Economy & Trade

Vietnam’s New Law on Rehabilitation and Bankruptcy: Aligning the Insolvency Framework with International Practice

02/12/2026Vietnam’s 2025 Law on Rehabilitation and Bankruptcy transforms its insolvency system by focusing on debtor-led rehabilitation with early intervention, court oversight, and structured creditor involvement.

Resolution 79: What Vietnam’s SOE Strategy Means for Private Businesses

02/09/2026Vietnam’s Resolution 79 positions state-owned enterprises as strategic anchors, reshaping opportunities for private-sector growth.

Vietnam Suspends Effectiveness of Decree 46 on Food Safety

02/04/2026Vietnam’s government has moved swiftly to address a series of practical difficulties emerging from the rollout of Decree No. 46/2026/ND-CP, a major new regulation implementing the Law on Food Safety.

India-EU FTA vs. EVFTA: A Comparative Look at Their Strategic Impact on EU Business Expansion

02/02/2026A comparative view of the FTAs with India and Vietnam reveals how the EU has customized its trade approach for different partners.

Da Nang After Merger: A New Industrial and Investment Landscape

01/30/2026Da Nang City is one of Vietnam’s six centrally governed cities and a designated national growth pole, playing a pivotal role in the South Central Coast and Central Highlands.

Green Transition in Vietnam’s Industrial Parks: Part 1 – Policy Foundations and Landscape

01/29/2026Vietnam’s industrial parks are shifting toward eco-industrial models, renewable energy, and green standards amid global supply chain changes.

-

01/22/2026

Vietnam Economic Performance in 2025: GDP, FDI, and Trade

Vietnam Briefing -

01/21/2026

EU Sustainability Due Diligence Rules: Compliance Implications for Vietnam Businesses

Vietnam Briefing -

01/12/2026

Dezan Shira & Associates Releases Asia Manufacturing Index 2026 Amid Intensifying Competition

Vietnam Briefing -

12/30/2025

Vietnam Briefing

-

12/19/2025

An Introduction to Doing Business in Vietnam 2026 – New Publication Out

Vietnam Briefing

Tax & Accounting

Driving Vietnam’s Private Sector Growth: Core Incentives Introduced by Decree 20/2026

02/10/2026Vietnam’s Decree No. 20/2026/ND-CP outlines incentives for private-sector development, covering taxes, fees, land, and human resources.

Fraud Prevention and Investigation in Vietnam: Guidance for Foreign Investors

02/03/2026Vietnam’s fraud risks often stem from weak internal controls, excessive trust in local partners, or fast growth without adequate governance frameworks. Proactive fraud prevention and building transparent systems are essential to safeguarding operations.

Preparing for Vietnam’s Special Consumption Tax Changes in 2026: Key Compliance Highlights

01/28/2026Vietnam applies new Special Consumption Tax rules from January 1, 2026, detailing key changes and compliance impacts for businesses.

Vietnam Abolishes Business License Tax from 2026

01/27/2026Vietnam official abolishes the business license tax (BLT), effective January 1, 2026, to reduce compliance costs and promote business growth.

Understanding Key Indirect and International Taxes in Vietnam

01/20/2026We outline the key indirect taxes and highlight several international tax considerations applicable in Vietnam.

Understanding Functional Currency in Vietnam’s Accounting Regime

01/09/2026Vietnam’s Circular 99 clarifies how enterprises determine, change, and translate functional currency, including VND reporting and disclosure requirements.

-

01/05/2026

Administrative Penalties for Tax and Invoice Violations in Vietnam

Vietnam Briefing -

12/31/2025

Vietnam’s Tax and Accounting Updates for Businesses in 2026

Vietnam Briefing -

12/30/2025

Capital Transfer Taxation and Exclusions Under Decree 320: A Practical Guide

Vietnam Briefing -

12/19/2025

Updated CIT Compliance in Vietnam: Key Provisions of Decree 320/2025

Vietnam Briefing -

12/15/2025

Vietnam’s New VAT Law in 2026: Key Compliance Guidance

Vietnam Briefing

Legal & Regulatory

Driving Vietnam’s Private Sector Growth: Core Incentives Introduced by Decree 20/2026

02/10/2026Vietnam’s Decree No. 20/2026/ND-CP outlines incentives for private-sector development, covering taxes, fees, land, and human resources.

