By Keith Hilden and Georgi Ivanov

People’s Democratic Reform Committee and Red Shirt protests in Thailand over the last several months are bringing political volatility that is shaking investor confidence in the country. The numbers speak for themselves: foreign investor outflows have hit US$3 billion from the onset of the protests to February. The short-term environment due to the protests will be characterized by slowing economic growth on a quarterly basis and a slight drop in tourist numbers. Equity prices look attractive for the Stock Exchange of Thailand (SET), although Thailand-unique political risks are affecting stock prices discriminately among party line divisions.

Medium term risks include increased capital flight, continued decline in exports, a fundamental crisis of legitimacy, and a declining stock market. In order to restore confidence, interim elections or coalition negotiations are necessary to restore the foundation for investment and investor confidence, which requires a predictable and stable political environment.

The macro data coming out of Thailand and the protests since October 31 (Q4) suggest that exports are due to contract for the Q1 of 2014, meaning exports are contracting for the 4th straight quarter. Private investment has declined somewhat in 2013 and outflows have accelerated to other ASEAN markets, such as Indonesia and Vietnam. Thailand’s export sector is still on an upward trend in a multi-year perspective, despite short-term quarter-on-quarter export declines. Amidst these conditions, Japanese businesses are reconsidering their business plans, shifting towards a Thailand Plus One business strategy, a noticeable shift from treating Thailand as their ASEAN headquarters to a more hedged diversification of business operations in regional neighbors, such as Vietnam and Cambodia.

Regardless, for long term investors who can embrace “Thai time,” and who are concerned with yearly rather than quarterly gains, Thailand does remain a destination of increasing returns, with its strength tipped towards being well positioned to grow its exports. Short term investors, however, may be affected by the effects of the protests upon quarterly equity prices and quarterly export number disappointments.

A Silver Lining in Thai Equities Amid Protests

In Bangkok, Managing Director of MBMG Group Paul Gambles is concerned about the very troubling economic data and the GDP slowdown, but maintains there still is value to be found in Thai equities.

In an interview with Squawkonomics , he explains that despite the disappointing protest-related fundamentals, Thailand still looks like a screaming buy. Concerns of Thailand having a 1997-redux were brushed off, as Gambles explained that Thailand now has reserves that exceed its foreign debt, a far cry from 1997 when Thailand’s debt exceeded its reserves multiple times over.

He explains from a sovereign finance perspective, Thailand is solid, and despite the drop in exports, new markets are opening up for Thailand. Thailand now exports about the same to Vietnam, Cambodia, Laos, and Burma combined as they export to the U.S. market, or the Japan market. This occurs at the backdrop of Thailand emerging as the geographical and commercial center of Southeast Asia, with the Stock Exchange of Thailand (SET) that is deeper in volume than that of the Singapore Stock Exchange, making the SET now Southeast Asia’s largest stock market.

Clearly, the winds of protest are blowing in Thailand, but Gambles sees no reason to shy away from the market at a time the SET is looking extremely attractive. Historically, protests in Thailand have resulted in drops in equity prices, resulting in big gains for investors once the protests are resolved. Short-term investors will be affected by the political turmoil in Thailand, but mid and long-term investors look poised to pick up some real value in Thailand right now.

Gambles also sees the banking sector in Thailand as good value for equities right now, and anticipates foreign money will be drawn to these stocks like a magnet, as has been historically so in the past.

Gambles also sees the political situation hard to determine, so advises buying the Thai index through a Thai ETF as more advantageous than stock picking. The following is an excerpt from the Squawkonomics interview with Gambles:

Paul: “Because we don’t know exactly what form the recovery is going to take, just buying a Thai ETF is probably the best move to play this. And we are expecting, as you were saying, foreigner money is going to come back – that will probably chase the same kinds of stocks it’s always done.”

Keith: “Which has been?”

