By Dezan Shira & Associates

Publications Editor: Samuel Wrest

Foreign companies establishing a presence in India will encounter a host of considerations that do not exist in their home country. Of these, interpreting and understanding India’s idiosyncratic system of accounting standards can be an especially difficult challenge.

Until recently, India, like many countries in Asia, employed an antiquated set of generally accepted accounting principles (GAAP) that often proved difficult for foreign firms to adhere to. In order to have these standards converge more closely with international financial reporting standards (IFRS), the Institute of Chartered Accountants in India (ICAI) set out to introduce a new system, called simply Indian Accounting Standards (Ind-AS).

The first phase of Ind-AS was implemented in April 2011 and introduced a total of 35 new accounting standards, including ones on income taxes, impairment of assets and statements of cash flows. Subsequent phases were implemented in April 2013 and April 2014.

On February 16, 2015, the Ministry of Corporate Affairs (MCA) released a roadmap for the next phase of implementation, to be active from April 1, 2016. The map is intended to bring both domestic and foreign companies with a minimum net worth of Rs 500 crore into full compliance with Ind-AS and, therefore, into effective compliance with IFRS. This will be extended to companies with a net worth of Rs 250 crore by April 1, 2017. Ind-AS-based comparative figures for the previous year will also be required.

RELATED: Tax and Compliance Services from Dezan Shira & Associates

RELATED: Tax and Compliance Services from Dezan Shira & Associates

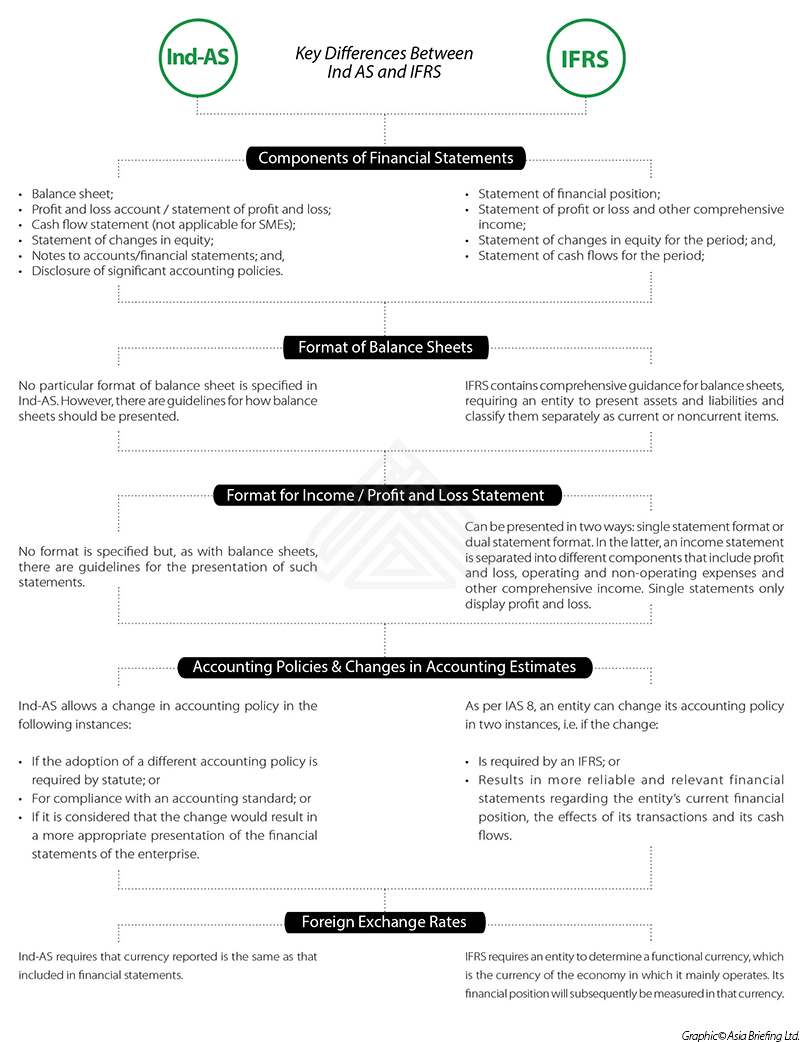

Even with this latest implementation phase, there are still some notable differences between Ind-AS and IFRS, as can be seen in our graphic to the below. While the ICAI may eventually attempt to fully incorporate IFRS into Ind-AS, this will likely not occur for a number of years. It is therefore important for foreign firms operating in India to fully understand the differences in accounting standards that still exist.

Overall, however, the accounting changes introduced by Ind-AS are positive for foreign firms operating in India. Implementation of the new principals will align a company’s reporting more closely with best practices in their home country, allowing for enhanced transparency that will help investors and stakeholders better understand a business’s financial situation.

With mandatory compliance fast approaching, there is a limited amount of time for companies operating in India to prepare for Ind-AS implementation. Businesses should firstly develop an outline of how the new standards will replace existing ones, and then look to embed Ind-AS into their operational systems, train their financial teams, and ensure all company managers understand the new accounting principles.

|

|

![]()

Establishing Your Sourcing Platform in India

Establishing Your Sourcing Platform in India

In this issue of India Briefing, we highlight the advantages India possesses as a sourcing option and explore the choices available to foreign companies seeking to create a sourcing presence here. In addition, we examine the relevant procurement, procedural and tax duty concerns involved in sourcing from India, and conclude by investigating the importance of supplier due diligence – a process that, if not conducted correctly, can often prove the undoing of a sourcing venture.

Taking Advantage of India’s FDI Reforms

Taking Advantage of India’s FDI Reforms

In this edition of India Briefing Magazine, we explore important amendments to India’s foreign investment policy and outline various options for business establishment, including the creation of wholly owned subsidiaries in sectors that permit 100 percent foreign direct investment. We additionally explore several taxes that apply to wholly owned subsidiary companies, and provide an outlook for what investors can expect to see in India this year.

Passage to India: Selling to India’s Consumer Market

Passage to India: Selling to India’s Consumer Market

In this issue of India Briefing Magazine, we outline the fundamentals of India’s import policies and procedures, as well as provide an introduction to the essentials of engaging in direct and indirect export, acquiring an Indian company, selling to the government and establishing a local presence in the form of a liaison office, branch office, or wholly owned subsidiary. We conclude by taking a closer look at the strategic potential of joint ventures.