The Green Transition in Vietnam’s Industrial Parks: Part 2 – Implementation, Energy, and Circular Models

02/06/2026This article focuses on the practical mechanisms by which industrial parks reduce emissions, improve resource efficiency, and strengthen competitiveness.

Vietnam Suspends Effectiveness of Decree 46 on Food Safety

02/04/2026Vietnam’s government has moved swiftly to address a series of practical difficulties emerging from the rollout of Decree No. 46/2026/ND-CP, a major new regulation implementing the Law on Food Safety.

Vietnam’s Regulatory Updates in February 2026: New Customs, Administrative, and Enforcement Rules

02/04/2026Vietnam will implement a range of new regulatory updates covering customs, administrative, monetary, and sector-specific regulations from February 2026.

Vietnam's Personal Data Protection: Key Requirements under Decree 356

01/26/2026Vietnam's personal data protection rules have tightened under Decree 356. Learn about new compliance duties for businesses operating in Vietnam.

Vietnam Introduces Motorcycle Emission Standards amid Nationwide Air-Quality Reforms

01/23/2026Vietnam introduces national motorcycle emission standards, establishing a first nationwide framework for controlling motorcycle and moped emissions.

-

01/21/2026

Vietnam Briefing

-

01/21/2026

EU Sustainability Due Diligence Rules: Compliance Implications for Vietnam Businesses

Vietnam Briefing -

01/19/2026

Vietnam Standard Industrial Classification Updated for Administrative Purposes

Vietnam Briefing -

01/08/2026

Vietnam to Assign Digital ID Codes to Properties: New Rules from March 1, 2026

Vietnam Briefing -

01/05/2026

Administrative Penalties for Tax and Invoice Violations in Vietnam

Vietnam Briefing

Industries

Vietnam Manufacturing Tracker: As of February 2026

02/11/2026The Vietnam Manufacturing Tracker by Vietnam Briefing provides the latest data, policy updates, FDI trends, industrial production indicators, and export performance insights to help investors monitor Vietnam’s fast-evolving manufacturing landscape.

The Green Transition in Vietnam’s Industrial Parks: Part 2 – Implementation, Energy, and Circular Models

02/06/2026This article focuses on the practical mechanisms by which industrial parks reduce emissions, improve resource efficiency, and strengthen competitiveness.

Da Nang After Merger: A New Industrial and Investment Landscape

01/30/2026Da Nang City is one of Vietnam’s six centrally governed cities and a designated national growth pole, playing a pivotal role in the South Central Coast and Central Highlands.

Green Transition in Vietnam’s Industrial Parks: Part 1 – Policy Foundations and Landscape

01/29/2026Vietnam’s industrial parks are shifting toward eco-industrial models, renewable energy, and green standards amid global supply chain changes.

Vietnam Introduces Motorcycle Emission Standards amid Nationwide Air-Quality Reforms

01/23/2026Vietnam introduces national motorcycle emission standards, establishing a first nationwide framework for controlling motorcycle and moped emissions.

Investing in Vietnam’s Resort Sector: Market Overview and Outlook

01/14/2026Vietnam’s resort sector enters 2026 with momentum, driven by rising domestic travel, international arrivals rebound, and demand for integrated leisure and wellness destinations.

-

01/13/2026

Vietnam: A Rising Manufacturing Hub in Asia in 2026

Vietnam Briefing -

01/12/2026

Dezan Shira & Associates Releases Asia Manufacturing Index 2026 Amid Intensifying Competition

Vietnam Briefing -

01/12/2026

Vietnam’s Seafood Exports: Growth Drivers, Market Shifts, and 2026 Outlook

Vietnam Briefing -

01/07/2026

Investing in Vietnam’s Textile and Garment Industry: 2025 Overview and Outlook

Vietnam Briefing -

01/06/2026

Vietnam E-Commerce Growth: Key Findings from the 2025 E-Business Index

Vietnam Briefing

HR & Payroll

Vietnam's Personal Data Protection: Key Requirements under Decree 356

01/26/2026Vietnam's personal data protection rules have tightened under Decree 356. Learn about new compliance duties for businesses operating in Vietnam.

