The corporate income tax rates of Asia have fluctuated considerably over the past two decades, and more change is forecast for the future. In China, the CIT rate has decreased from 33 percent in 2007 to its current 25 percent, and Indonesia’s has decreased twice since 2007. Vietnam’s rate has changed from 28 percent in 2008 to 25 percent in 2012 and 22 percent in 2014, and the country’s government has already announced its intention to alter the rate once more to 20 percent in 2016.

Malaysia, the Philippines, Thailand, and the majority of the other countries in the the Association of Southeast Asian Nations (ASEAN) have experienced a similar downward turn in CIT rates over the past several years. This points to a trend in emerging Asia – particularly in the East and Southeast – towards legislating a lower rate of corporate taxation, indicating that the governments of each are beginning to focus more on securing investment than on subsidizing state spending.

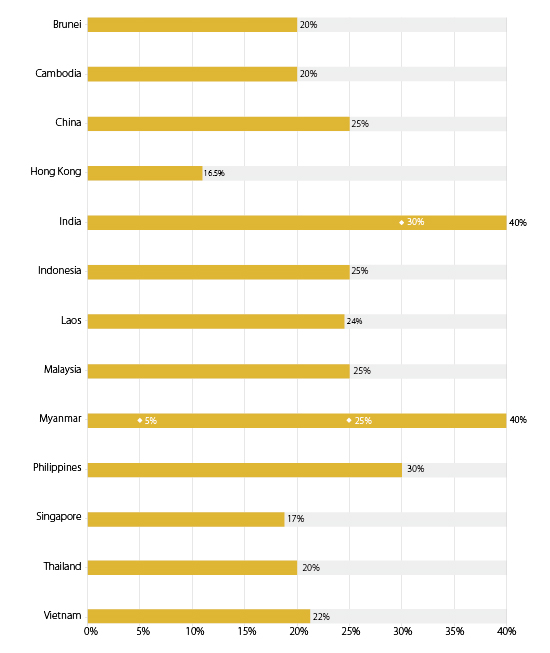

That being said, there is still a sizable gap between the rates of CIT in Asia, with the highest more than doubling that of the lowest. Here, we provide a visual representation of the CIT of India, China, Hong Kong, and the ten member states of ASEAN.

![]() Analysis of Asia’s Tax Rates, Part 2: Withholding Tax

Analysis of Asia’s Tax Rates, Part 2: Withholding Tax

![]() An Introduction to Taxation in Asia

An Introduction to Taxation in Asia

Special Conditions

India

30 percent for Indian companies and 40 percent for foreign companies.

Laos

24 percent, with a five percent reduction for companies listed on the Lao Stock Exchange.

Myanmar

25 percent if company is established under the Myanmar Foreign Investment Law (MFIL); five to 40 percent if not registered under MFIL.

Philippines

30 percent based on net income for resident companies, or two percent minimum corporate tax rate based on gross income. For non-resident companies, 30 percent based on gross income.

Thailand

Reduced from 23 percent to 20 percent until end of 2015 accounting year.

This article is an excerpt from the December issue of Asia Briefing Magazine, titled “The 2015 Asia Tax Comparator“. In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN, which consists of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia. This article is an excerpt from the December issue of Asia Briefing Magazine, titled “The 2015 Asia Tax Comparator“. In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN, which consists of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia. |

![]()

Manufacturing Hubs Across Emerging Asia

In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

The Gateway to ASEAN: Singapore Holding Companies

The Gateway to ASEAN: Singapore Holding Companies

In this issue of Asia Briefing Magazine, we highlight and explore Singapore’s position as a holding company location for outbound investment, most notably for companies seeking to enter ASEAN and other emerging markets in Asia. We explore the numerous FTAs, DTAs and tax incentive programs that make Singapore the preeminent destination for holding companies in Southeast Asia, in addition to the requirements and procedures foreign investors must follow to establish and incorporate a holding company.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.