Vietnam Introduces New Visa Application Fees and Procedures

Nov. 28 – The Vietnamese government has relaxed previous visa application requirements whereby foreigners had to apply at Vietnamese embassies and consulates in their country of origin to obtain single or multiple-entry visas. Now, Vietnam has outsourced the process to a number of select companies who can quickly process visa applications online.

China’s Transfer Pricing Obligations

Nov. 21 – Transfer pricing concerns the prices charged between associated enterprises established in different tax jurisdictions for their inter-company transactions. Relevant prices are those for services, intangible property and financing activities. The transfer pricing regime in China is generally consistent with the OECD guidelines and has developed rapidly over the past few years. A […]

Asia Briefing Releases New Guide: Human Resources and Payroll in China

Asia Briefing has just released a new 102-page guide introducing everything that foreign investors in China should be familiar with from the human resources and payroll management perspective.

Annual Audit and Compliance for Foreign-Invested Entities in India

Oct. 15 – Annual audit and compliance procedures are relatively simple for foreign representation entities compared to Indian setup entities. Foreign Representation Entities For annual compliance, foreign representation entities are required to file the following: Audited balance sheet Profit and loss accounts Director’s report Statutory auditors’ report Annual account of holding company List of places […]

A FESCO as a Tool for Labor Dispatch in China

Oct. 12 – Many foreign-invested companies and representative offices in China have a contract in place with a FESCO (Foreign Enterprise Service Company) for labor dispatch, payroll and/or additional services for Chinese employees. Many foreign investors assume that FESCO is a single organization, but in fact it is a generic term used by dozens of […]

Setting Up a Company in Vietnam

Sept. 27 – The first step in setting up a business in Vietnam is acquiring an Investment Certificate (IC), also known as a Business Registration Certificate. The time period required to acquire an IC varies by industry and entity type, as these determine the registrations and evaluations required: For projects that require registration, IC issuance […]

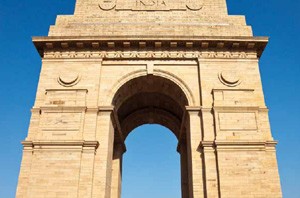

Asia Briefing Report: An Introduction to Doing Business in India

Asia Briefing’s new 30-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in India.

Housing for Foreigners in Vietnam

Sept. 26 – Foreigners working in Vietnam for an extended period of time must find housing outside of a hotel, generally by renting an apartment/house. In 2008, after a good deal of debate, the door was also officially opened for foreign individuals and organizations, as well as overseas Vietnamese citizens and organizations, to purchase apartments […]

Double Taxation Agreements for China Investment

Sept. 18 – Simply put, double taxation agreements (DTAs) aim to prevent the same income from being taxed by two or more states, while also eliminating tax evasion and encouraging cross-border trade efficiency. DTAs are mostly of a bilateral nature and, while DTA-signing countries are not all members of the Organization for Economic Cooperation and […]

Asia Briefing Report: An Introduction to Doing Business in Vietnam

Asia Briefing has just released a new 32-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in Vietnam.