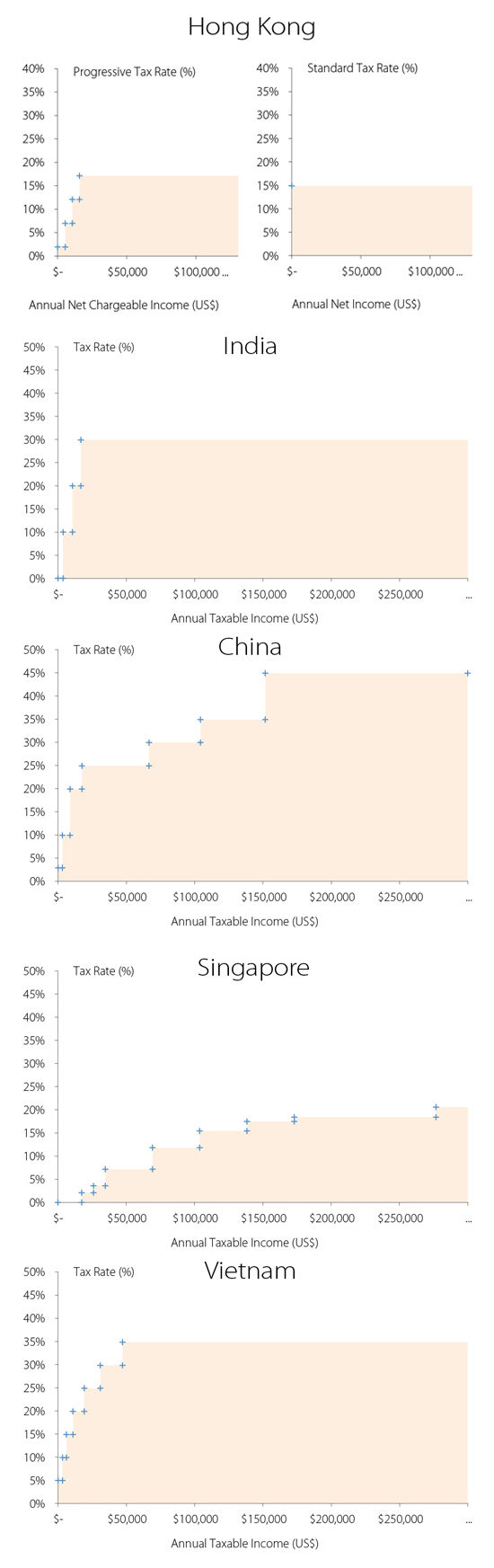

Individual income tax rates vary widely across jurisdictions. Here, we visualize these rates for China, India, Vietnam, Singapore and Hong Kong.

A key issue when determining individual income tax liabilities for foreigners is residency. In China, for example, individuals who spend fewer than 90 days in one calendar year in the country (or 183 days for residents of countries that have a tax treaty with China) are exempt from individual income tax if the income is paid by an overseas entity and the income is not attributable to a permanent establishment in China. If an individual is paid by a China entity, any income derived from working in China will be taxable.

Other jurisdictions have their own rules in this regard. You can contact the tax experts at Dezan Shira & Associates at tax@dezshira.com for details relating to your region.

This article is an excerpt from the November and December issue of Asia Briefing Magazine, title “The 2014 Asia Tax Comparator.” In this issue of Asia Briefing Magazine, we examine the different tax rates in 13 Asian jurisdictions – the 10 countries of ASEAN, plus China, India and Hong Kong. We examine the on-the-ground tax rates that each of these countries levy, including corporate income tax, individual income tax, indirect tax and withholding tax. We also examine residency triggers, as well as available tax incentives for the foreign investor and important compliance issues.

This article is an excerpt from the November and December issue of Asia Briefing Magazine, title “The 2014 Asia Tax Comparator.” In this issue of Asia Briefing Magazine, we examine the different tax rates in 13 Asian jurisdictions – the 10 countries of ASEAN, plus China, India and Hong Kong. We examine the on-the-ground tax rates that each of these countries levy, including corporate income tax, individual income tax, indirect tax and withholding tax. We also examine residency triggers, as well as available tax incentives for the foreign investor and important compliance issues.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.