Paul: “Banking sector, the main banks – all of them are magnets for foreign money and also they’ve very good stocks, they’re very well valued, they could possibly suffer a global liquidity crisis, that would make them a lot cheaper, but generally I think that in Thailand it’s a sector that’s great value right now.”

You can watch the interview in full here.

In calculating the costs of the protests so far, Thailand has faced losses due to the protest totaling over US$15 billion in a US$366 billion dollar economy (2012 GDP by PPP), which already stalls the economic forecast for 2014.

If Thailand encounters the scenario of total losses of US$30 billion, as the Faculty of Economics at Rangsit University has quantified, then Thailand’s economy would shrink by 0.5 percent. A badly-performing economy might exacerbate social tensions, and this is why finding a political settlement with the protests is in the best possible interest of Thailand.

However, not all macroeconomic declines in Thai fundamentals are protest-related. Thailand has some underlying challenges in which to address.

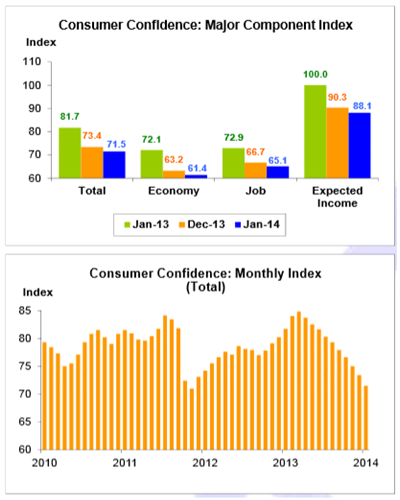

Declining exports in 2013 pose a problem for the short term, with declining consumer confidence an issue as well. Consumer confidence has been steadily declining, from the beginning of 2013 to the present, touching or exceeding five-year lows of consumer confidence in Thailand.

For those investors seeking a return through increased Thai consumption, this may be an indicator to rethink investment positions, as the protests are only exacerbating an already underlying dynamic of decreased consumer confidence. Exports are also on a decline since 2013. However, for the patient investor who is looking for returns through Thai exports, it is worth noting Thailand’s neighbor markets are developing and their needs are becoming greater.

Like Gambles says in the interview above, if we look at the ASEAN export market as a bloc for Thailand to sell to, the volume of goods Thailand is selling to its neighbors is equivalent to developed markets such as Japan and the U.S. Thailand is already very well positioned as a logistics and export hub to its ASEAN neighbors, and Gambles sees this trend continuing onwards. Overall, regarding import/export bottom lines, decreased consumer confidence in Thailand looks to be offset in the long run with expanding export volume to Thailand’s regional neighbors.

For patient investors with a strategy focused on Thailand benefiting from Southeast Asian growth, Thailand’s export numbers look poised to post lucrative returns in the long term.

