Economy & Trade

Europe’s India Pivot: Ports, Missiles, and AI

02/18/2026In this op-ed, we discuss how Europe appears to be deepening its engagement with India across maritime connectivity, defense co-production, and AI innovation and governance. A cluster of leadership visits and industrial agreements following the conclusion of the India–EU FTA signals a structural alignment rather than temporary diplomatic momentum.

Modi and Macron Elevate India-France Ties to 'Special Global Strategic Partnership'

02/18/2026On February 17, 2026, India's prime minister and the French president announced the Special Global Strategic Partnership, formalizing deeper defense, aerospace, and advanced technology integration. For foreign firms and investors, the framework enhances policy predictability and long-term industrial and investment alignment.

India’s Orange Economy: Creative Industries Outlook After Budget 2026

02/16/2026As of 2026, India’s orange economy is emerging as a high-growth services opportunity, spanning media, live concerts, AVGC, and creative industries, supported by policy reform.

India Fast-Tracks New Drug & Clinical Trial Approvals with 2026 NDCT Amendments

02/12/2026India’s 2026 amendments to the New Drug and Clinical Trials (NDCT) Rules, 2019, materially improve the operating environment for pharmaceutical companies, contract manufacturers, and foreign investors by compressing approval timelines and reducing pre-licensing bottlenecks.

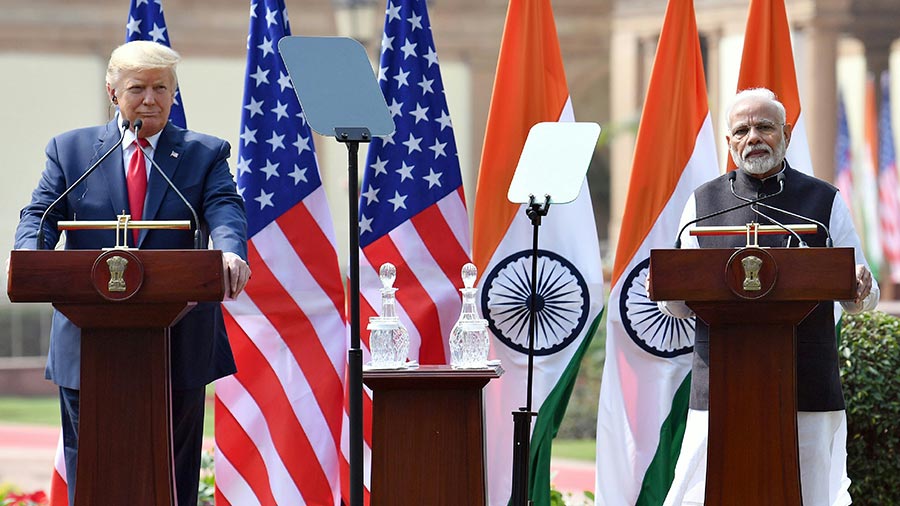

After 10 Months of Tariff Deadlock, US and India Find Common Ground on Trade

02/11/2026The White House has revised its February 2026 factsheet on the interim India-US trade framework, softening procurement language from “committed” to “intends” regarding over US$500 billion in US goods.

India Pitches Semiconductors, Clean Energy to Malaysian Capital During Modi Visit

02/09/2026Prime Minister Narendra Modi's visit to Kuala Lumpur, Malaysia, signals India's push to attract Malaysian capital into semiconductors, clean energy, digital payments, and advanced manufacturing.

-

02/06/2026

US to Reduce Tariffs on Indian Exports Within Days: India's Commerce Minister

India Briefing -

02/05/2026

CDSCO Introduces Online Risk Classification Portal for Medical Device Importers and Manufacturers

India Briefing -

02/03/2026

India-US Trade Deal Cuts Tariffs, Lifts Export and Investment Outlook

India Briefing -

02/01/2026

India Briefing

-

01/30/2026

Economic Survey of India 2025–26: Looking Beyond Headline Numbers

India Briefing

Tax & Accounting

India's Component Warehousing Safe Harbor: A Competitive Tax Proposition for Global Manufacturers

02/11/2026India’s Budget 2026-27 introduces a 2 percent safe harbor for bonded component warehousing and a five-year tax exemption for non-resident suppliers, offering transfer pricing certainty and strengthening India’s role in global manufacturing supply chains.

