China Briefing

China's Visa-Free Policies: Latest Updates

02/15/2026This article looks at all of the China visa-free policies that are currently in place.

China Enforces Higher Salary Thresholds for A/B Work Permits

02/12/2026China has tightened enforcement of salary-based requirements for foreign work permits, with major cities applying full 6× and 4× multipliers. These changes impact both new applications and renewals, increasing compliance obligations for employers and foreign staff.

An Update on Work Permit Renewal for Foreign Talent in Shenzhen

02/05/2026Shenzhen has tightened enforcement of age thresholds for Category B and C work permit renewals, with applicants aged 60 and above now facing rejection from 2026 onward.

Preparing for Chinese New Year 2026: Workforce Management and Business Continuity

02/03/2026As Chinese New Year 2026 approaches, businesses must prepare for one of the most operationally disruptive periods in the China business calendar. Proactive workforce planning, payroll compliance, and continuity measures will be critical to ensuring a smooth transition before and after the holiday.

China Minimum Wage Standards 2026

01/22/2026This article offers a guide to minimum wages in the Chinese Mainland and discuss how labor costs are affected by changes to the minimum wage levels. The data is current as of January 22, 2026.

The Greater Bay Area IIT Subsidy for 2026 Kickstarts in Shenzhen

01/16/2026Shenzhen has opened applications for the 2026 GBA IIT subsidy program. High-end foreign talent have until March 31 to apply for a rebate on the portion of IIT paid in excess of 15 percent of their taxable income.

-

01/01/2026

Hong Kong Public Holidays 2026 Schedule

China Briefing -

12/23/2025

An Introduction to Doing Business in China 2026 - New Publication Out

China Briefing -

12/10/2025

Performance Appraisals in China: How Employers Can Legally Link It to Pay

China Briefing -

12/04/2025

Non-fixed-Term Labor Contract in China: Rules Further Clarified Under Judicial Interpretation II

China Briefing -

11/20/2025

Shanghai’s Overseas Qualification Recognition List: What Foreign Professionals Need to Know

China Briefing

India Briefing

What Counts as an “Industry” Under Indian Law? Supreme Court to Decide on March 17-18

02/16/2026India’s Supreme Court will revisit the definition of “industry” under the Industrial Disputes Act, 1947, a ruling that could directly influence the interpretation and implementation of the Industrial Relations Code, 2020.

Uttar Pradesh Updates Shops & Establishments Law: Check Applicability, Working Hours, and Compliance

02/11/2026The Indian state of Uttar Pradesh has overhauled its Shops and Commercial Establishments Act, expanding statewide applicability and modernizing employer compliance. The latest updates include threshold-based coverage, digital registration, revised working hours, and stronger enforcement for businesses operating in the state.

Madhya Pradesh Shops & Establishments Act Amendment: Digital Compliance Reforms and Employer Implications

02/10/2026The Madhya Pradesh Shops & Establishment Act, Second Amendment, enacted on December 15, 2025, brings digital registration, online inspections, real-time updates, and simplified compliance for employers operating in the state.

One Central Registration: India's Answer to Labor Compliance Complexity

02/09/2026India’s one central registration under the new labor codes streamlines employer registrations, licenses, and returns, while preserving statutory worker protections.

Gujarat Updates Labor Rules for Shops & Commercial Establishments

01/14/2026Gujarat’s Shops & Establishments amendments, notified on December 16, 2025, introduce key labor compliance changes, including higher applicability thresholds, extended working and overtime limits, and regulated night-shift employment for women.

An Introduction to Doing Business in India 2026 - New Publication Out Now

01/07/2026The 2026 edition of 'An Introduction to Doing Business in India' provides practical insights for foreign firms and investors navigating India’s fast-evolving market, covering key policy developments and essential legal and operational areas such as company incorporation, taxation, audit, and HR and payroll.

-

01/02/2026

How India’s New Labor Codes Will Reshape M&A Transactions in 2026

India Briefing -

12/31/2025

India Releases Labor Code Draft Rules; Stakeholder Feedback Begins Dec. 31, 2025

India Briefing -

12/18/2025

How India's New e-B-4 Visa Solves Your Foreign Talent Challenges

India Briefing -

12/16/2025

India Streamlines Business Visa Approval for Chinese Professionals to 4 Weeks

India Briefing -

12/16/2025

How to Navigate Cultural Differences in India to Succeed in Your Business Journey

India Briefing

Vietnam Briefing

Vietnam's Personal Data Protection: Key Requirements under Decree 356

01/26/2026Vietnam's personal data protection rules have tightened under Decree 356. Learn about new compliance duties for businesses operating in Vietnam.

2026 Vietnam Public Holiday Schedule: Vietnam Culture Day Added as New Public Holiday

01/13/2026November 24 has been officially designated as Vietnam Culture Day and recognized as an annual public holiday.

Vietnam Mandates Centralized Electronic Labor Contracts from July 2026: Key Requirements under Decree 337

12/31/2025From July 1, 2026, Vietnam’s government mandates that all electronic labor contracts must be digitally managed on a centralized platform.

