Dec. 13 – In this article, we outline some of the key tax responsibilities for both foreign and domestic companies operating in India with regards to the following areas:

- Corporate Income Tax

- Value-Added Tax

- Goods and Service Tax

- Withholding Tax

Corporate Income Tax

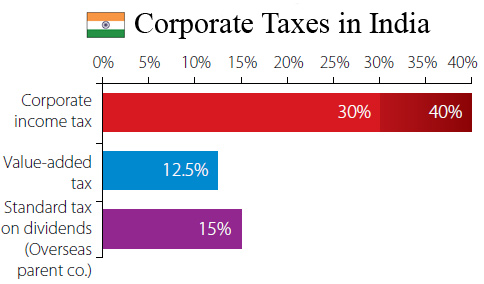

Corporate income tax for domestic companies (including limited liability partnerships) is 30 percent, while foreign companies in India are taxable at 40 percent. Foreign companies with contractual work in India will be subject to income tax of 40 percent on net income earned from the contract.

A company is considered a foreign company if it is registered outside of India. Companies formed in India are considered domestic companies, including subsidiary units with parent companies in foreign countries.

Normally, a company is liable to pay tax on the income computed in accordance with the provisions of the Income Tax Act. However, previously, there were large number of companies who had book profits as per their profit and loss account, but were not paying any tax because their income computed as per provisions of the Income Tax Act was either nil, negative or insignificant. In such cases, although the companies were showing book profits and declaring dividends to the shareholders, they were not paying any income tax. These companies are popularly known as zero tax companies.

Continue reading this article on India Briefing News.