Teflon Tourism Outside the Capital, Political Maneuvering in the North

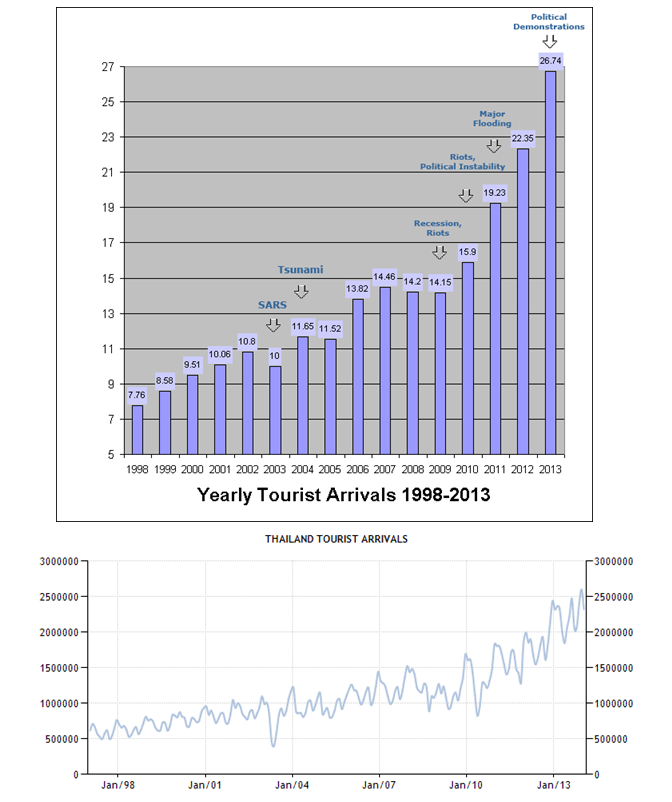

A sector in Thailand that looks to be truly teflon is the tourism sector. Tourism looks to be a sector that will only see a decline in Bangkok, while continuing its trend towards tourist arrivals approaching all-time highs. The news of Thailand losing up to 900,000 tourists over the next six months sounds significant in absolute terms, but not so much, when looked at in relative perspective.

Thailand welcomed 26.7 million visitor arrivals in 2013, an all-time high since at least 1997. For the tourist arrivals to drop 900,000 would bring the levels to 25.8 million, and it is still well above the record breaking levels of tourists in 2012. Even if Thailand were to have tourist arrivals drop by 2 million in 2014, it would not have a significant impact on the industry.

Manufacturing sectors look to be an area of concern in Thailand, particularly in the Northern region where various calls for an autonomous region or separate republic entity to be formed could bring political risk to operations in Northern Thailand if the movement comes to tangible fruition.

From Bank of Thailand data, we see that %YOY Thailand MPI has been in negative territory since Q2 2013, with numbers declining from -3.5 percent to numbers about -6-7 percent since the protests have begun. Sectors such as electronics components in Northern Thailand could have political instability ramifications, due to the discussion and movement towards a new Lanna republic entity in the North of Thailand. This factor is something to be certainly considered on an invididual basis for those investors with North Thailand exposure.

On the bright side in Northern Thailand, tourism continues to boom. Hotel occupancy as of February 2014 is roughly 95 percent. While tourism numbers have been down in the capital, with some hotels reporting 50 percent occupancy rates, the rest of the country continues to attract a high amount of tourists. Regardless, these are still at all-time, or close to all-time high tourism numbers over the last 10 years, so the tourism sector still remains one of the bright spots in Thailand’s economy for investors.

Part Two of our Investors’ Confidence Report can be found here, where we lay out how investors can avoid pitfalls in vulnerable sectors of the Thai economy, and reap windfall returns even amidst a Bangkok broiled in protests.

Squawkonomics is focused on delivering multi-dimensional media and business intelligence products on emerging and frontier markets, to assist companies with their market entry strategy and market research needs. Employing a team of capable analysts, Squawkonomics provides first-hand business insights from the best sources and synthesizes them into perspectives that understand markets like never before. Currently based out of Taipei, Taiwan, and with operations in Thailand, China and Canada, Squawkonomics offers an unparalleled glimpse into a whole new economy. Contact us on Twitter, Facebook, or info@squawkonomics.com.

Keith Hilden is a financial interviewer and forensic accounting analyst, specialized in fraud prevention, financial trends analysis and dynamic developments in emerging markets. He is the founder of Squawkonomics, and is also affiliated with Wikistrat and Market Oracle. His specific expertise and research focuses on China, Taiwan and Southeast Asia. To reach Keith: kehilden@gmx.com

Georgi Ivanov is a political scientist with competencies in geopolitical analysis and international security, political economy and a specific specialization in polar governance. As a market entry strategist with Squawkonomics, he evaluates the political, security and economic risks that affect the fundamentals of emerging and frontier markets and develops recommendations for their mitigation. To reach Georgi: g.ivanov@gmx.com

The opinions expressed in this article are those of the authors, and do not necessarily reflect the views of Asia Briefing Ltd. Furthermore, the above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should always first consult with their personal financial advisors.