Op-Ed Commentary: Benedict Lynn

September was an important month for the environment, with worldwide rallies demanding urgent action on climate change and a UN Climate Summit. It was against this backdrop that researchers at the Global Carbon Project released new data showing that China’s per capita carbon emissions have overtaken those of the EU. In 2019, India is expected to follow suit.

This puts renewed pressure on the two Asian superpowers to curb their notoriously high levels of pollution and seek out other, cleaner sources of energy. In this article, Asia Briefing examines the as-yet largely untapped market for energy efficient vehicles in these two still rapidly growing economies.

Pollution is of course a natural by-product of rapid industrialization, and both India and China have arguably done more than some of the developed West to counter its effects. Nevertheless, China remains the number one polluter in the world, accounting for 29 percent of the record 36 billion tonnes of carbon emitted in 2013, while India ranks fourth at 7.1 percent (after the EU and the U.S.).

At the summit, to which neither country sent their top politicians, Chinese Vice Premier Zhang Gaoli reiterated China’s pledge to reduce 2005’s carbon intensity levels by 40-45 percent by 2020. Meanwhile, India’s new energy minister Piyush Goyal has announced that India will be a “renewables superpower”, attracting US$100 billion in renewable energy investments over the next five years.

RELATED: Electric Vehicles Receive Tax Exemption in China

However, both these developing nations need to keep increasing their energy supplies if they are to drag their millions of poor out of poverty, which makes cutting back on fossil fuels a task easier said than done. Indeed, in order to provide electricity to the 300 million who currently live without it, India is expected to aggressively expand its coal-fired electricity generation.

But if either nation is to meet their ambitious emissions targets, significant cuts need to be made somewhere. The latest IPCC report (Mitigation of Climate Change, 2014) found that to ensure substantial reductions in emissions in the coming decades, it was energy efficiency across all sectors (e.g. buildings and industry as well as transport) that will take the lion’s share of investment, rather than investments in renewables or nuclear.

RELATED: Can India’s Newly Drafted Road Safety Laws Help Boost its Economy?

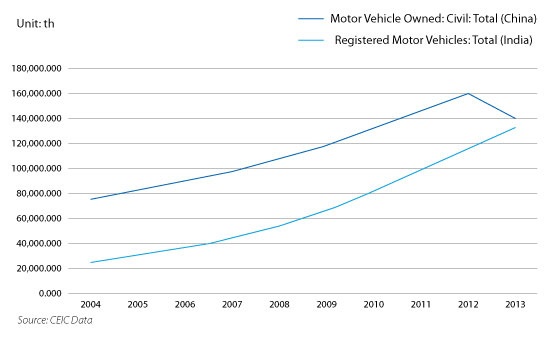

It is the auto-sector, and in particular its potential for a market in electric and energy efficient vehicles, that presents the most viable options to investors. Firstly, driven by the two giants’ burgeoning middle class consumer bases, the sector is growing at an exponential pace. In India alone, total vehicle sales increased to almost 16 million in 2012, up from approximately 10 million in 2007, and the total number of vehicles on the road is expected to reach 250 million by 2025.

This is a big contributor to pollution. According to the IPCC report, transport accounts for 14 percent of all greenhouse gas emissions. In India there are 600, 000 premature deaths a year from diseases directly related to air pollution, notably in the form of particulate matter (PM). About a third of PM pollution is created by the transport sector. Meanwhile CO2 emissions from China’s transport sector more than doubled between 2000 and 2010, and are forecasted to jump another 54 percent by 2020 (from 2010 levels).

Both governments are under increasing pressure from the international community and their own growing middle classes to do something about the appalling air conditions, and given the practical difficulties in cutting back on coal fired electricity production, the transport sectors seem the way to go.

RELATED: Clean Energy Investing in China

From a macroeconomic point of view, the costs would be negligible. Both China and India rely heavily on imports for oil, so the potentially huge savings on spending on fossil fuels would pay for investments into energy efficiency. Cleaner air would also lead to vast savings in health budgets, and government investments and subsidies into energy efficient vehicles would consequently pay for themselves.

Yet demand remains low. Despite the fact that electric and hybrid vehicles are actually cheaper to maintain than cars that run purely on fuel combustion engines, the up-front cost is significantly higher. In economically growing countries like China and India, where many people can for the first time afford to buy their own car, this proves a serious deterrent. Engineering problems also abound, from speed to “range anxiety” – the fear of running out of power somewhere without the means of recharging your vehicle.

These problems are “far from insurmountable” says Edward Guinness, who manages the Alternative Energy Fund at Guinness Asset Management, a London based investment bank specialising in Asia and energy.

RELATED: The East is Green: The Future of China’s Environmental Regime (Part 1)

“I absolutely think demand [for energy efficient vehicles] will increase. They will be similarly priced to combustion engine vehicles in the next 5-10 years,” said Mr Guinness, speaking to Asia Briefing by phone. “We are already seeing these kinds of vehicles on the roads. The time charge problem is fast being dealt with and issues such as range anxiety and cost will go away, further than they are with combustion engine vehicles.”

Governments have been taking steps, introducing a slew of incentives for both manufacturers and consumers. In China, which aims to see 500, 000 energy efficient vehicles on the streets by the end of next year and 5 million by 2020, the 10 percent vehicle purchase tax has been waived until the end of 2017 for locally produced and imported new energy vehicles. In June, the China Automotive Technology and Research Center proposed opening up electric-vehicle manufacturing to foreign companies as well.

Volkswagen is an example of a large multinational expanding bullishly in China, which is still the world’s biggest auto market. The German automaker, whose brands include Audi and Porsche, is now planning a further 18.2 billion euro investment into new plants and energy efficient products there.

RELATED: India Proposes New National Offshore Wind Energy Agency

The Indian government launched the National Electric Mobility Mission Plan in 2013, which aims to produce 6-7 million electric vehicles by 2020. The Heavy Industry Ministry recently submitted a proposal to the Finance Ministry, concerning some US$4.2 billion in subsidies for the purchase of electric and hybrid cars.

In an email to Asia Briefing, Darshan Goswami, an India specialist and project manager at the US Department of Energy, said “Both India and China are moving at a dynamic pace in the development of electric vehicles and plug-in hybrids for automotive transportation. Progress made at BMW and Tesla will change the way we drive cars in the future. You will see this dynamic growth of electric vehicles in both countries in the next 5-7 years.”

Both Mr Guinness and Mr Goswami are right to be upbeat. Mass production is bringing down costs, government subsidies are increasing demand, and technology continues to advance. Still in the stages of rapid growth and industrialization, China and India are better placed than any of their more developed counterparts to herald a “Green Revolution” in vehicle fuel efficiency. To echo Mr Guinness’ sentiments, “We are at the start of the change ahead.” Investors take note.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asia@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Manufacturing Hubs Across Emerging Asia

In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

The Gateway to ASEAN: Singapore Holding Companies

The Gateway to ASEAN: Singapore Holding Companies

In this issue of Asia Briefing Magazine, we highlight and explore Singapore’s position as a holding company location for outbound investment, most notably for companies seeking to enter ASEAN and other emerging markets in Asia. We explore the numerous FTAs, DTAs and tax incentive programs that make Singapore the preeminent destination for holding companies in Southeast Asia, in addition to the requirements and procedures foreign investors must follow to establish and incorporate a holding company.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.