India Unveils Draft Income Tax Rules, 2026 Ahead of April 1 Rollout

02/09/2026India’s tax administration has released the draft Income Tax Rules, 2026. The proposal streamlines the compliance framework, reducing it to 333 rules and 190 statutory forms. Public consultation remains open until February 22, 2026.

Budget 2026 Explainer: Tax Clarity and Incentives for Cloud, Data Centers & AI Players

02/02/2026Budget 2026–27 elevates data centers to strategic infrastructure, pairing tax exemptions and regulatory certainty with India’s fast-growing digital demand. For global cloud players, India is moving from an emerging data center market to a scale-and-stability play position.

Budget 2026 Resets GIFT City Economics for Banks with 20-Year IBU Tax Holiday

02/02/2026India’s Union Budget 2026 proposes a 20-year tax holiday during a 25-year period for International Banking Units in GIFT City, followed by a concessional 15 percent tax rate.

What the Binny Bansal Tax Residency Ruling Means for HNIs Moving Abroad

01/30/2026The ITAT’s ruling on the Binny Bansal tax residency case highlights that global mobility without meaningful economic disengagement does not eliminate tax exposure. For founders and investors, substance and timing outweigh physical location or day-count management when seeking treaty benefits.

US Parent-India Subsidiary: Transfer Pricing and Intercompany Agreements

01/22/2026US parent companies with subsidiaries in India face heightened transfer pricing scrutiny when intercompany agreements, operational reality, and financial outcomes do not align. Ensuring documentation consistently reflects the Indian subsidiary’s role and value creation is critical to managing audit and dispute risk.

-

01/19/2026

Tiger Global-Flipkart Tax Dispute: A Landmark Test of India’s Anti-Avoidance Regime

India Briefing -

01/07/2026

An Introduction to Doing Business in India 2026 - New Publication Out Now

India Briefing -

12/29/2025

Claiming DTAA Benefits in India: What Every NRI Must Know to Reduce Tax Liability

India Briefing -

12/15/2025

India-France Tax Treaty Update Favors Long-Term Investors, Expands Capital Gains Rights

India Briefing -

12/03/2025

Bank Account Freeze Under GST: Legal Remedies and Business Continuity Steps

India Briefing

Legal & Regulatory

What Counts as an “Industry” Under Indian Law? Supreme Court to Decide on March 17-18

02/16/2026India’s Supreme Court will revisit the definition of “industry” under the Industrial Disputes Act, 1947, a ruling that could directly influence the interpretation and implementation of the Industrial Relations Code, 2020.

New FEMA Guarantees Framework: From Approval-Centric Controls to a Principle-Led Regime

02/16/2026The RBI has replaced the Foreign Exchange Management (Guarantees) Regulations, 2000, with the 2026 Regulations, introducing a principle-based, eligibility-driven framework under FEMA while retaining the underlying statutory prohibition structure.

India's Antitrust Regulator CCI Fines Intel US$3.01 Million for Abuse of Dominant Position

02/13/2026Antitrust regulator CCI has imposed a US$3.01 million fine on Intel Corporation for an India-specific warranty policy deemed discriminatory and restrictive of parallel imports. The ruling clarifies how dominance is assessed under Indian competition law and highlights key compliance risks global companies.

Deepfake, Content Labeling & Safe Harbor Risks for Global Platforms: India’s 2026 AI Regulation

02/12/2026India’s latest updates to the IT (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021, tighten artificial intelligence (AI) and deepfake regulation with mandatory labeling and 2-3 hour takedowns, putting safe harbor protection at risk for foreign platforms.

