An introduction to foreign-invested partnerships and foreign-invested joint stock companies

By Chet Scheltema and Frank Yang

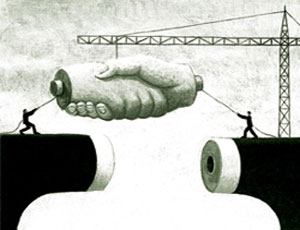

Aug. 20 – Foreign investors and domestic Chinese investors have traditionally been unable to co-invest in mainland business ventures, except by means of the joint venture or unofficially sanctioned structures. With the introduction of several new legal entities, this restriction has been lifted and foreign and domestic investors may now freely co-mingle their resources in one enterprise. These structures are the foreign-invested partnership and the foreign-invested joint stock company, both of which are bound to become ever more important instruments in the foreign investors’ chest of tools for doing business in China.

Aug. 20 – Foreign investors and domestic Chinese investors have traditionally been unable to co-invest in mainland business ventures, except by means of the joint venture or unofficially sanctioned structures. With the introduction of several new legal entities, this restriction has been lifted and foreign and domestic investors may now freely co-mingle their resources in one enterprise. These structures are the foreign-invested partnership and the foreign-invested joint stock company, both of which are bound to become ever more important instruments in the foreign investors’ chest of tools for doing business in China.

The traditional foreign invested enterprises introduced in the 1980s are the representative office (RO), joint venture (JV), and wholly foreign-owned enterprise (WFOE). Note that although JVs allow co-investing, it is on highly restrictive terms and excludes individual investors. Meanwhile, unofficially sanctioned structures range from:

- Offshore holding companies that control WFOEs and are held in the name of foreign persons for the benefit of domestic Chinese;

- Domestic corporations held on behalf of foreign investors by local Chinese; and

- Variable interest entities, which are domestic companies with Chinese ownership, but controlled by foreign interests through a series of contractual relationships.

These structures reflect the fact that Chinese regulators have been mistrustful and resistant towards foreign investment and that Chinese markets have remained connected to the global economy primarily as a manufacturing base for export abroad. Accessing domestic markets by means of these structures has been slow, difficult, and costly.

Chinese legislators have introduced these new investment structures as China’s markets have matured and strengthened and the need and desire for greater openness has become apparent (e.g. accession to the WTO). This was first seen in the foreign-invested joint stock company in 1995 (Revised in the 2000s) and then the foreign-invested partnership in the 2000s. They are a far cry from the traditional foreign invested enterprises and offer the promise of tremendous flexibility and structuring versatility.

Continue reading this article of China Briefing News.