2026 Vietnam Public Holiday Schedule: Vietnam Culture Day Added as New Public Holiday

01/13/2026November 24 has been officially designated as Vietnam Culture Day and recognized as an annual public holiday.

Vietnam Mandates Centralized Electronic Labor Contracts from July 2026: Key Requirements under Decree 337

12/31/2025From July 1, 2026, Vietnam’s government mandates that all electronic labor contracts must be digitally managed on a centralized platform.

Vietnam Amends Personal Income Tax Law: Key Highlights and Business Implications

12/10/2025Vietnam’s National Assembly approves the amended Law on Personal Income Tax, aiming to broaden the tax base while lowering inequality.

Vietnam E-Visa: A Complete Guide

12/09/2025Vietnam’s e-visa program makes it easier and faster for visitors to Vietnam to enter the country. The country has recently added 41 new ports that accept e-visas for entry, bringing the total to 83.

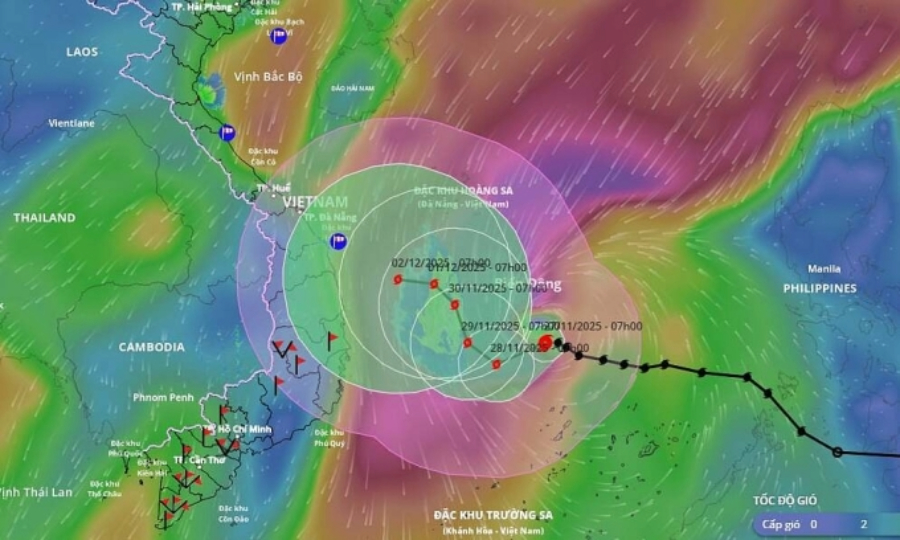

Typhoon Koto Update: Current Status, Forecasts, and Preparedness Measures

11/27/2025Typhoon Koto (Storm No. 15) has intensified over the central South China Sea, bringing dangerous winds and rough seas.

-

11/24/2025

Strategic Approaches to HR and Payroll Management in Vietnam

Vietnam Briefing -

11/19/2025

Enforcing Vietnam's Social Insurance Law: New Measures on Late Payments and Evasion

Vietnam Briefing -

11/11/2025

Vietnam’s Regional Minimum Wage Effective from January 1, 2026

Vietnam Briefing -

09/10/2025

Hanoi Issues Guidance on Work Permit Procedures for Foreign Employees

Vietnam Briefing -

08/25/2025

Typhoon Kajiki to Make Landfall in Central Vietnam

Vietnam Briefing

Our firm Dezan Shira & Associates provides legal, tax and operational advisory across Asia.

Our firm Dezan Shira & Associates provides legal, tax and operational advisory across Asia.