The administration of social insurance can be a complicated and confusing process for employers with operations in multiple countries. In this article, we explore social insurance in Hong Kong, India and Singapore to help clarify the key components of compliance across Asia. Social insurance compliance in mainland China is covered here and Vietnam’s social insurance is covered here.

Hong Kong’s Central Provident Fund

While companies are not required to withhold tax from employee income, employers must ensure they contribute to the Mandatory Provident Fund (MPF, Chinese: 强制性公积金or 强积金), a compulsory saving scheme (pension fund) for the retirement of residents in Hong Kong. Most employees and their employers are required to contribute monthly to MPF funding schemes according to both salary and period of employment. Both full and part-time employees in addition to self-employed persons (except those exempt under the Mandatory Provident Funding Schemes Ordinance or MPFSO) are required to participate in the MPF schemes. The maximum monthly contribution that can be required for MPF schemes totals HK$1,250 at the maximum relevant income level of HK$25,000. After an employee has determined which MPF scheme he or she wants to participate in, companies can easily schedule monthly contributions directly to the agent managing the scheme.

India’s Provident Fund Scheme

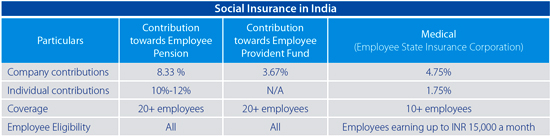

While much of the Indian population does not participate in the country’s social insurance program known as the Provident Fund Scheme, Indian citizens in the organized sector are entitled to coverage.

International workers including expatriates working for an employer in India are also eligible to participate in the Provident Fund Scheme. Employers are required to contribute 12 percent of their employees’ specified salary to the scheme, and contributions must be deposited on a monthly basis by the 15th of the subsequent month.

Singapore’s Central Provident Fund

The Central Provident Fund (CPF), a compulsory comprehensive savings plan, is designed to fund the retirement, healthcare, and housing of permanent residents and working Singaporeans. Administered by the Central Provident Fund Board, a statutory board under the Ministry of Manpower, employers are typically required to contribute 16% of an employee’s monthly salary to the fund while employees must typically contribute 20%. Employers and employees must contribute monthly to CPF schemes managed by approved private organizations, according to both their salary and age.

This article is an excerpt from the January and February 2014 issue of Asia Briefing Magazine, titled “Payroll Processing Across Asia.” In this issue of Asia Briefing Magazine, we provide a country-by-country introduction to how payroll and social insurance systems work in China, Hong Kong, Vietnam, India and Singapore. We also compare three distinct models companies use to manage their payroll across various countries with external vendors, and explain the differences among three main models: country-by-country, managed, and integrated models while highlighting some benefits and drawbacks of each.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Foreigner Participation in China’s Social Insurance System

Vietnam’s State Social Insurance Fund

Social Security in Vietnam: Social Insurance

Social Insurance, Housing Fund, and Minimum Wage Adjusted in Suzhou

China-South Korea Sign Social Insurance Contribution Agreement and Protocal