education institutions are usually required to be

registered as “private non-enterprise units” in the

civil affairs department, rather than registered as

“limited liability companies” in the Administration

of Industry and Commerce (AIC).

Although the Private Education Promotion Law

(

民办教育促进法

) stipulates that investors could

get a “reasonable return”of up to 75 percent of the

net margin from a private education institutions, it

is still significantly different from regular dividends

distribution. In practice,“reasonable return”is rarely

added into the institution’s Articles of Association

because this concept is never clearly defined,

making pre-establishment approval even more

difficult as a result.

Nevertheless, the recent revision of China’s national

education laws in 2015 – together with some

local level regulations and practices – sheds some

light on the feasibility of for-profit education. The

revised PRC Education Law (

教育法

) abolished the

previous provision “No organization or individual

may establish or run a school or any other

educational institution for profit-making purposes”,

pointing towards a more relaxed attitude from the

government regarding for-profit education. At

the local level, Shanghai released two provisional

regulations on commercial training institutions

in 2013, making Sino-foreign for-profit education

explicitly operable in the Pilot Free Trade Zone

(FTZ). Similar practices are also observed in Beijing,

Guangzhou, Shenzhen, and Hangzhou, amongst

others, though these cities have not released

formal regulations as Shanghai has. Conversely,

however, the vote on the proposed amendment

to the “Private Education Promotion Law”, which

emphasizes the legitimacy of for-profit education

and specifies the transfer method of non-profit

education institutions to for-profit institutions,

was temporarily suspended. There are also further

contradictions in China’s recently released NGO

law, which is discussed in detail in this magazine’s

final article. Consequently, it is still too early to say

that the barriers to for-profit education have been

eliminated, both legally and in practice.

Common Investment Models

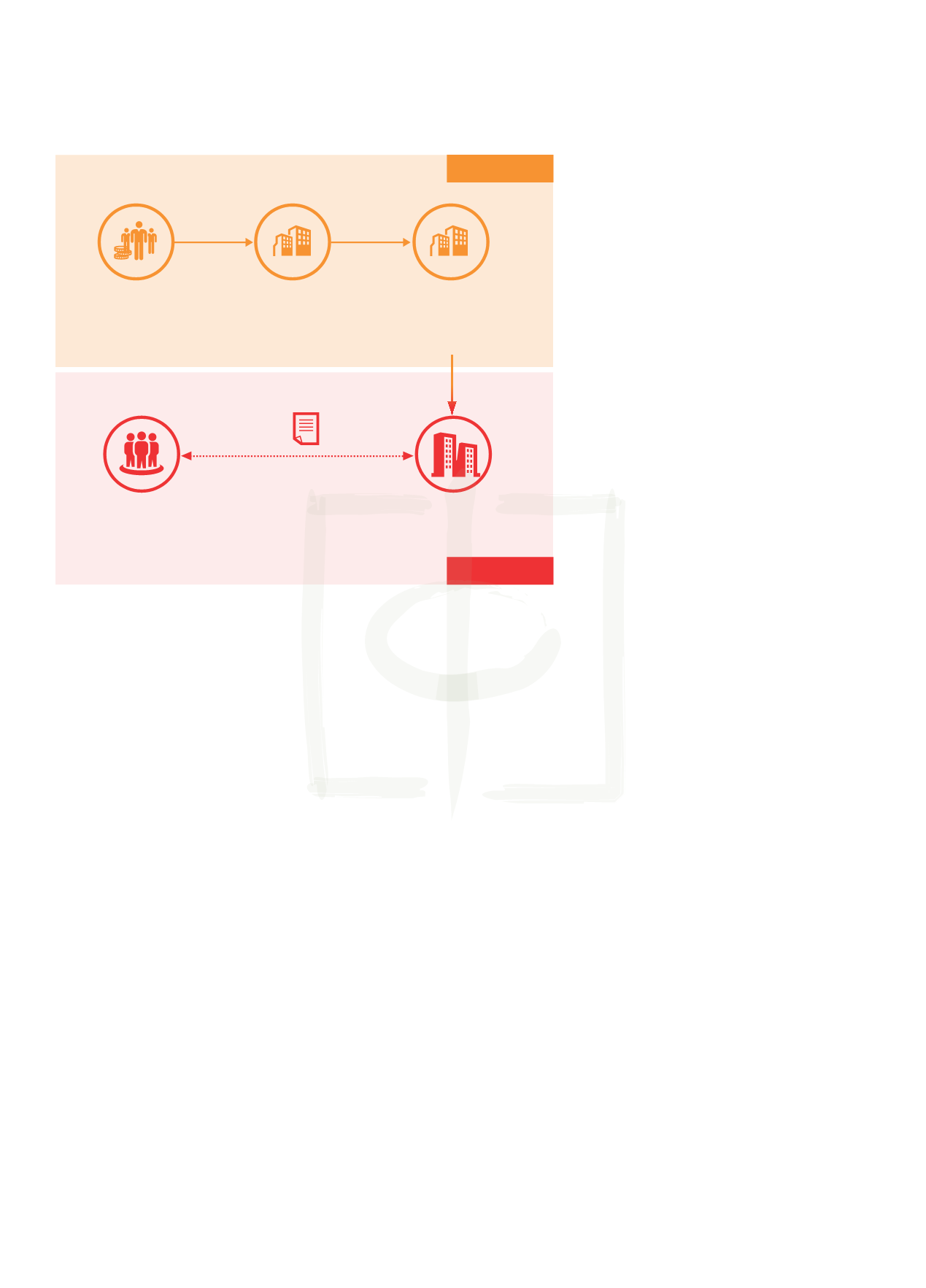

In view of the abovementioned restrictions and

market entry barriers, foreign investors sometimes

use the “variable interest entities (VIE)” model

to access China’s education industry. Under

this model, foreign investors retain control over

entities operating domestically in China through

a series of contractual arrangements rather than

direct shareholding. Typical examples include

TAL Education Group, New Oriental, and Maple

Leaf Educational System, the structure of which is

summarized in the graph in the upper left.

However, considering the increasing legal risks

embedded in the VIE structure, such as contract

invalidity, fighting of control rights, and transfer

pricing reviews, investors may instead choose one

of several direct investment models, including:

• Model 1:

Set up self-owned pre- and K12

international schools for children of foreigners

or vocational training centers, e.g. Wellington

College International Shanghai, Wall Street

English, etc.

• Model 2:

Set up Sino-foreign cooperative

educational institutes, such as a university-level

cooperation (e.g. NYUShanghai), department-level

cooperation (e.g. China-EU School of Law), and

program-levelcooperation(MDSProgrambetween

Peking University and Hong Kong University)

WFOE

Typical VIE Structure

Domestic

Operating

Entities

Contractual Arrangements

Such as: Trademark licensing agreements,

teaching support agreements,

service agreements, website development

and use agreements,

equipment rental agreements

OFF SHORE

Foreign Investors

SPV-1

Overseas

SPV-2

(a VIE structure targeting China

will usually have two SPVs,

with the second typically Hong Kong)

ON SHORE