New Issue of India Briefing: India’s Taxes for Foreign-Invested Entities

Jan. 17 – The new issue of India Briefing Magazine, titled India’s Taxes for Foreign-Invested Entities, is out now available as a complimentary PDF download on the Asia Briefing Bookstore. Recent tax amendment controversy creates an excellent opportunity to provide an overview of the relevant taxes for foreign-invested entities in India, including the most important […]

Vietnam and Singapore Sign Second Protocol to Amend DTA

Jan. 16 – On September 12, 2012, Singaporean Deputy Prime Minister and Minister for Finance Tharman Shanmugaratnam and Vietnamese Minister of Finance Vuong Dinh Hue signed a second Protocol to amend the existing double taxation agreement (DTA) between the two countries. The DTA entered into force on January 11, 2013 in Singapore, and will be […]

China Expat Tax Filing and Declarations for 2012 Income

Individual income tax finalization for foreigners in China By Eunice Ku Jan. 14 – Individual income tax (IIT) is normally withheld from wages or salaries by employers and paid to the tax authorities on a monthly basis (within 15 days of the end of each month). An annual IIT declaration should be submitted to tax […]

Annual Tax Finalization in Vietnam

Jan. 11 – At the end of the year, in addition to completing corporate income tax (CIT) finalization, enterprises must complete personal income tax (PIT) on behalf of their employees. Following the finalization process at the end of the fiscal year, or when terminating the investment project in Vietnam, foreign investors are allowed to remit […]

New Issue of China Briefing: Annual Compliance, License Renewals & Audit Procedures

In this issue of China Briefing Magazine, we discuss annual compliance requirements for China foreign-invested entities and detail the full audit processes for representative offices, wholly foreign owned enterprises, and joint ventures in China.

New Issue of Vietnam Briefing: Annual Compliance and Audit

Dec. 24 – The new issue of Vietnam Briefing Magazine, titled Annual Compliance and Audit, is out now and temporarily available as a complimentary PDF download on the Asia Briefing Bookstore. In Vietnam, the standard tax year is typically the calendar year, and therefore the deadline for foreign-owned entities to submit audited financial reports to […]

Corporate Tax Rates in India

Dec. 13 – In this article, we outline some of the key tax responsibilities for both foreign and domestic companies operating in India with regards to the following areas: Corporate Income Tax Value-Added Tax Goods and Service Tax Withholding Tax

New Issue of China Briefing: The Asia Tax Comparator

Dec. 1 – The new issue of China Briefing Magazine, titled The Asia Tax Comparator, is out now and will be temporarily available as a complimentary PDF download on the Asia Briefing Bookstore throughout the month of December. This month’s issue also offers our new 2013 Asia Tax Guide as a complimentary supplement, providing an […]

China’s Transfer Pricing Obligations

Nov. 21 – Transfer pricing concerns the prices charged between associated enterprises established in different tax jurisdictions for their inter-company transactions. Relevant prices are those for services, intangible property and financing activities. The transfer pricing regime in China is generally consistent with the OECD guidelines and has developed rapidly over the past few years. A […]

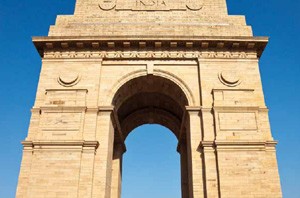

Asia Briefing Report: An Introduction to Doing Business in India

Asia Briefing’s new 30-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in India.