India Fast-Tracks New Drug & Clinical Trial Approvals with 2026 NDCT Amendments

02/12/2026India’s 2026 amendments to the New Drug and Clinical Trials (NDCT) Rules, 2019, materially improve the operating environment for pharmaceutical companies, contract manufacturers, and foreign investors by compressing approval timelines and reducing pre-licensing bottlenecks.

Uttar Pradesh Updates Shops & Establishments Law: Check Applicability, Working Hours, and Compliance

02/11/2026The Indian state of Uttar Pradesh has overhauled its Shops and Commercial Establishments Act, expanding statewide applicability and modernizing employer compliance. The latest updates include threshold-based coverage, digital registration, revised working hours, and stronger enforcement for businesses operating in the state.

-

02/10/2026

India Briefing

-

02/09/2026

One Central Registration: India's Answer to Labor Compliance Complexity

India Briefing -

02/05/2026

India’s New Insurance FDI Framework Takes Effect from February 5, 2026

India Briefing -

01/30/2026

What the Binny Bansal Tax Residency Ruling Means for HNIs Moving Abroad

India Briefing -

01/29/2026

India Amends Foreign Investment Rules for Insurance Companies: What Global Insurers Need to Know

India Briefing

Industries

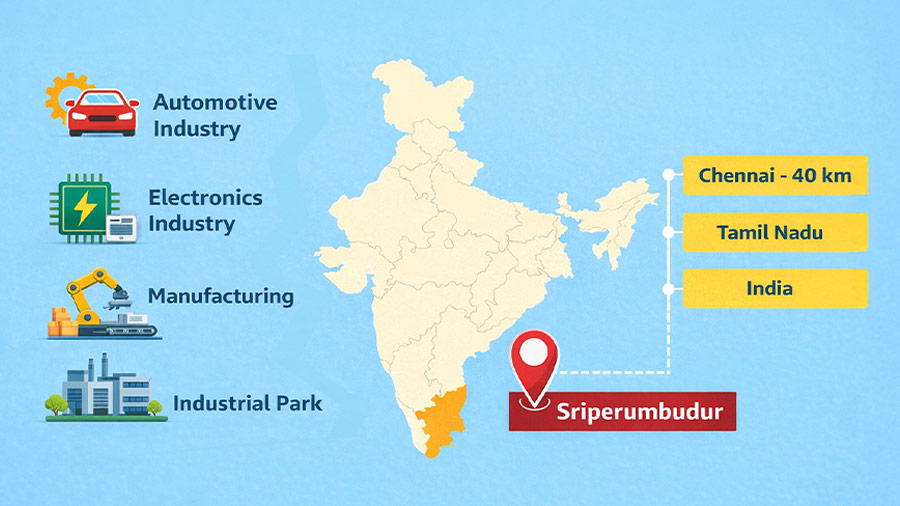

Investing in Sriperumbudur: Tamil Nadu's High-Value Manufacturing Corridor

02/17/2026Sriperumbudur in Tamil Nadu is one of India’s most strategic high-value corridors, propelled by electronics production and a strong global OEM presence, including Foxconn. The region offers a scalable and de-risked platform for investment in India through 2026.

What Counts as an “Industry” Under Indian Law? Supreme Court to Decide on March 17-18

02/16/2026India’s Supreme Court will revisit the definition of “industry” under the Industrial Disputes Act, 1947, a ruling that could directly influence the interpretation and implementation of the Industrial Relations Code, 2020.

India’s Orange Economy: Creative Industries Outlook After Budget 2026

02/16/2026As of 2026, India’s orange economy is emerging as a high-growth services opportunity, spanning media, live concerts, AVGC, and creative industries, supported by policy reform.

