By Koushan Das, Dezan Shira & Associates, New Delhi

The COVID-19 virus in 2020 brought the global economies to a standstill impacting everything from manufacturing, trade, employment, services, and compelled governments to enact several policies to provide fiscal stimulus to the economy. India, similar to other emerging markets, was not immune to the pandemic, which had a significant impact on economic growth.

Despite witnessing a steady GDP deceleration in the last few years, the government has been able to attract significant and steady foreign direct investment (FDI) inflows in the last decade. In the first nine months of 2020-21, India attracted equity FDI of US$51.4 billion, up 40% compared to US$36.77 billion during the same period in the previous year.

In addition, the government’s focus on reducing complexities and compliances for investors coupled with investor-friendly policies have led to significant investments in the manufacturing sector in the last decade. Investors shifting from other countries in Asia to India has not only done so to cater to the country’s growing consumer market, but also to make India one of their major export hubs to cater to other economies.

As the pandemic hit in March 2020, the country faced a demand and supply shock. Demand shock in the form of reduced investments and consumption, and supply shock, due to disruptions in supply chain linkages and labor supply. After a slowdown in 2019, the economy witnessed a further contraction of 24.4% and 7.3% in Q1 and Q2 respectively of 2020 due to the pandemic.

To manage the growing uncertainties in the economy, the government and the central bank, undertook a multi-prong approach through fiscal policies, monetary measures, and structural reforms to manage the fall in demand and country-wide lockdown.

As lockdowns eased and construction/manufacturing picked up, India grew by 0.4% in Q3 in 2020 (Oct to Dec). In 2020-21, the GDP is set to fall 8% against an earlier estimate of 7.7%. For FY22, India is projected to grow at 12.8%, as per Fitch Ratings.

Creating a Conducive Environment

Despite all its potential, India has been perceived as a complex country by investors. Several factors influence their perception, such as bureaucratic restrictions, delays in land acquisition, contract enforcement, inconsistent policies, complex tax structures, and complicated labor compliances.

To ensure smoother operations for investors, the current government embarked on an ambitious program of regulatory reforms aimed at making it easier to do business in India. This pushed India’s ranking from 142nd (2014) to 63rd (2019) in the World Bank’s Ease of Doing Business Rankings.

Major reforms as per the World Bank’s Ease of Doing Business, implemented since 2014, are:

- Simplification of forms and other attachments required to set up a legal entity

- Digitization of several government departments such as incorporation and customs

- Single window for trade facilitation

- Digitization of land and property registration departments

- Resolution of insolvency through Insolvency and Bankruptcy Code

- Reduction in corporate taxes with higher reduction for manufacturing companies

- Introduction of Goods and Services Tax (GST) that has subsumed several other taxes at the Central and State level.

The key reforms undertaken by the government in the last few years also include:

- Goods and Services Tax GST, one of the most important reforms in India, was introduced in 2017, subsuming almost all indirect taxes at the Central and State levels. This provided a simplified, single tax regime similar to other leading economies leading to a more efficient business environment.

- Insolvency and Bankruptcy Code

The Code introduced in 2016, aims to consolidate and amends the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms, and individuals on time. - Labor Code

To simplify and consolidate the labor laws, the government introduced four Labor Codes (wages, industrial relations, social security, and occupational safety, health & working conditions) which subsumed several central government laws which are expected to provide a transparent system to suit the changing business environment. - Increasing FDI limits

The government has opened up or increased the FDI limits in several sectors such as defense, civil aviation, railways, coal, mining, and insurance.

Recent Incentive Policies

In the pre-covid years, the government had been working on consistently improving the business environment to attract foreign investors. However, during the pandemic, the government went beyond its usual pace and relatively quickly introduced several incentive schemes to attract foreign manufacturers. These schemes have already attracted several major foreign and domestic manufacturers to the country and the trend is expected to continue as more industries are included within the policies.

The key policy introduced during the pandemic was the Production Linked Incentive Scheme (PLI) scheme, that provided incentive on the incremental sales of goods in certain target segments. Under the production-linked initiative (PLI), incentives were approved to boost domestic production, and to attract investment in mobile phone manufacturing and specified electronic components including assembly, testing, marking, and packaging (ATMP) units. In November 2020, this was further extended to 10 flagship sectors such as pharmaceuticals, automotive, and telecom.

The scheme has been highly successful in attracting not only domestic enterprises but also foreign companies. Companies such as Samsung, and contract manufacturers of Apple such as Foxconn Hon Hai, Wistron, and Pegatron have already received approval under the PLI mobile manufacturing scheme. In the electronic components segment, companies such as Visicon, Vitesco, and AT&S have also received approvals. As for the medical devices sector, companies such as Siemens and Wipro GE have been selected.

Developing connectivity

One of the crucial components that drive and sustain economic growth in a country is infrastructure, as it is critical for improving and maintaining the country’s manufacturing competitiveness leading to higher growth. The key challenges in India’s infrastructure sector are land acquisition policies, implementation delays, and the risk of project overruns due to bureaucratic delays. However, the current government has ensured to minimize such delays, reduce complexities, and improve transparency in projects in India to increase the pace of infrastructure projects.

The government launched the National Infrastructure Pipeline (NIP) for FY 2019-25, an INR 111-lakh-crore (US$1.5 trillion) group of infrastructure projects aimed at improving ease of living and business environment. Initially, it was earmarked for 6,835 projects, which was further expanded to 7,400 projects in 2021. Roads, housing, urban development, railways, conventional power, renewable energy, and irrigation account for the majority of the project value.

