By Benedict Lynn and Grace Tate

India has emerged as a surprising friend and strategic partner to Israel. The Asian giant was formerly more closely allied with the Soviet Union and the Arab world; in 1938, Mahatma Ghandi decried the imposition of a Jewish state.

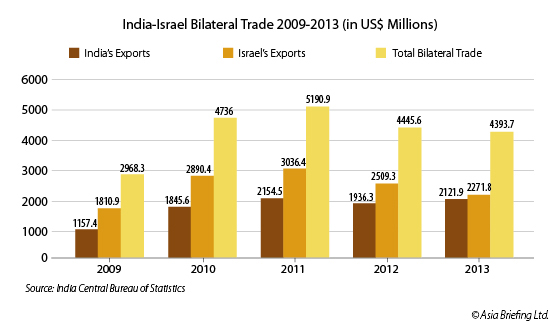

Publically, this anti-Israel sentiment remained until the end of the cold war, although de-jure recognition was granted in 1950 along with the establishment of an Israeli consulate in Mumbai. Normal diplomatic relations were established in 1992 and since then, bilateral trade has flourished, rising from US$200 million to around US$6 billion in 2013.

For a number of years, ties between the two were mostly kept quiet for fear of antagonizing the Arab states and India’s large number of Muslim voters that the previous Congress-led government relied on for support. As little as two decades ago, India refused to even keep an embassy in Israel.

However, the Indo-Israeli relationship has been steadily growing since the 1960s, and now with the staunchly Hindu Narendra Modi-led Bharatiya Janata Party (BJP) in power, this long-running, quiet allegiance has sprung back into the public eye.

Mr Modi sees Israel as an ally fighting a similar enemy: Islamic terrorism. Since the end of the Second World War and the partition of the Indian sub-continent, several armed conflicts have been fought with Pakistan. In fact, India’s change of attitude towards Israel can be traced back to the provision of Israeli weapons in 1999, which led India to victory in one of these conflicts. Recently, India has been stepping up its border patrols.

Free from U.S. constraints, India has fast grown into the world’s top buyer of Israeli weapons, with some US$662 million spent between the BJP’s landslide May victory and November alone. The world’s biggest buyer of arms intends to spend a further US$150 billion modernizing its military by 2027, and with the BJP being touted as the most pro-Israel government in India’s history, this bodes well for the Jewish State, especially given the increasingly chilly relationship with the U.S. (Israel was their 21st largest supplier of goods imports in 2013).

Fast growing India has been keen to harness Israeli agricultural and water expertise too; Prime Minister Modi visited Israel while governor of Gujarat in 2006 to attend a bilateral summit on agricultural cooperation and now some 2000 Gujarat farmers visit Israel every year for training in advanced farming techniques. There are also 10 “centers for excellence” operating throughout India providing training and Israeli know-how on such techniques as vertical farming, drip irrigation and soil solarization.

Last September, Prime Minister Modi met his Israeli counterpart Benjamin Netanyahu at the UN general assembly in New York – the first meeting between the two countries’ leaders in a decade, sparking expectations of a free trade deal being finalized next year. This would triple trade between the two, reaffirming that Indo-Israeli relations are moving from strength to strength.

![]() Israel’s Economic Relationship with the Asia-Pacific, Part 1: China

Israel’s Economic Relationship with the Asia-Pacific, Part 1: China

ASEAN

Further east, the trend continues, as Israel-ASEAN relations thrive in the region’s increasingly liberal trade and investment climate.

Further east, the trend continues, as Israel-ASEAN relations thrive in the region’s increasingly liberal trade and investment climate.

Since the early 1950s, Israel has established formal diplomatic relations with the vast majority of ASEAN member states. However, the country falls short of absolute diplomacy owing to enduring bilateral tension with Muslim majority states Malaysia, Indonesia and Brunei.

Israel’s thirst for new markets, in conjunction with the looming ASEAN Economic Community (AEC) achievement deadline, has seen economic frontiers converge to forge a bond so alluring, it is rapidly undermining hostile foreign policy.

Israel, a world leader in technological and cultural innovation, is well placed to facilitate ASEAN realization of AEC developmental targets in the agriculture, healthcare and R&D sectors. Conversely, ASEAN’s regional economic integration and trade liberalization initiatives present significant investment opportunities for Israeli business.

Unsurprisingly, Israel’s world class agricultural and renewable energy technology is a main draw card for ASEAN member states looking to realize their full agrarian potential. Across ASEAN, Israeli technologies and management techniques have aided the AEC bid to stimulate long-term competitiveness of ASEAN agricultural produce. In recent years, agricultural cooperation between Israel and Vietnam has steadily increased, with bilateral trade exceeding US$605.24 million in 2013. Moreover, this burgeoning bilateral relationship has served to aid ASEAN in narrowing the developmental gap between Vietnam and the ASEAN 6.

Furthermore, economic growth in the Asia-Pacific has stimulated demand for quality and innovative healthcare services. With more than 700 companies and the highest number of patents in medical devices per capita, Israel has become a leading provider of advanced technological solutions in the ASEAN healthcare arena.

Singapore, a celebrated ally of Israel, provides an ideal test bed for Israeli companies to develop new technologies and product innovations for the regional and global market. In 2014, bilateral trade surged 44.4 percent year-on-year to reach US$604.6 million. Yet while ties between the two nations are undoubtedly prosperous, some analysts have attributed rising figures to indirect trade with Muslim majority states Malaysia and Indonesia.

Singapore is ideally positioned to be the gateway to Asia for global companies and growing Asian enterprises. Consequently, the country has long been facilitating private trade with its Indonesian and Malaysian neighbors. While Indonesian and Malaysian foreign policy on Israel remains decidedly hostile, economic diplomacy and informal relations continue to increase.

In 2012, Indonesia agreed to informally upgrade its relations with Israel, opening a consulate in Ramallah. Since then, trade has rapidly increased, with Israel importing significant amounts of Indonesian footwear (US$19.6 million in 2013) and rubber (US$27.1 million). With its rapidly growing population, swelling middle class and assured pathway to the trillion dollar club, Indonesia is ripe for investment and Israel is poised to facilitate the country’s transition.

Similarly, in Malaysia trade statistics continue to grow. In 2013, Malaysia was ranked as Israel’s seventh largest export destination, with exports reaching US$1.5 billion. While this largely represents market allocation of electronic components by tech-giants such as Global Intel, the data is indicative of a relaxation of trade and investment barriers.

Thus, it seems the world’s most intractable conflict has taken a backseat in the bid to achieve global economic integration.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asia@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

![]()

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

The Gateway to ASEAN: Singapore Holding Companies

The Gateway to ASEAN: Singapore Holding Companies

In this issue of Asia Briefing Magazine, we highlight and explore Singapore’s position as a holding company location for outbound investment, most notably for companies seeking to enter ASEAN and other emerging markets in Asia. We explore the numerous FTAs, DTAs and tax incentive programs that make Singapore the preeminent destination for holding companies in Southeast Asia, in addition to the requirements and procedures foreign investors must follow to establish and incorporate a holding company.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.