Feb. 14 – In this article, we give a brief overview of India’s major taxes and duties on business, including Corporate Income Tax, Dividend Distribution Tax, Minimum Alternative Tax, Value-Added Tax, Central Sales Tax, Goods And Service Tax, Customs Duty, Excise Duty (CENVAT) Service Tax, Capital Gains Tax, Wealth Tax, and Withholding Tax.

The central and state governments provide various tax incentives for foreign investors establishing companies in India, including indirect and direct tax incentives, reductions in indirect taxes (sales tax and tax depreciation allowance), tax deduction for the first ten years of operation of new industrial units in specific areas, and special tax provisions for 100% export-oriented operations. Special economic zones offer additional important benefits and tax reductions.

Corporate Income Tax

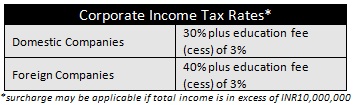

Corporate income tax is levied against profits and income under the provisions of the Income Tax Act. Corporate income tax must be paid by all types of foreign-invested entities, except for liaison offices, which are not permitted to earn income. Foreign and domestic companies are subject to different corporate income tax rates. A company is considered a foreign company if its core management (i.e. where key decisions on management are made) is located outside of India for the duration of the year.

Corporate income tax must be paid in increments throughout the year according to the advance corporate tax (ACT) payment schedule, as follows:

- July 15 – 15%

- September 15 – 45%

- December 15 – 75%

- March 15 – 100%