Vietnam Amends Personal Income Tax Law: Key Highlights and Business Implications

12/10/2025Vietnam’s National Assembly approves the amended Law on Personal Income Tax, aiming to broaden the tax base while lowering inequality.

Vietnam E-Visa: A Complete Guide

12/09/2025Vietnam’s e-visa program makes it easier and faster for visitors to Vietnam to enter the country. The country has recently added 41 new ports that accept e-visas for entry, bringing the total to 83.

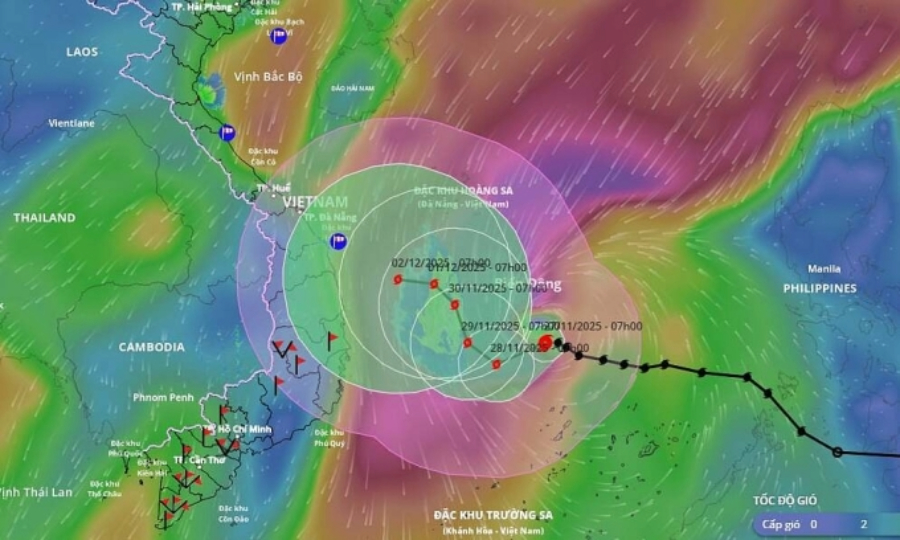

Typhoon Koto Update: Current Status, Forecasts, and Preparedness Measures

11/27/2025Typhoon Koto (Storm No. 15) has intensified over the central South China Sea, bringing dangerous winds and rough seas.

-

11/24/2025

Strategic Approaches to HR and Payroll Management in Vietnam

Vietnam Briefing -

11/19/2025

Enforcing Vietnam's Social Insurance Law: New Measures on Late Payments and Evasion

Vietnam Briefing -

11/11/2025

Vietnam’s Regional Minimum Wage Effective from January 1, 2026

Vietnam Briefing -

09/10/2025

Hanoi Issues Guidance on Work Permit Procedures for Foreign Employees

Vietnam Briefing -

08/25/2025

Typhoon Kajiki to Make Landfall in Central Vietnam

Vietnam Briefing

ASEAN Briefing

Vietnam’s 183-Day Rule: Tax Implications for Foreign Employees

02/11/2026Understand how Vietnam’s 183-day rule changes tax exposure, withholding, and assignment structuring for foreign staff.

Malaysia Revises Its Expatriate Employment Policy

01/19/2026Malaysia will revise its expatriate employment policy from June 2026, raising salary thresholds and introducing time limits for Employment Pass holders.

Local Director and Management Presence Requirements in Singapore

01/06/2026Foreign investors should assess Singapore’s local director and management presence rules, nominee disclosure updates, and governance expectations.

Should Foreign Companies in Indonesia Appoint Local Directors for Governance or Compliance Only?

12/22/2025Foreign companies in Indonesia must assess when local directors should hold real authority and how governance choices affect risk and control.

Employment Contracts and Probation Rules for Foreign Employers in Vietnam

12/17/2025How Vietnam’s employment contracts and probation rules affect foreign employers, workforce flexibility, and compliance risk in practice.

Contract of Service vs Contract for Service in Malaysia

12/09/2025Foreign employers can distinguish between Malaysia’s contract of service and contract for service to manage hiring compliance, worker rights, and classification risks.

-

11/26/2025

Thailand Introduces Digital Work Permit System for Foreign Employers

ASEAN Briefing -

11/17/2025

Payroll in Malaysia: Understanding Monthly Tax Deductions, EPF, and SOCSO Contributions

ASEAN Briefing -

11/04/2025

Which Philippine Work Visa Best Fits Foreign Investors

ASEAN Briefing -

10/29/2025

Employment Contracts in Indonesia: Fixed-Term Vs Permanent

ASEAN Briefing -

10/24/2025

Avoiding Penalties During Labor Inspections in Indonesia

ASEAN Briefing

Our firm Dezan Shira & Associates provides legal, tax and operational advisory across Asia.

Our firm Dezan Shira & Associates provides legal, tax and operational advisory across Asia.