The Cost of Doing Business in ASEAN Compared with China – New Issue of Asia Briefing Magazine

The newest issue of Asia Briefing magazine, titled “The Cost of Doing Business in ASEAN Compared with China”, is out now and available as a complimentary download in the Asia Briefing Bookstore.

ASEAN’s 2015 AEC Compliance Deadline – What It Actually Means

Chris Devonshire-Ellis explains what the much publicized “AEC Deadline” which is due at 31st December 2015 really means for your business in ASEAN.

India: Your China Plus One?

Modi will attempt to put a dent in India’s trade deficit with China, but his real challenge is changing the way businesspeople in China think about India.

City Spotlight: Investing in Jakarta

Located on the northwest coast of Java, Jakarta is the capital of Indonesia and the largest city in the country. Strategically located in the archipelago, Jakarta serves as the gateway to the rest of the country. In this article, we highlight the city’s key industries and opportunities for SMEs.

China’s AIIB – The Facts To Know

The deadline has passed to become a founding member of the Asia Infrastructure Investment Bank, China’s answer to the World Bank. Most Asian countries are on board, as well as Australia and the key Western European nations. The New Silk Road is taking a tangible form.

Quality and Cost of Living Reports Point Towards Emerging Trends in Asia-Pacific

Mercer’s 2015 Quality of Living Rankings confirms some well-established insights into Asian cities. However, rankings alone can be notoriously superficial. In this article, we explore the trends which stand up to scrutiny.

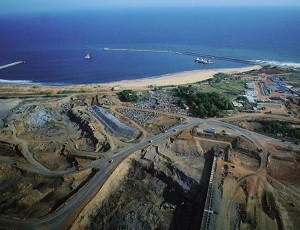

Asian Investment in Europe’s Shipping Sector, Part 2: Asian Shipping Centers & Routes to Watch

Asian shipping centers continue to go from strength to strength. In the second of our two-part article on Asian investment in Europe’s shipping sector, we look at how these centers have developed and discuss important shipping routes in the Asia-Pacific region.

It’s Wait and See for the Mooted China-India-Sri Lanka Partnership

Sri Lanka found itself in the faintly odd position of being feted by two superpowers last week, as new Sri Lankan Foreign Minister Mangala Samaraweera met with Chinese Foreign Minister Wang Yi in Beijing. Not surprisingly, the visit does not sit especially well with India, just an hour away from Sri Lanka’s west coast.

Choosing a Sourcing Model in China and Vietnam

China and Vietnam are two of Asia’s most appealing destinations for outsourcing. Here, we discuss how ‘indirect’ and ‘direct’ sourcing platforms function in both and discuss some of the HR and compliance issues that foreign companies should be aware of.

Quality Standards in Asia: Regional Differences and Long-Term Trends

A typical assumption made by purchasing managers is that quality standards applying to products made in Asia for export are similar to those of the West. However, there are strong differences between the quality control standards in different countries and between purchasers, both on the demand and the supply sides.