India Fast-Tracks New Drug & Clinical Trial Approvals with 2026 NDCT Amendments

02/12/2026India’s 2026 amendments to the New Drug and Clinical Trials (NDCT) Rules, 2019, materially improve the operating environment for pharmaceutical companies, contract manufacturers, and foreign investors by compressing approval timelines and reducing pre-licensing bottlenecks.

India's Textile PLI Scheme: Extended Window till March 31

02/10/2026India has extended the application window for the Textile PLI Scheme to March 31, 2026. Businesses in the textile sector should act quickly to secure incentives for scaling production and strengthening export competitiveness.

India’s New Insurance FDI Framework Takes Effect from February 5, 2026

02/05/2026India’s liberalized insurance foreign direct investment (FDI) regime is now operational, allowing up to 100 percent foreign ownership from February 5, 2026, under the amended insurance laws.

-

02/02/2026

Budget 2026 Resets GIFT City Economics for Banks with 20-Year IBU Tax Holiday

India Briefing -

02/01/2026

India Briefing

-

01/29/2026

Investing in India’s Insurance Sector: Frequently Asked Questions

India Briefing -

01/29/2026

India Amends Foreign Investment Rules for Insurance Companies: What Global Insurers Need to Know

India Briefing -

01/28/2026

Luxury Cars Take the Fast Lane: How European Carmakers Stand to Gain from the India-EU FTA

India Briefing

HR & Payroll

What Counts as an “Industry” Under Indian Law? Supreme Court to Decide on March 17-18

02/16/2026India’s Supreme Court will revisit the definition of “industry” under the Industrial Disputes Act, 1947, a ruling that could directly influence the interpretation and implementation of the Industrial Relations Code, 2020.

Uttar Pradesh Updates Shops & Establishments Law: Check Applicability, Working Hours, and Compliance

02/11/2026The Indian state of Uttar Pradesh has overhauled its Shops and Commercial Establishments Act, expanding statewide applicability and modernizing employer compliance. The latest updates include threshold-based coverage, digital registration, revised working hours, and stronger enforcement for businesses operating in the state.

Madhya Pradesh Shops & Establishments Act Amendment: Digital Compliance Reforms and Employer Implications

02/10/2026The Madhya Pradesh Shops & Establishment Act, Second Amendment, enacted on December 15, 2025, brings digital registration, online inspections, real-time updates, and simplified compliance for employers operating in the state.

One Central Registration: India's Answer to Labor Compliance Complexity

02/09/2026India’s one central registration under the new labor codes streamlines employer registrations, licenses, and returns, while preserving statutory worker protections.

Gujarat Updates Labor Rules for Shops & Commercial Establishments

01/14/2026Gujarat’s Shops & Establishments amendments, notified on December 16, 2025, introduce key labor compliance changes, including higher applicability thresholds, extended working and overtime limits, and regulated night-shift employment for women.

An Introduction to Doing Business in India 2026 - New Publication Out Now

01/07/2026The 2026 edition of 'An Introduction to Doing Business in India' provides practical insights for foreign firms and investors navigating India’s fast-evolving market, covering key policy developments and essential legal and operational areas such as company incorporation, taxation, audit, and HR and payroll.

-

01/02/2026

How India’s New Labor Codes Will Reshape M&A Transactions in 2026

India Briefing -

12/31/2025

India Releases Labor Code Draft Rules; Stakeholder Feedback Begins Dec. 31, 2025

India Briefing -

12/18/2025

How India's New e-B-4 Visa Solves Your Foreign Talent Challenges

India Briefing -

12/16/2025

India Streamlines Business Visa Approval for Chinese Professionals to 4 Weeks

India Briefing -

12/16/2025

How to Navigate Cultural Differences in India to Succeed in Your Business Journey

India Briefing

Our firm Dezan Shira & Associates provides legal, tax and operational advisory across Asia.

Our firm Dezan Shira & Associates provides legal, tax and operational advisory across Asia.