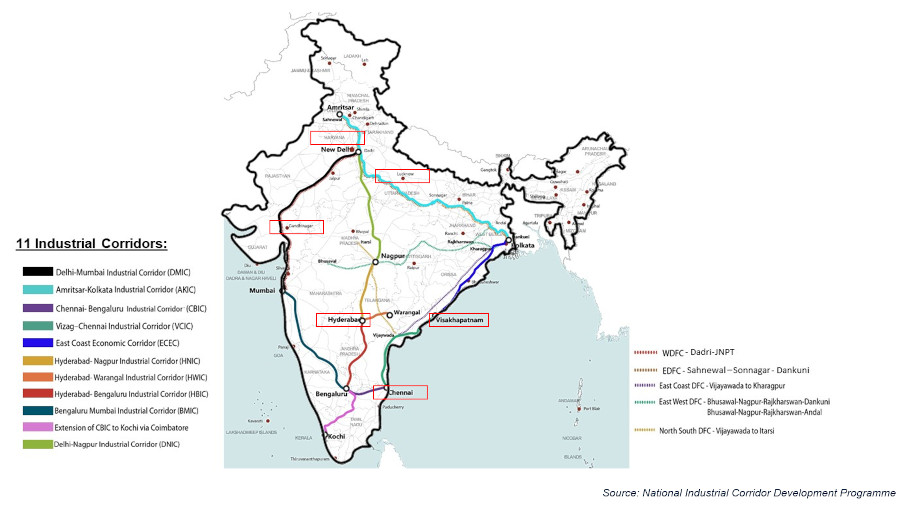

Under these infrastructure projects, several key programs solely focus on highways and railways that aim to reduce logistics costs. The government is developing several Industrial Corridor Projects as part of the National Industrial Corridor program, which is focused on the development of industrial cities and improve connectivity, that can compete with the top global investment destinations. In addition, the government had also established a Special Purpose Vehicle for construction, operation, and maintenance of dedicated freight corridors under the Dedicated Freight Corridor (DFC) that aims to decongest the existing rail network by constructing dedicated tracks for goods trains. Currently, the construction for both projects is in full swing.

Recent Developments – India and China

Historical economic and trade ties between India and China have been strong despite several geopolitical challenges. However, recent border tensions have led to relative deterioration in the bilateral ties impacting investments and trade.

Despite strict actions by the Indian government such as banning Chinese apps and restricting investments from countries with shared land borders (which includes China), the full-fledged deterioration of economic relations between India and China is highly unlikely. This is largely due to

the import dependency that some sectors in India have for Chinese inputs. This was also one of the reasons that the Indian government has aggressively pitched policies under the Atmanirbhar Bharat (Self-reliant India) program to ensure self-reliance. The Indian government is likely to safeguard longer-term considerations of security more proactively as it opens the door to new sources of investments to diversify.

Competitiveness

Rising labor cost, US-China trade war, along with the need for supply chain diversification, has forced manufacturers to relocate to alternative locations in South and South East Asia. India along with ASEAN nations hopes to take advantage of this trend and continue to vie for investments.

Despite South East Asia being a highly competitive region, especially Vietnam, India has its own set of advantages that sets it apart from its competitors. In addition, some of the advantages are also applicable when comparing India to China for manufacturing purposes.

India’s advantages lie in areas such as:

- Stable democratic government with relatively consistent and investor-friendly policies

- Huge consumer market with the total population expected to increase to 1.4 billion by 2025

- Relatively low labor cost along with a growing educated workforce

- Huge youth population

- Growth in disposable income

- Rise in rural consumption

- Increase in urbanization – by 2030, around 42% of the population would be urbanized

- Significant investments in infrastructure that will increase supply chain linkages

- Part of key maritime trade route in the Indian Ocean

- Growing economic influence in the region

Trade Linkages

Despite its advantages, India continues to lag when compared to other competitive economies in trade linkages. Historically, India has been skeptical about the gains from trade agreements, which is not the case for counties in South East Asia, such as Vietnam. In most cases, India has not seen much of a difference in growth exports with countries with which it has a free trade agreement (FTA) compared to countries with which it doesn’t have an agreement.

In the case of the Regional Comprehensive Economic Partnership (RCEP), India opted out of the agreement in 2019, mostly over concerns related to cheaper imports, tariff commitments, circumvention of rules of origin, and impact on certain domestic sectors.

With fewer FTAs in place, there will be an impact on trade ties and investor sentiments. India needs to review its existing bilateral FTAs and enter into newer agreements with individual countries or trade bloc such as the EU if it wants to compete at all levels with South East Asian economies for investments.

Besides, India also needs to move up the value chain to ensure that reductions in tariffs under an FTA that they enter into has their intended impact, rather than an increase in the trade deficit for the country.

Conclusion

Although it is an uphill battle, India has all the crucial elements that can be utilized to make it one of the leading manufacturing hubs, not only in Asia but globally. However, the government can not only depend on its low labor costs and demographics, and need to continue investing in infrastructure, skill development, education, and ensure a relatively stable regulatory environment, if it wants to move up the global supply chain, which is a key prerequisite for global manufacturing investors.

Koushan Das oversees the management of client projects in India for Dezan Shira & Associates Business Intelligence Unit, providing strategic solutions for foreign companies seeking to enter into or expand operations within India. Koushan holds an MBA in International Business from the IILM University in Gurgaon, and a BE degree in Computer Technology.

E: India@dezshira.com

W: www.dezshira.com

M: www.india-briefing.com

Disclaimer

Any views or opinions represented in this blog are personal commentary, belong solely to the contributor and do not necessarily represent the views of Asia Briefing Limited or Dezan Shira & Associates.